Telecommunications rollout speeds up

May 7, 2025 · A profile of the information and communications technology sector in Papua New Guinea. A slew of new satellite technologies promise a future of faster connections and lower

Papua New Guinea 5G Small Cell Market (2025-2031)

6Wresearch actively monitors the Papua New Guinea 5G Small Cell Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers, revenue analysis,

Papua New Guinea 5G Network Infrastructure Market (2025

6Wresearch actively monitors the Papua New Guinea 5G Network Infrastructure Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers,

Papua New Guinea Private LTE 5G Network Market (2025

6Wresearch actively monitors the Papua New Guinea Private LTE 5G Network Market and publishes its comprehensive annual report, highlighting emerging trends, growth drivers,

Energy-efficiency schemes for base stations in 5G

In today''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

5G and the digital imagination: Pacific Islands

Sep 14, 2023 · This article explores the ways in which 5G networks are imagined in the Pacific Islands nations of Fiji and Papua New Guinea. What promises,

Papua New Guinea NICTA Opens Public Consultation for 5G

Apr 1, 2021 · The National Information & Communications Technology Authority (NICTA) of Papua New Guinea has opened the following three public consultations: Draft band plan for the 2.6

Vodafone to deliver 4G, 5G network

Jun 2, 2022 · Vodafone PNG has partnered with SES to provide 4G and 5G high-speed mobile broadband services. Both companies announced yesterday that the reliable high-speed data

PNG Unlocks 5G Spectrum for Next-Generation Connectivity

2 days ago · Papua New Guinea Acting Minister for Information and Communications Technology, Hon. Peter Tsiamalili Jnr, has confirmed the release of the 5G mobile spectrum, marking a

Papua New Guinea Communications 2024, CIA World Factbook

NOTE: The information regarding Papua New Guinea on this page is re-published from the 2024 World Fact Book of the United States Central Intelligence Agency and other sources. No

Papua New Guinea Communications 2021, CIA World Factbook

Papua New Guinea Communications 2021, CIA World Factbooktelecom services stymied by rugged terrain, high cost of infrastructure, and poverty of citizens; services are minimal with

The Role of FPGA in 5G Technology and Beyond

Jul 27, 2023 · It costs a lot of money to deploy 5G infrastructure, including base stations and tiny cells. Smaller cell densification in networks creates additional

Quick guide: components for 5G base stations and antennas

Mar 12, 2021 · 5G technology manufacturers face a challenge. With the demand for 5G coverage accelerating, it''s a race to build and deploy base-station components and antenna mast

Papua New Guinea Communications 2023, CIA World Factbook

Papua New Guinea Communications 2023, CIA World FactbookTelecommunication systems general assessment: fixed-line teledensity in Papua New Guinea has seen little change over

5G base stations to proliferate widely

Nov 17, 2021 · China plans to have 26 5G base stations for every 10,000 people by the end of 2025, as the nation works hard to build a new digital infrastructure that is intelligent, green,

Establishing Telecommunications Infrastructure in Rural Areas: Papua

Sep 1, 2020 · Initial mobile network deployment saw 59 mobile base-stations deployed by Digicel in remote areas of all four regions of this island-nation country, bringing telecom connectivity to

China rolls on with 5G deployment, development

Jul 15, 2022 · For instance, Beijing earlier announced a plan to build 6,000 new 5G base stations this year, while the Shanghai Communications Administration said in June the city will speed

Papua New Guinea''s 5G rollout is more than just a

Jul 16, 2025 · Is PNG''s 5G rollout a genuine step toward inclusive growth, or will it deepen existing inequalities? Will market-based spectrum pricing foster competition or entrench

3 FAQs about [When will Papua New Guinea Communications deploy 5G base stations ]

Does Papua New Guinea have a mobile and Internet market?

“Papua New Guinea's mobile and internet market has enormous growth potential, but this has been hampered by geographical challenges, limited speed and connectivity choices," said Ivan Fong, director at Vodafone PNG.

Why is Vodafone entering png's telecoms market in 2022?

