2022 Micro Inverter European Version Deye Sun2000g3-EU

Apr 9, 2025 · 2022 Micro Inverter European Version Deye Sun2000g3-EU-230 Single Phase 4 MPPT 2000W Solar Inverter Deye DDP to Italy, Find Details and Price about Inverter Micro

Deye Hybrid Inverter European Version Single Phase Three

Aug 8, 2025 · Safety Assurance: Certified by UN38.3, IEC62133, and insured by Ping An (¥ 10M coverage). Eco-Efficiency: LiFePO4 batteries with fast charging, low environmental impact,

European Version Solar Inverter Huawei Sun2000

May 6, 2000 · After-sales Service: Yes Warranty: Yes Nature of Source Flow: Active Inverter Phase: Three Output Power: >1000W Certification: SAA, CE, ROHS, ISO9001, CCC, TUV

EU Version Three Phase Hybrid Solar Inverter 3KW to 30KW Factory Price

EU Version Three Phase Hybrid Solar Inverter 3KW to 30KW Factory Price for Solar Energy Conversion No reviews yet Xiamen Universe Solar Technology Co., Ltd. Custom

Deye Micro Inverter European Version Single Phase 4 Mppt Sun-m160g4 -eu

Deye Micro Inverter European Version Single Phase 4 Mppt Sun-m160g4 -eu-q0 1300w Solar Inverter Price Charge Controller Inverter, Find Complete Details about Deye Micro Inverter

European Version Sofar Invt 3kw 5kw 6kw 10kw 12kw 15kw

European Version Sofar Invt 3kw 5kw 6kw 10kw 12kw 15kw 100a Mppt Charge Hybrid Inverter Price For Solar Energy System, Find Complete Details about European Version Sofar Invt

Deye European Warehouse 3kw 5kw 6kw 8kw 16kw Hybrid Solar Inverter

Aug 18, 2025 · Deye European Warehouse 3kw 5kw 6kw 8kw 16kw Hybrid Solar Inverter Hybrid Deye EU Version, Find Details and Price about Deye Inverter Deye Low Voltage Lnverter from

DDP Three Phase Hv Solar Hybrid Inverter Sun-40/50K-Sg01HP3-EU-Bm4 EU

Jun 19, 2025 · DDP Three Phase Hv Solar Hybrid Inverter Sun-40/50K-Sg01HP3-EU-Bm4 EU Version Wholesale Price, Find Details and Price about Deye 3 Phase Hybrid Inverter Deye

Solis European Version Three Phase 380/400V Hybrid Inverter

Jul 12, 2025 · Solis European Version Three Phase 380/400V Hybrid Inverter 12-20kw Power Range - European Version Hybrid Inverter and Factory Direct Sales Inverter

Goodwe Hybrid Solar Energy Storage Inverters 5kw 6.5kw 8kw 10kw EU

Jul 31, 2025 · Goodwe Hybrid Solar Energy Storage Inverters 5kw 6.5kw 8kw 10kw EU Version Three Phase Solar Energy Inverter on Grid, Find Details and Price about Inverter on Grid

Solis European Version Three Phase 380/400V Hybrid Inverter

Jul 12, 2025 · Solis European Version Three Phase 380/400V Hybrid Inverter 12-20kw Power Range, Find Details and Price about European Version Hybrid Inverter Factory Direct Sales

Good Price Deye EU Version Hybrid Inverter 12kw MPPT 8kw

Jul 1, 2025 · Deye hybrid inverters include single phase 3-16kW and three-phase 8-12kW, For the SUN-3K-SG04LP1-24-EU, it uses 24V battery bank and the rest of them adopts 48V battery.

