Energy Storage Trends and Opportunities in Emerging

Dec 6, 2021 · Energy storage is a crucial tool for enabling the effective integration of renewable energy and unlocking the benefits of local generation and a clean, resilient energy supply. The

Energy Storage Industry Chain Segmentation: A Deep Dive into the Power

Mar 15, 2025 · Think of the energy storage industry as a three-act play. Act 1: Upstream (raw materials and equipment). Act 2: Midstream (batteries and brainy systems). Act 3:

Enabling renewable energy with battery energy storage

Feb 10, 2025 · These developments are propelling the market for battery energy storage systems (BESS). Battery storage is an essential enabler of renewable-energy generation, helping

Understanding the Energy Storage Industry Chain: Key

Jul 28, 2020 · Energy storage systems are the peacemakers, smoothing out renewables'' mood swings. California''s Solar + Storage projects now power 1.2 million homes after sunset. Take

Energy Storage Operation Modes in Typical Electricity Market

Aug 19, 2024 · Subsequently, combined with the actual development of China''s electricity market, it explores three key issues affecting the construction of cost-sharing mechanisms for energy

Energy Storage Operation Modes in Typical Electricity Market

Aug 19, 2024 · The operating scope of front-of-the-meter energy storage market mainly includes peak shaving, frequency regulation, and ancillary services markets, spot energy market, and

Energy Storage Projects: a global overview of trends and

Consumers are demanding more options. Expert commentators like Navigant Research estimate that energy storage will be a US$50 billion global industry by 2020 with an installed capacity of

Global energy storage

Feb 27, 2025 · The global battery industry has been gaining momentum over the last few years, and investments in battery storage and power grids surpassed 450 billion U.S. dollars in 2024.

Energy Storage Grand Challenge Energy Storage Market

Dec 18, 2020 · This report covers the following energy storage technologies: lithium-ion batteries, lead–acid batteries, pumped-storage hydropower, compressed-air energy storage, redox flow

What are the energy storage projects in China?

Jul 3, 2024 · In this manner, China''s commitment to sustainability reinforces its leadership position within the global energy storage market. Boldly affirming

Energy Storage Industry In The Next Decade: Technological

Mar 13, 2025 · Introduction Driven by the global energy transformation and carbon neutrality goals, the energy storage industry is experiencing explosive growth, but it is also facing

2020 Energy Storage Industry Summary: A New

Mar 1, 2021 · Despite the effect of COVID-19 on the energy storage industry in 2020, internal industry drivers, external policies, carbon neutralization goals,

Energy Storage Industry Chains: The Backbone of a

Mar 21, 2023 · While startups grab headlines, the energy storage industry chains are dominated by heavyweights with global footprints. Take LG Energy Solution, which sources nickel from

What are the energy storage industry chains? | NenPower

Jan 5, 2024 · Energy storage has emerged as a critical component in modern power systems due to varying energy demands and renewable energy generation patterns. The unique demand

6 FAQs about [The difference between energy storage projects and energy storage industry chain]

What are energy storage systems?

Energy storage systems allow energy consumption to be separated in time from the production of energy, whether it be electrical or thermal energy. The storing of electricity typically occurs in chemical (e.g., lead acid batteries or lithium-ion batteries, to name just two of the best known) or mechanical means (e.g., pumped hydro storage).

What makes a good energy storage project?

key aspect of any energy storage project is trust that the system will deliver expected value and savings, thus unlocking affordable financing. In the Minster project, the performance of the battery was guaranteed through a warranty from LG Chem, a well-established and reputable vendor.

What are energy storage profits under a dual-pricing system?

Under the current dual-pricing system, energy storage profits mainly include capacity income, electricity income, and ancillary services income, achieved through reducing the demand for thermal power capacity, peak-valley price arbitrage, and providing ancillary services.

What is the external value of energy storage in China?

For China’s most widely used dual-pricing system, the external value of energy storage in the market can be regarded as reflecting and radiating value through the electricity market and capacity market, where the capacity market includes some functions of the ancillary services market.

How can energy storage projects improve economic viability in China?

The analysis points out that the improvement of electricity market mechanisms and rational subsidy policies are crucial for the economic viability of energy storage projects and are also key issues to focus on in the future development of energy storage operation models in China.

What will the energy storage industry look like in East Asia & Pacific?

Additionally, in many of these areas the industry is likely to adopt a more distributed approach to grid development, using more local power generation and microgrid systems. We expect that the largest energy storage market in the East Asia & Pacific region will be China.

Update Information

- Container Energy Storage Industry Chain Analysis Report

- New energy storage industry chain

- Distribution of energy storage industry chain in the Philippines

- The industry chain of energy storage battery packs

- Supplier of energy storage cabinets for heavy industry in Managua

- The next new industry energy storage

- Future prospects of photovoltaic energy storage projects

- Energy storage projects in Thimphu

- Portable energy storage application industry

- Castrie Heavy Industry Energy Storage Cabinet Brand

- Energy Storage Cabinet Industry

- Energy storage gel battery industry standard

- Port Moresby Heavy Industry Energy Storage Cabinet Customized Manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

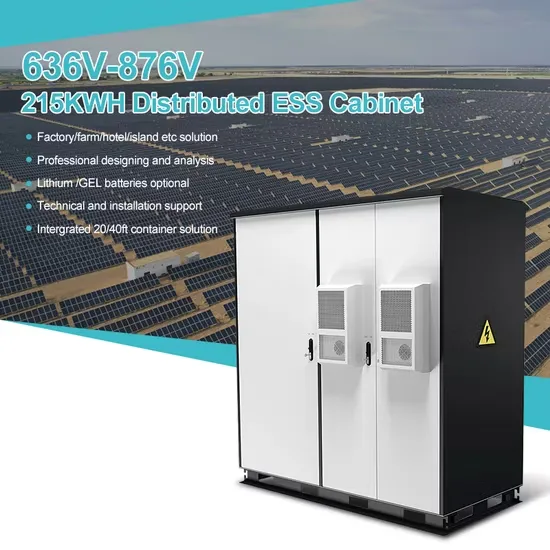

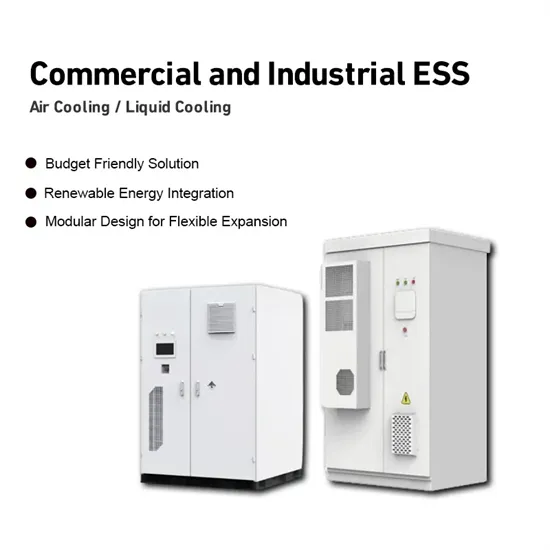

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.