Ups Power Supply Imports in Ghana

Oct 1, 2024 · According to Volza''s Ghana Import data, Ghana imported 38 shipments of Ups Power Supply during Feb 2023 to Jan 2024 (TTM). These imports were supplied by 34 foreign

Ac Power Supply Imports in Ghana

Jan 19, 2025 · According to Volza''s Ghana Import data, Ghana imported 172 shipments of Ac Power Supply during Feb 2023 to Jan 2024 (TTM). These imports were supplied by 93 foreign

Power generation shortfalls impact domestic supply and

Nov 1, 2024 · Increased Reliance on Imports To offset the domestic shortfalls, Ghana imported 1,605MW of power from La Cote d''Ivoire between September 12 and October 7, 2024.

Power Supplies and Transformers

Reliable power conversion and voltage regulation for industrial control and automation systems. Automation & Plant Technologies Limited (APT) specializes in providing high-quality electrical

Power generation deficit impacting negatively

Nov 1, 2024 · An analysis of Ghana''s power generation data from 1 st September 2024 to 27 th October 2024 by the Institute for Energy Security (IES) reveals

current price of outdoor mobile energy storage power supply in ghana

The energy efficiency situation in Ghana 2.1. Electricity supply security experience. Ghana has experienced several serious electrical energy supply challenges over the last four decades

Power supply ups Imports in Ghana

Jun 21, 2023 · Overview As per Volza''s Ghana Import data, Power supply ups import shipments in Ghana stood at 518, imported by 229 Ghana Importers from 290 Suppliers. Ghana imports

Update Information

- Vatican brand new outdoor power supply for sale

- Communication outdoor power supply brand

- Brand lithium battery outdoor power supply

- Nigeria outdoor power supply brand

- Gambia sells brand new outdoor power supply

- Bosnia and Herzegovina outdoor power supply brand new

- Small size outdoor power supply brand

- Brand new outdoor power supply in Barbados

- Taipei s best outdoor power supply brand

- Dushanbe imported outdoor power supply recommendation

- Wellington brand new outdoor power supply for sale

- Ghana smart outdoor power supply installation

- The role of outdoor power supply in the home

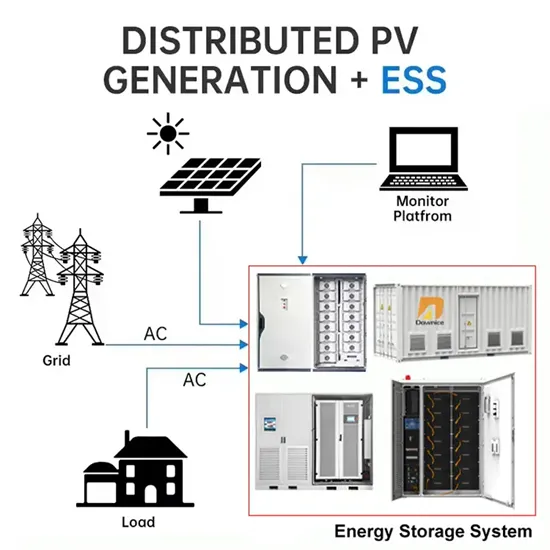

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.