Deye Eu Version Price Inverter 12Kw 13Kw 14Kw Hybrid Solar Inverter

Deye Eu Version Price Inverter 12kw 13kw 14kw Hybrid Solar Inverter For Solar System, Find Complete Details about Deye Eu Version Price Inverter 12kw 13kw 14kw Hybrid Solar Inverter

Factory Price Micro Inverter European Version Single Phase

Oct 25, 2024 · Factory Price Micro Inverter European Version Single Phase 600W 700W 800W Solar Inverter, Find Details and Price about Micro Inverter Micro Solar Inverter 800W from

Micro Inverter European Version Deye Sun300g3-eu-230 Sun500g3-eu

Micro Inverter European Version Deye Sun300g3-eu-230 Sun500g3-eu-230 Single Phase 300w 500w Solar Micro Inverter - Buy Deye Solar Micro Inverter 1200w 600w 800w Tsun Micro On

Solar Hybrid Inverter Manufacturers, Grid Interactive Inverter

NingBo Deye Inverter Technology Co.,Ltd is famous hybrid inverter manufacturers and grid interactive inverter suppliers, we offer hybrid inverter with solar battery charging.

Sungrow European version 33kw 40kw 50kw on grid solar pv inverters

Output Type: TRIPLE Size: 702*595*310mm Type: DC/AC Inverters Inverter Efficiency: 98.6% Certificate: CE TUV IEC CQC MEA PEA INMETRO, IEC CE TUV CQC Warranty: 10Years

6 FAQs about [European version inverter price]

How big is the European solar inverter market?

The European solar inverter market is set to grow from USD 2.85 billion in 2024 to USD 3.66 billion by 2029, with a growth rate of 5.06% annually. This growth is driven by government incentives, investments in solar energy, and a focus on reducing carbon emissions. Germany is the largest market, followed by the UK and France.

Where can I buy a solar inverter?

PVshop.eu offers a complete range of solar inverters for your PV system. The world's leading solar power inverters for all photovoltaic applications at the best price with worldwide delivery

What is European inverter efficiency?

European efficiency: It refers to inverter efficiency measured at different ac output power points, then multiplied by different weighted number, so it’s more useful than peak efficiency because its shows how inverter performs at different output power during the solar day.

What is the European standard for photovoltaic inverters?

This European Standard describes data sheet and name plate information for photovoltaic inverters in grid parallel operation. The intent of this document is to provide minimum information required to configure a safe and optimal system with photovoltaic inverters. In this context,

Which countries use the most solar inverters?

Germany is the largest market, followed by the UK and France. Central inverters for large solar projects are expected to dominate, while micro inverters for homes are also growing. Hybrid inverters, which combine solar and battery storage, are gaining popularity as more people seek energy independence.

Who makes the most solar PV inverters in the world?

In 2023, the global shipment of solar PV inverters reached 536 GWac, with Chinese solar inverter manufacturers responsible for half of these shipments. Companies like Huawei, Sungrow, and Ginlong Solis dominate the top ranks, securing more than 50% of the global market share.

Update Information

- Riyadh EK inverter price

- Price of photovoltaic inverter in Milan Italy

- Factory price 4000 w inverter in Toronto

- China wholesale 1500 power inverter Price

- Panama inverter price

- Factory price 4000 w inverter in Tanzania

- Wind power inverter purchase price

- Sri Lanka dedicated inverter price

- 2200w inverter price

- Photovoltaic energy storage inverter dsp price

- Praia off-grid inverter price

- Hot sale 1000w solar inverter for sale Price

- Djibouti inverter price

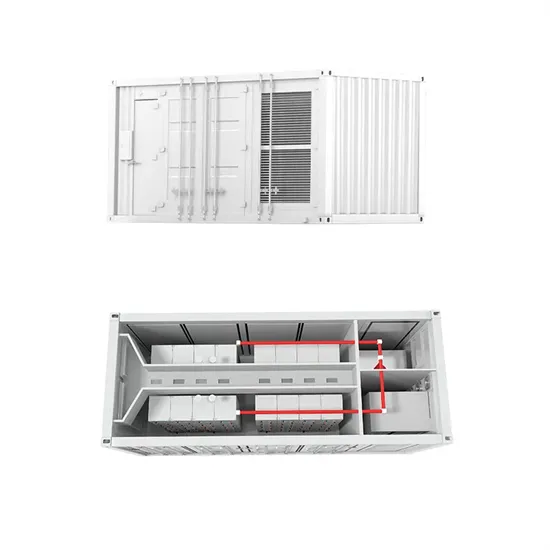

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.