Top Solar inverter Manufacturers Suppliers in Colombia

Aug 19, 2025 · Are you a solar installer or any other photovoltaic professional looking for opportunities in Latin America? I can assure you that Colombia''s nascent solar market is your

Colombia unveils list of bidders for upcoming renewable auction

Sep 10, 2019 · Acciona, Canadian Solar, Enel and Trina Solar among 27 firms competing for contracts under clean energy tender, scheduled in October after months of delay.

Sellers in Colombia | PV Companies List | ENF Company

Colombian wholesalers and distributors of solar panels, components and complete PV kits. 16 sellers based in Colombia are listed below. List of Colombian solar sellers. Directory of

Top Mobile Inverters Manufacturers Suppliers in Colombia

Aug 14, 2025 · What is a Mobile Inverter? Mobile inverters are like regular inverters. They convert direct current into AC for domestic use. All the household appliances work on AC but the

Solis Shines as a Key Player in Colombia and Latin America''s

Medellin, Colombia, October 9th, 2023 – Ginlong (Solis) (Stock code: 300763.S.Z), the world''s 3rd largest PV inverter manufacturer, takes pride in its successful participation in the 7th

FIMER supplies inverters to Colombian dairy producer for

Jul 13, 2021 · FIMER has collaborated with ESSI – COPOWER supplying inverters to Colombian diary producer Lácteos la Esmeralda following the installation of a 669 kWp ground-mounted

Top Solar Panel Manufacturers Suppliers in Colombia

Aug 19, 2025 · Solar equipment production and supply capacity in Colombia There are several local and foreign solar equipment suppliers serving Colombia''s budding solar market. Some of

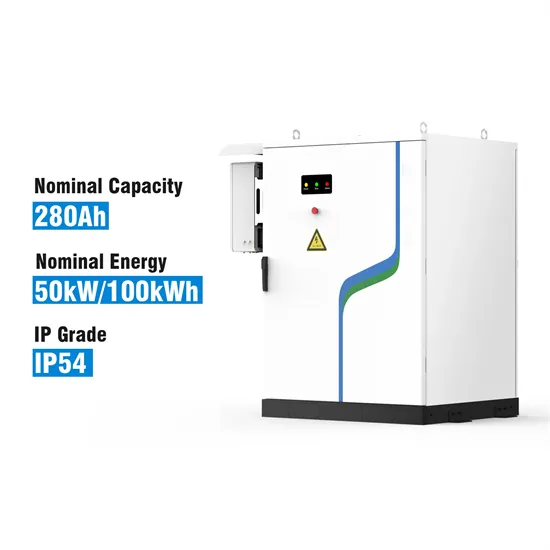

Top Solar Battery Suppliers in Colombia

Aug 18, 2025 · Wholesale Solar Battery for sale! A solar battery is a device that is charged by a connected solar system and stores energy as a backup for consuming later. Users can

Top 10 Inverter Manufacturers In Colombia

Aug 19, 2025 · Find information about the Top 10 inverter manufacturers in Colombia, some corporations that dominate the market sales and other related supporting information.

Top Solar inverter Manufacturers Suppliers in Colombia

Nov 15, 2022 · Gamesa Electric has signed an agreement with Elecnor Atersa to supply its Proteus 4300 inverters to the Portón del Sol solar project that

KSTAR, Leading UPS & PV Inverter Manufacturer-KSTAR

KSTAR is a global leader in R&D and manufacture of UPS,modular data center,PV and ESS solutions.Kstar Ranks No.1 In China''s UPS sales and NO.5 in global market share (IHS

SOLIS EXPECTS TO DOUBLE THIS YEAR SALES OF SOLAR

Mar 10, 2023 · Medellin, Colombia March 8th, 2022. - The multinational Ginlong Solis plans to double its sales of solar inverters in Colombia, a country that is at the forefront of solar energy

Update Information

- Solar panels as inverter power supply

- Solar inverter high power 6000w all-in-one machine

- How many watts does a full set of solar power supply have

- 6000w solar inverter in China in Croatia

- 7 5 kw solar inverter factory in Bahamas

- 1 2 kw solar inverter factory in Jordan

- LeXin Off-Grid Solar Inverter

- Wholesale 220v solar inverter in Mombasa

- Liberia Power System Solar Power Supply

- Off grid solar power inverter in Brisbane

- Solar Inverter Agents in Tunisia

- 300kw solar power inverter

- 2000w solar inverter in China in Panama

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.