Deep-learning-based scheduling optimization of wind

Apr 1, 2025 · The foundation of wind power system scheduling optimization lies in accurately forecasting wind power and electricity load, areas that have garnered significant attention in

Optimal bidding strategy and profit allocation method for

Jan 1, 2023 · The cooperation of wind power aggregators, PV aggregators, and controllable load aggregators as a VPP can effectively increase their expected profits in joint energy and

Capacity configuration and control optimization of off-grid wind

Jun 1, 2025 · The results demonstrate the following: Firstly, the proposed system achieves a significant financial improvement, with an annual revenue increase of 33.79 % compared to a

Assessment of wind-related storage investment options in a

Nov 1, 2024 · To analyze how storage directly owned by wind farms increases wind farms'' profits, Fig. 10 shows wind power, wind power prices, charging and discharging power of storage

Energy storage capacity optimization of wind-energy storage

Nov 1, 2022 · The construction of wind-energy storage hybrid power plants is critical to improving the efficiency of wind energy utilization and reducing the burden of wind power uncertainty on

Value of Storage for Wind Power Producers in Forward

Mar 20, 2015 · We study the infinite horizon problem of maximizing the expected discounted profits by selling wind power in a two-settlement market accompanied by storage operation.

Profit analysis of energy storage and power

A sensitivity analysis indicates that the storage amount is highly dependent on the investment costs and political targets. applying for example, demand-side management reduces the

Game-based planning model of wind-solar energy storage

Aug 1, 2025 · Abstract The rational allocation of microgrids'' wind, solar, and storage capacity is essential for new energy utilization in regional power grids. This paper uses game theory to

Energy storage station profit

Keywords: electricity spot market, electrochemical energy storage, profit model, energy arbitrage, economic end of life. Citation: Li Y, Zhang S, Yang L, Gong Q, Li X and Fan B (2024) Optimal

Air energy storage profit model analysis report

Air energy storage profit model analysis report Liquid air energy storage (LAES) can be a solution to the volatility and intermittency of renewable energy sources due to its high energy density,

A hybrid stochastic-robust bidding model for wind-storage

Jan 1, 2025 · In this paper, a novel hybrid stochastic-robust bidding model for a wind-storage system in the day-ahead (DA) market considering risk preferences is proposed. In the

Value and economic estimation model for grid-scale energy storage

Apr 15, 2019 · Recent trend in increasing the penetration level of renewable energy challenges safety and stability of the power grid. Electrical energy storage (EES

Optimal multi-market operation of gravity energy storage and wind power

Sep 15, 2023 · A wind-energy storage facility has thus drawn a great deal of interest as a kind of integrated power-generating equipment [4]. In order to promote or mandate the development

Assessment of wind-related storage investment options in a

Nov 1, 2024 · Three game models for wind-related storage investments in direct ownership, cooperative, and competitive modes are proposed. Storage investment in direct ownership

Optimal offering strategy for wind-storage systems under

Mar 1, 2023 · This paper formulates the offering problem for a cluster of wind-storage systems in the day-ahead energy market using a risk-constrained stochastic pr

Optimization operation strategy of wind–pumped storage

Nov 2, 2024 · An optimization model for a wind power–pumped storage system under deterministic scenarios is constructed, employing robust optimization theory and informa

Wind Power Generation and Modeling

Nov 9, 2023 · This chapter provides a reader with an understanding of fundamental concepts related to the modeling, simulation, and control of wind power plants in bulk (large) power

Low Carbon-based Scheduling Optimization Model for

Sep 13, 2019 · Abstract: In order to reduce the randomness of wind power and improve system consumption capacity, a jointly scheduling optimization model with energy storage systems

Optimal Offering and Operating Strategies for

Jul 10, 2019 · In every model of our model series, since the objective function is not directly affected by wind power uncertainties, WF-ESS does not need to

6 FAQs about [Wind power storage profit model]

What is the revenue of wind-storage system?

The revenue of wind-storage system is composed of wind generation revenue, energy storage income and its cost. With the TOU price, the revenue of the wind-storage system is determined by the total generated electricity and energy storage performance.

