Solis S6-EH3P (12-20)K-H Hybrid Solar Inverter 12kw 15kw

Supplier highlights: This supplier is both a manufacturer and trader, offering full customization, design customization, and sample customization with product certification, primarily exporting

Residential Building Construction companies in Norway

Aug 1, 2025 · Find detailed information on Residential Building Construction companies in Norway, including financial statements, sales and marketing contacts, top competitors, and

Solar,inverter,infinisolar Suppliers from Cambodia

May 13, 2025 · Find Economical Suppliers of Solar,inverter,infinisolar: 133 Manufacturers in Cambodia based on Export data till May-25: Pricing, Qty, Buyers & Contacts.

Wholesale Solar Inverter from Supplier | Cambodia

We are a subsidiary platform of the Fortune Global 500 company CNBM, able to provide you with one-stop Solar Inverter procurement services in the Cambodia. Not only do we have a wide

Washing Machine : Cambodia

Feb 25, 2025 · With the latest advanced technology and the trust that comes with a 100-year reputation for reliability, Hitachi is committed to finding integrated solutions that provide reliable

Growatt WIT 50-100K-H/HU Three-Phase Hybrid Solar Inverter

Supplier highlights: This supplier is both a manufacturer and trader, offering full customization, design customization, and sample customization with product certification, primarily exporting

Recommended local inverter manufacturers in Phnom Penh

Hybrid Solar Inverter China Manufacturer Xindun is a hybrid solar power inverter manufacturer in China. We only supply good quality solar inverter power inverter hybrid inverter and hybrid

Power Solutions in Cambodia

4 days ago · Our team operate all over the country and combined with our technical know-how, excellent service and high-quality solutions – we are the #1 provider of solar equipment in

INVERTER Suppliers Data, List of INVERTER Exporters Cambodia

cambodia is one of the leading manufacturers, suppliers or exporters of INVERTER in the global trade market. In 2020, the nation has exported INVERTER worth of billion USD. If you''re

Solar Inverters_Energy Storage Inverters

Solis is one of the world''s largest and most experienced manufacturers of solar inverters supplying products globally for multinational utility companies, commercial & industrial rooftop

Cambodia high quality power inverter manufacturer

inverter manufacturer Starting with the supply of high-quality raw material from the China which is the number one PV Market in the world,Changzhou STIN has built a lot of solar plants

Solar Off-Grid Inverter,Pump Inverter Manufacturer,Solar

We developed solar off-grid inverter and solar off-grid power system, solar pump inverter and solar pump system,solar power irrigation system,solar aeration system,solar energy storage

Update Information

- Ashgabat home inverter sales manufacturer

- Home inverter manufacturer in Chiang Mai Thailand

- Namibia home inverter manufacturer

- Hanoi original inverter manufacturer

- Russian St Petersburg energy storage inverter manufacturer

- Inverter 3000va home use

- Home inverter is a string

- Santo Domingo Civil Inverter Manufacturer

- China small inverter for home in Chicago

- Guatemala City power frequency inverter custom manufacturer

- Inverter manufacturer in Ho Chi Minh Vietnam

- Manila photovoltaic energy storage 300kw inverter manufacturer

- Honiara multifunctional communication base station inverter grid-connected manufacturer

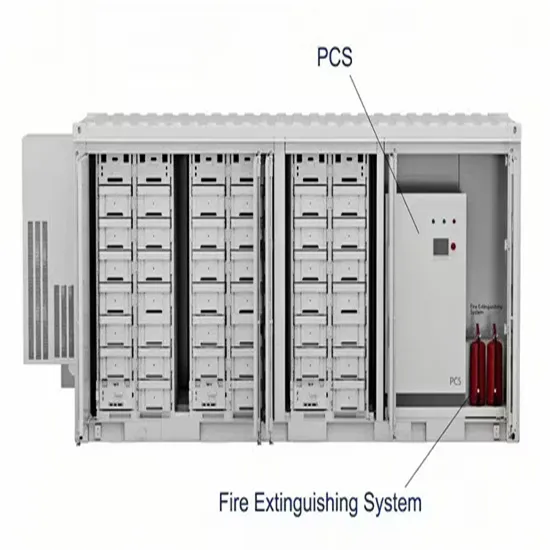

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.