Industrial Warehouses / Distribution Businesses for sale in Slovakia

Showing Slovakia businesses currently available in Slovakia. Browse real opportunities to buy from established and trusted sellers in the search listing results page below. Please use the

Properties, Sale, Slovakia

In this section of our ever-growing selection of properties abroad, you will find our presentation of the best that the Slovak real estate market has to offer. Our Slovak portfolio mostly consists of

Low-voltage Power Distribution Products | Low-voltage Circuit Breakers

Low-voltage Power Distribution Products | Low-voltage Circuit Breakers | Circuit Breakers for Use in Particular Applications - Mitsubishi Electric Factory Automation - Slovakia

Electrical Distribution Board Suppliers in Slovakia | Electrical

Mar 21, 2022 · allwinelectric - Ganauria Industries Llp New Delhi - Manufacturers and Suppliers of Electric Pvc Conduit Pipes, Pvc Conduit Pipes & Accessories,, Conduit

Breaker electrical box in slovakia

Our corporation primarily engaged and export Breaker electrical box in slovakia. we depend on sturdy technical force and continually create sophisticated technologies to meet the demand of

Real Estate Slovakia, Bratislava, apartments for sale

The Real Estate Slovakia company offer lots of real estates in different areas of Slovakia. Apartments, houses, villas and other cost-effective realties for buy or for rent.

Low-voltage Power Distribution Products | Low-voltage Circuit Breakers

Products for adapting equipment to a particular application Upgrade your electrical equipment by using products suitable for your particular application. If it is considered as proper when the

Businesses for Sale and Investment in Slovakia

122 Businesses for Sale and Investment in Slovakia. Buy or Invest in a Business in Slovakia. Listed by Direct Business Owners & Business Brokers. SMERGERS is a user-friendly,

Breaker box and breakers in slovakia

We are suppliers of all kind of Breaker box and breakers in slovakia moved in market place for fantastic sales, we''ve Breaker box and breakers in slovakia type and specification''s which will

Best offers on Electrical Items in Kosice, Slovakia | GINBOX

Choose from Ginbox''s Variety of Distribution Boards in Kosice, Slovakia to Surprise Your Friends and Family Electrical systems need distribution boards. They are used to separate electrical

Power Distribution Panel In Slovakia

Looking for a trusted source to buy Power Distribution Panel In Slovakia? Brilltech Engineers Pvt. Ltd is the one you can reach. We have a highly experienced team, well-loaded manufacturing

Electricity Control and Distribution Equipment Market in

Jul 3, 2025 · This industry report offers the most up-to-date market data on the actual market situation, trends and future outlook for electricity control and distribution equipment in

Update Information

- High quality breaker distribution for sale Factory

- Breaker distribution for sale in Abu-Dhabi

- Breaker distribution for sale in Mongolia

- Hot sale breaker distribution for sale supplier

- Distribution breaker for sale in Nepal

- Breaker distribution for sale in Johannesburg

- Best breaker distribution in China for sale

- Hot sale main circuit breaker factory producer

- Hot sale pole mounted circuit breaker Factory

- Hot sale factory price battery breaker Wholesaler

- Koten safety breaker for sale in Russia

- Cheap circuit breaker amps for sale for sale

- Best replacing a breaker for sale supplier

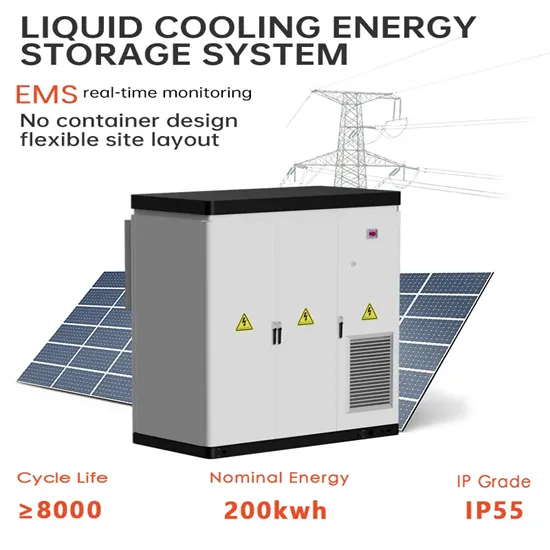

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.