Can energy storage system integrate into a wind farm?

An optimization capacity of energy storage system to a certain wind farm was presented, which was a significant value for the development of energy storage system to integrate into a wind farm. A high penetration of various renewable energy sources is an effective solution for the deep decarburization of electricity production [1, 2, 3].

What is the annual revenue of wind-storage coupled system?

The annual revenue of the wind-storage coupled system is 12.78 million dollars which is the income of wind generation only sold to the grid or customer. With the decrease of energy storage plant cost and the increase of lifetime, the best storage capacity and the corresponding annual income of wind-storage coupled system increase.

How much money does a simulated wind-storage system make?

When the energy storage system lifetime is of 10 years, and the cost is equal to or more than 375 $/kWh, the optimization configuration capacity is 0 MWh, which means no energy storage installation. The annual revenue of the simulated wind-storage system is 12.78 million dollars, which is purely from the sale of wind generation.

Can integrated energy storage system generate more revenue than wind-only generation?

The integrated system can produce additional revenue compared with wind-only generation. The challenge is how much the optimal capacity of energy storage system should be installed for a renewable generation. Electricity price arbitrage was considered as an effective way to generate benefits when connecting to wind generation and grid.

How integrating energy storage technologies into wind generation improve economic performance?

The economic performance by integrating energy storage technologies into wind generation has to be analyzed for commercial development . One solution is to implement the electricity price arbitrage strategy. The real-time pricing (RTP) varies in the market throughout a single day due to the different patterns of supply and demand.

Update Information

- Wind power storage profit model

- Practical operation of the profit model of energy storage power station

- Profit model of grid-side energy storage power station

- Ecuador wind and solar energy storage power generation

- The impact of photovoltaic and wind power generation on energy storage

- Kuwait City Wind Power Storage System Manufacturer

- Wind and solar power stations with energy storage

- What are the wind and solar energy storage power stations in Bucharest

- Wind power hybrid energy storage

- Brasilia wind power generation and energy storage

- The world s largest wind and solar energy storage power generation

- Wind power and solar energy storage

- Wind and solar energy storage power station equipment

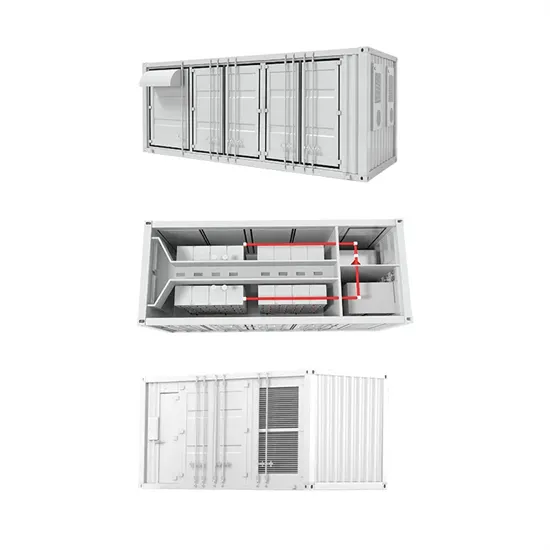

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

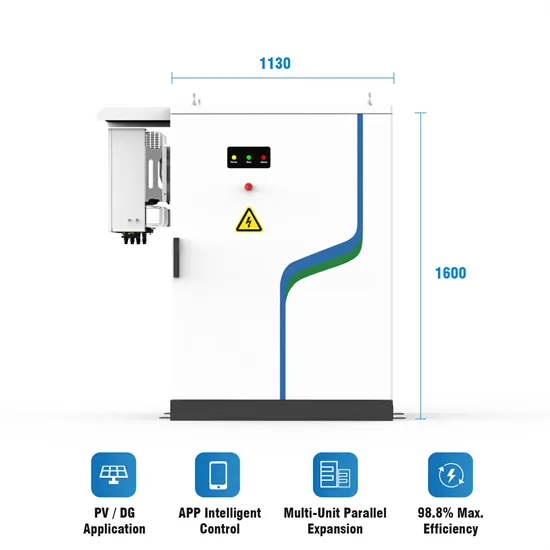

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.