Ghana Energy Storage Market (2025-2031) | Share & Size

The Ghana Energy Storage Market is primarily driven by the increasing adoption of renewable energy sources such as solar and wind power, leading to the need for efficient energy storage

Ghana s complete mobile energy storage power supply

6 FAQs about [Ghana s complete mobile energy storage power supply prospects] How has Ghana improved its power system? Ghana has experienced significant milestones and

Top Lithium Battery Suppliers in Ghana | Vantom Power

VANTOM POWER is the leading provider of Battery Energy Storage Systems (BESS) in Ghana. With more than 10 years of experience in the energy storage industry, we have established

Ghana''s energy transition requires $562 billion by 2070

May 21, 2025 · The Ministry of Energy and Green Transition has disclosed that Ghana will need an impressive $562 billion to fully achieve its energy transition agenda by 2070.

Ghana energy prices | GlobalPetrolPrices

Aug 18, 2025 · Ghana fuel prices, electricity prices The table below shows the most recent prices per liter of octane-95 gasoline, regular diesel, and other fuels. These are retail (pump) level

Ghana Solar Power Storage Solutions | GSL ENERGY, a One-Stop Energy

Aug 6, 2025 · GSL ENERGY brings high-performance solar energy storage system s to the Ghanaian market, helping businesses and households achieve energy independence, reduce

Photovoltaic energy storage station cost analysis table

In this paper, we propose a dynamic energy management system (EMS) for a solar-and-energy storage-integrated charging station, taking into consideration EV charging demand, solar

National Energy Statistical Bulletin 2023

Jan 9, 2025 · The 2023 National Energy Statistics provides data on Ghana''s energy supply and use situation largely from 2000 to 2022. It contains data on energy production, import, export,

Ghana, first in line to drive solar adoption in Africa

Oct 26, 2021 · A Daystar Power solar installation on a Vivo Energy service station in Accra. While in Africa, no country is better poised to drive the clean energy

2024 First Quarter Natural Gas, Electricity & Water Tariff

Mar 20, 2024 · Revenue gap analysis reveals a reduction in total revenue requirement by GHS113.09 million resulting from increase in projected hydro electrical energy allocation for

current price of outdoor mobile energy storage power supply in ghana

Leveraging rail-based mobile energy storage to increase grid In this Article, we estimate the ability of rail-based mobile energy storage (RMES)—mobile containerized batteries,

Ghana Energy Storage Market (2025-2031) | Share & Size

6Wresearch actively monitors the Ghana Energy Storage Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis, and forecast

Harbour ghana energy storage power station

The agreement did notrequire Ghana to pay the upfront cost for the power ships but rather for the about 450 MW electricity to be fed into the national grid. The increasing transition to thermal

Feasibility analysis of off-grid hybrid energy system for

Jul 4, 2025 · generator and battery storage hybrid power system for the electrification of off-grid rural areas in northern Ghana. The HOMER software package was used for simula-

Update Information

- Ghana energy storage power price

- Madagascar energy storage power price

- Portable energy storage power supply mobile equipment

- Mobile Energy Storage Power Backpack Installation

- Power plant lithium battery energy storage power station price

- Outdoor mobile energy storage power supply source manufacturer

- Mobile room communication base station battery energy storage system power supply

- Samoa Mobile Energy Storage Vehicle BESS Price

- Sri Lanka power station energy storage system price

- Overall structure of mobile energy storage power supply vehicle

- Myanmar high power energy storage machine price

- Burkina Faso mobile energy storage charging pile price

- Roman Energy Storage Emergency Power Supply Wholesale Price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

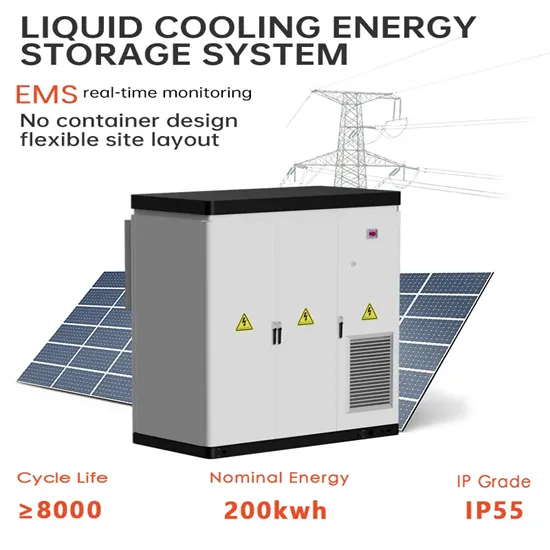

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.