Clean Energy Tax Incentives for Tax-Exempt and

Aug 19, 2025 · The Inflation Reduction Act (IRA) was signed into law in August 2022, introducing significant enhancements to federal energy tax credits for

Finalized Rules for Clean Energy Tax Credits:

Jan 24, 2025 · Read on for information on recently finalized rules for clean energy tax credits under the Inflation Reduction Act and details on eligibility,

What changes were made to the tax credit for energy storage

Feb 7, 2025 · Residential Energy Storage Credit: Homeowners can now claim a 30% credit under Section 25D (a) (6) for standalone energy storage systems with a capacity of 3 kWh or

How much is the tax burden on photovoltaic energy storage

Jun 23, 2024 · A photovoltaic energy storage system encompasses various components, including solar panels and batteries, aimed at harnessing and storing solar energy for later

SALT and Battery: Taxes on Energy Storage

Jul 31, 2023 · The IRA expanded the investment tax credit by eliminating the requirement that a storage system be charged by solar and including stand-alone energy storage systems placed

Sales tax implications in green energy

Sep 26, 2022 · Many states have either a solar or wind exemption, which provides that equipment used for electricity generation by either solar or wind be exempt from sales tax. Florida, for

What are the eligibility requirements for energy storage

Feb 13, 2025 · Eligibility for tax credits on energy storage projects varies depending on whether they are residential or commercial/industrial. Here are the eligibility requirements for each

Taxes on photovoltaic energy storage industry

Germany''''s most recent PV subsidy policy 1. A tax-free tax credit : Electricity income is tax-free (German personal income tax in 22 years will be 14% to 45%): From January 2023,

How much is the tax burden on photovoltaic energy storage

Jun 23, 2024 · 1. The tax burden on photovoltaic energy storage systems is significant, influenced by various regulations and incentives affecting installation and operation costs. 2. Different

Legal and Financial Considerations for Solar PV Arrays

Jan 29, 2024 · In 2018, the Massachusetts Department of Energy Resources (MA DOER) established the Solar Massachusetts Renewable Target (SMART) program, which regulates

Battery energy storage systems integrated in

Sep 15, 2020 · Tax incentives spurring deployment of energy storage are limited in their application, as they require the system to paired with solar. On top of

Reduce Solar Panel Installation Costs, Property Taxes, and

Oct 11, 2024 · Key takeaways Reduced Installation Costs: Solar panel exemptions eliminate state sales tax, lowering the upfront cost of solar energy systems. Property Tax Relief: In many

Income tax exemption for photovoltaic energy storage

(section 48 of the tax code), the solar PV system must be: o Used by a business subject to U.S. federal income taxes (i.e., it cannot be used by a tax-exempt entity like a

PV plant tax free

4 days ago · Before we get to WHO and HOW you can benefit from the new legal changes in tax terms, let''s first look at WHAT is actually being taxed. The aim of the legislator is to accelerate

Property Tax Exclusion for Solar Energy Systems and Solar Plus Storage

Mar 17, 2025 · Section 73 of the California Revenue and Taxation Code allows a property tax exclusion for certain types of solar energy systems installed between January 1, 1999, and

Tax rules for photovoltaics: PV systems mostly tax-free since

Apr 10, 2025 · Private photovoltaic systems and solar power storage systems have been tax-exempt in most cases since 2023. This means lower costs and less bureaucracy. These rules

Update Information

- Minsk New Energy Photovoltaic Energy Storage

- Athens new photovoltaic energy storage company

- Tunisia New Energy Storage Photovoltaic

- Building new energy vehicles and photovoltaic energy storage clusters

- Australia photovoltaic new energy storage application

- New photovoltaic energy storage model

- Uruguay Photovoltaic New Energy Storage Field

- The role of photovoltaic new energy storage

- Does photovoltaic have energy storage equipment

- Uganda container photovoltaic energy storage

- Swiss energy storage photovoltaic companies

- Photovoltaic system energy storage ratio

- New Energy Storage Cabinet Integrated System

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

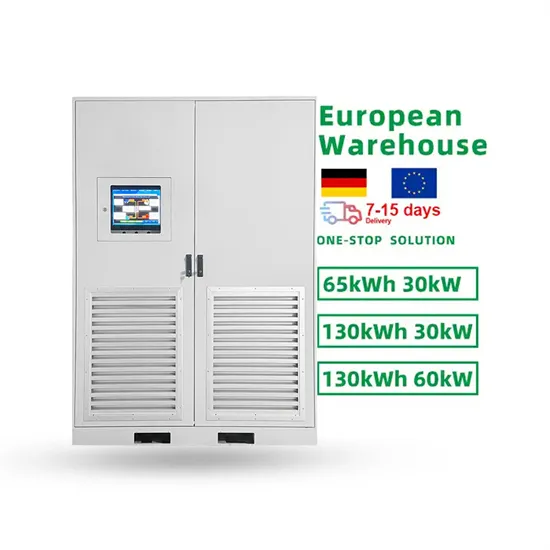

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.