An energy storage roadmap study incorporating government

Gov subsidies, operator support, and system transition are prerequisites for growth. Gov subsidies stabilize the system; promoting 46.9 % faster equilibrium achievement. Monte Carlo

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Spain publishes framework for cleantech manufacturing support

Jul 31, 2024 · Ministry of Ecological Transition has published regulatory basis for €750 million scheme for renewables and energy storage manufacturing.

US government''s US$3 billion support for battery

Feb 14, 2022 · The US Department of Energy (DOE) has provided dates and a partial breakdown of grants totalling US$2.9 billion to boost the production of batteries for the electric vehicle

Ofgem super-charging clean power storage for first time in

Apr 8, 2025 · Ofgem has launched a new cap and floor investment support scheme, unlocking billions in funding to build major Long Duration Electricity Storage projects for the first time in

Battery Industry Strategy

May 20, 2022 · The battery supply chain : Importance of securing the manufacturing base Risks exist in the supply chain of mineral resources and materials which support battery cell

New scheme to attract investment in renewable energy storage

Oct 10, 2024 · Government will unlock investment opportunities in vital renewable energy storage technologies to strengthen energy independence, create jobs and help make Britain a clean

"Battery Storage Subsidies in Japan" | Atsumi & Sakai

Feb 17, 2023 · Details Battery Storage Subsidies in Japan Introduction In the Sixth Strategic Energy Plan, published by the Japanese Government in October 2021, targets are set to (a)

Impact of Government Policies on Battery Storage Investments

Feb 25, 2025 · Government policies in both the US and Europe play a pivotal role in driving investments in battery energy storage systems. From tax incentives and infrastructure

Government Incentives for Energy Storage Systems in 2025 – Energy

In 2025, governments around the world are expected to ramp up their support for energy storage systems (ESS) through a variety of incentives. These initiatives aim to facilitate the transition

Alberta government offers financial support for energy storage

Nov 4, 2021 · WindCharger, Alberta''s first grid-scale battery storage system, brought online by TransAlta Renewables in 2020. Image: TransAlta via Twitter. The government of Alberta,

Energy storage backed with over £32 million

Nov 28, 2022 · £32.9 million government funding awarded to projects across the UK to develop new energy storage technologies, such as thermal batteries

Government subsidy strategies for power batteries of new energy

Jun 2, 2025 · Our analysis reveals several key findings: (1) any form of government subsidy enhances both power battery research and development (R&D) levels and waste recovery

National Blueprint for Lithium Batteries 2021-2030

Nov 23, 2024 · Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary

6 FAQs about [Government support for energy storage batteries]

Are electric vehicles' lithium-ion batteries reused for energy storage?

Fan T, Liang W, Guo W, Feng T, Li W (2023) Life cycle assessment of electric vehicles’ lithium-ion batteries reused for energy storage. J Energy Storage 71:108126 Gong H, Hansen T (2023) The rise of China’s new energy vehicle lithium-ion battery industry: The coevolution of battery technological innovation systems and policies.

How do government R&D subsidies affect battery manufacturing?

The stronger the subsidy, the stronger the consumer’s preference for R&D. Government R&D subsidies can more effectively stimulate the innovation drive of battery manufacturers, thus significantly improving the R&D and innovation capacity of power batteries and increasing the profits of battery manufacturers.

Do government subsidies improve battery recycling rates?

Firstly, our analysis reveals that without government subsidies, battery recycling rates exhibit an inverse relationship with wholesale prices but a positive correlation with R&D advancement. The introduction of any subsidy mechanism proves beneficial, leading to enhanced battery R&D levels and improved recycling rates of used batteries.

Could a new energy storage scheme help the UK achieve energy independence?

The UK is a step closer to energy independence as the government launches a new scheme to help build energy storage infrastructure. This could see the first significant long duration electricity storage (LDES) facilities in nearly 4 decades, helping to create back up renewable power and bolster the UK’s energy security.

How can a battery company help the environment?

This includes providing R&D incentives, particularly in battery technology advancement, while simultaneously promoting environmental awareness and sustainable consumption patterns through consumer education and green certification programs.

How does government subsidize Nev batteries?

The government subsidizes battery manufacturers according to their market size and R&D strength, which can stimulate them to increase R&D efforts and help them create NEV batteries with stronger endurance and better safety performance.

Update Information

- Energy storage power stations receive government subsidies

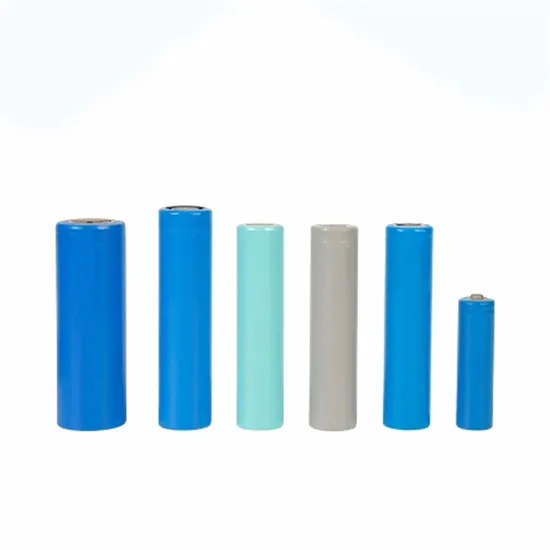

- That company needs lithium batteries for energy storage

- The prospects of lead-carbon energy storage batteries

- What is the proportion of lithium batteries in energy storage fields

- Can lithium batteries be used as energy storage power stations

- How much does a set of emergency energy storage batteries cost

- The prospects of lithium-ion energy storage batteries

- Recommended sources of industrial energy storage batteries in Nicaragua

- Main application scenarios of energy storage batteries

- New energy storage vanadium battery government

- What are the fully automatic energy storage batteries

- Energy storage batteries can be outside

- Stacking Energy Storage Batteries

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.