Having started services in April 2022, Vodafone's entry into PNG’s telecoms market meets the demand for reliable high-speed connectivity and broadband Internet access. “With our O3b constellation we’ve been connecting communities and industries around the world for almost a decade, positively impacting their lives and their businesses.

Is png ready to embrace the digital age?

This connectivity will enable more people here to fully embrace the digital age.” With over 86% of its population located in rural areas, much of PNG’s population is still underserved despite an 15% increase in internet penetration and a 34% increase in mobile connections as of January 2021.

Update Information

- When will Sarajevo Communications deploy 5G base stations

- Papua New Guinea Communication Base Station EMS Construction Regulations

- New Delhi now has 5g communication base stations

- New policy on electricity charges for 5g base stations released

- Are 5G signal base stations and communications together

- How many 5G base stations will Kampala Communications build

- What are Tunisia Communications 5G base stations

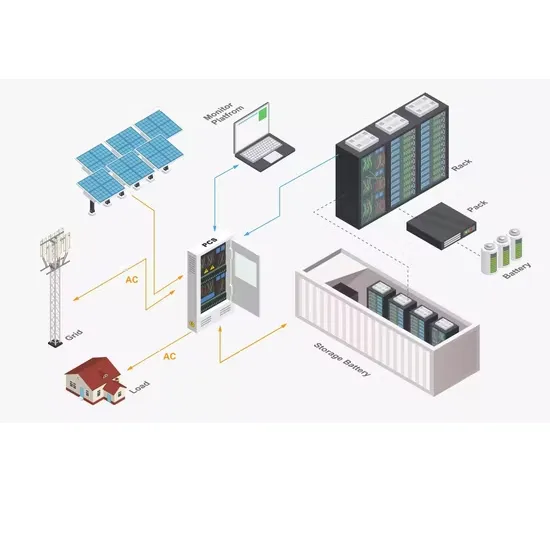

- Papua New Guinea Small Base Station Equipment Lithium Ion Battery Project

- Ranking of Energy Storage Container Power Stations in Papua New Guinea

- Co-build 5g network base stations with communications

- Do 5G base stations consume extra electricity

- How many 5G communication base stations are built each year

- Are 5G base stations separate and communicated

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

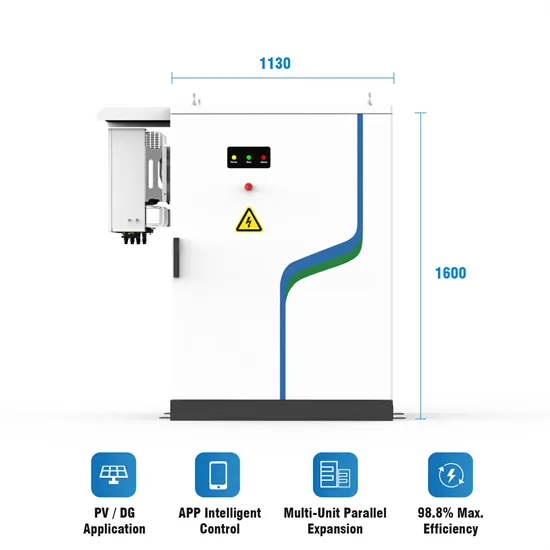

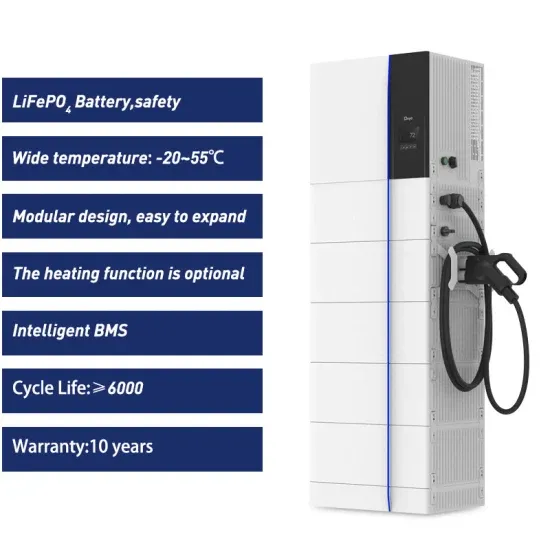

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.