Solar Jobs, Solar PV Jobs and Solar Panel Installer Jobs in the UK

Each month we promote hundreds of job postings across a variety of sectors including engineering jobs, installer jobs, manufacturing jobs, photovoltaic jobs, sales jobs, and thermal

GB-Sol PV Slate solar panels, Infinity solar roofs

Apr 21, 2024 · PV Slate, Infinity solar roofs & Integrated solar roofs Established in 1994, GB-Sol is an independent UK company, manufacturing solar PV panels

9 Top Solar Companies in London · August 2025 | F6S

Aug 1, 2025 · Detailed info and reviews on 9 top Solar companies and startups in London in 2025. Get the latest updates on their products, jobs, funding, investors, founders and more.

A review of photovoltaic systems: Design, operation and

Aug 1, 2019 · Within the sources of renewable generation, photovoltaic energy is the most used, and this is due to a large number of solar resources existing throughout the planet. At present,

6 FAQs about [Solar PV system manufacturing in London]

Where are solar panels made?

It’s true that most solar panels across the world are made in China, but there are plenty of British and European-based companies involved in the process too. Choosing the right solar panel manufacturer, as well as the right sized system, can seem daunting. That’s where we want to help.

Who is solar energy London?

Solar Energy London is a leading solar energy solutions provider in the London area, specializing in the design, installation, and maintenance of solar panel systems. How do solar panels work? - Solar panels work by harnessing sunlight and converting it into electricity using photovoltaic cells, providing a clean and renewable energy source.

Who is UK solar power?

UK Solar Power Ltd is a Multi-Award winning Global British Solar Panels & Solar Street Lights Manufacturer.

Who are uksol solar panels?

UKSOL is a British family-owned solar panel producer specialising in the design and manufacturing of residential and commercial solar panels. The company has made a name for itself by offering good quality solar PV panels at competitive prices.

Who are UK solar power global installers?

Our UK Solar power global team of installers are a specialist State Government & NGO project installer that work closely with the UK Government DBT to facilitate solar projects, this unique ability makes us one of the most popular in the industry for Government & NGO projects.

How many homes in the UK have solar panels?

According to the latest government data, over 1.4 million homes in the UK have installed solar panels. With a wide range of choice out there, this grand total is made up from many different solar panel manufacturers.

Update Information

- 12 Volt Solar PV Inverter

- Solar PV ModulesWoN0

- Hungary Energy Storage Solar PV Project

- Solar PV Tile Installation

- London off-grid solar photovoltaic power generation system

- High-end manufacturing of wind power solar power and energy storage

- Türkiye Solar PV Panels

- Solar PV Panel Inverter in Cebu Philippines

- Dakar solar air conditioning manufacturing

- Nassau Solar PV Panel Manufacturer

- Kenya Solar PV Panels

- Hot sale omega solar inverter for sale Seller

- Solar power generation and energy storage quotation in Sydney Australia

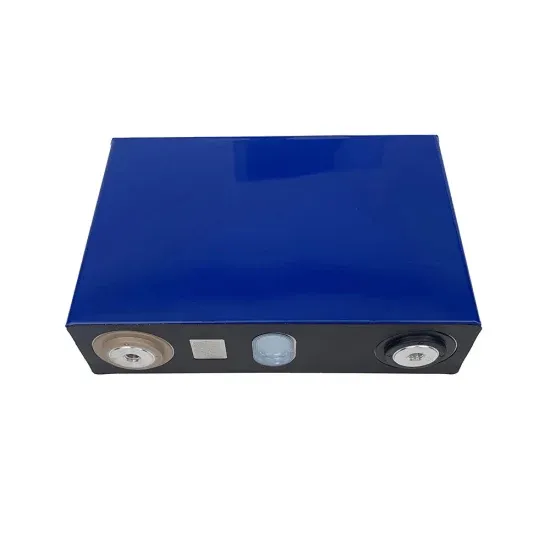

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.