Optimal configuration of 5G base station energy storage

Jun 21, 2025 · The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries.To maximize overall

Power Supply for 5G Infrastructure | Renesas

Aug 19, 2025 · Renesas'' 5G power supply system addresses these needs and is compatible with the -48V Telecom standard, providing optimal performance, reduced energy consumption, and

5G Base Station Power Supply Market''s Decade-Long

Apr 14, 2025 · The global 5G Base Station Power Supply market is experiencing robust growth, projected to reach a market size of $7.203 billion in 2025, expanding at a Compound Annual

Recommendations for 5G small base station power supply

Therefore, Cheng Wentao suggested that power supply design engineers should familiarize themselves with new material devices and high-frequency design as early as possible, and

Selecting the Right Supplies for Powering 5G Base

Jul 2, 2022 · It includes everything needed to power 5G base station com-ponents, including software design and simulation tools like LTpowerCAD and LTspice. These tools simplify the

The Future of Power Supply Design for Next Generation Networks (5G

Nov 29, 2024 · The deployment of next-generation networks (5G and beyond) is driving unprecedented demands on base station (BS) power efficiency. Traditional BS designs rely h

Recommendations for 5G Small Base Station Power Supply

Oct 24, 2024 · For macro base stations, Cheng Wentao of Infineon Technologies gave some suggestions on the optimization of primary and secondary power supplies. "In terms of primary

Power Supply for Base Station Strategic Insights for 2025

Mar 25, 2025 · The global power supply market for base stations is experiencing robust growth, driven by the widespread deployment of 5G networks and the increasing demand for higher

Power Supply Solutions for Wireless Base Stations Applications

In particular, MORNSUN can provide specific power supply solutions for optical communication and 5G base stations applications. In particular, MORNSUN''s VCB/VCF series of isolated 3

Energy Management of Base Station in 5G and B5G: Revisited

Apr 19, 2024 · Since mmWave base stations (gNodeB) are typically capable of radiating up to 200-400 meters in urban locality. Therefore, high density of these stations is required for

An optimal dispatch strategy for 5G base stations equipped

Abstract The escalating deployment of 5G base stations (BSs) and self-service battery swapping cabinets (BSCs) in urban distribution networks has raised concerns regarding electricity

5G Power: Creating a green grid that slashes

Jun 6, 2019 · Base stations with multiple frequencies will be a typical configuration in the 5G era. It''s predicted that the proportion of sites with more than five

Selecting the Right Supplies for Powering 5G Base Stations

Additionally, these 5G cells will also include more integrated antennas to apply the massive multiple input, multiple output (MIMO) techniques for reliable connections. As a result, a

Optimal configuration of 5G base station energy storage

Mar 17, 2022 · Abstract: The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize

5G communication challenge to switching power supply-VAPEL

5G communication requires more micro base station at the RAN side, so, the switching power supply of rectifier, -48V power supply, HVDC, DCDC converter, DCDC power module, power

Optimal configuration of 5G base station energy storage

Feb 1, 2022 · A multi-base station cooperative system composed of 5G acer stations was considered as the research object, and the outer goal was to maximize the net profit over the

5G base station architecture, Part 1: Evolution

May 16, 2015 · By late 2014 they had built an additional 720,000 4G base stations which no doubt puts a further strain on the power budget. There is continuous

Comparison of Power Consumption Models for 5G Cellular Network Base

Jul 1, 2024 · The work in [26] presents an assessment of the environmental impacts associated with mobile networks in Germany. Power consumption models for base stations are briefly

5G macro base station power supply design strategy and

Oct 24, 2024 · For macro base stations, Cheng Wentao of Infineon gave some suggestions on the optimization of primary and secondary power supplies. "In terms of primary power supply, we

5G Base Station Power Supply Growth Opportunities and

Jan 8, 2025 · The global 5G base station power supply market is estimated to be worth USD 7203 million in 2025 and is projected to grow at a CAGR of 7.3% from 2025 to 2033. The market

Building better power supplies for 5G base stations

May 25, 2025 · Building better power supplies for 5G base stations Authored by: Alessandro Pevere, and Francesco Di Domenico, both at Infineon Technologies Infineon Technologies -

Study on Power Feeding System for 5G Network

Oct 24, 2019 · With the increase of power density and voltage drops on the power transmission line in macro base, it is recommended to use HVDC system for the 5G network. Requirements

5G Base Station Power Supply Industry Analysis and

Jan 23, 2025 · The global 5G base station power supply market is projected to reach a value of 9,043 million by 2033, exhibiting a CAGR of 7.3% during the forecast period of 2025-2033.

5G Base Station Power Supply Market''s Evolution: Key

Jan 22, 2025 · The global 5G base station power supply market is experiencing substantial growth, driven by the increasing adoption of 5G technology and the need for reliable and

6 FAQs about [5g base station power supply work ideas]

How does a 5G base station reduce OPEX?

This technique reduces opex by putting a base station into a “sleep mode,” with only the essentials remaining powered on. Pulse power leverages 5G base stations’ ability to analyze traffic loads. In 4G, radios are always on, even when traffic levels don’t warrant it, such as transmitting reference signals to detect users in the middle of the night.

Will 5G use micro-cells?

Therefore, in 5G networks, high-frequency resources will no longer use macro base stations, micro-cells become the mainstream, and the small base stations will be used as the basic unit for ultra-intensive networking, that is, small base stations dense deployment.

How will mmWave based 5G affect PA & PSU designs?

Site-selection considerations also are driving changes to the PA and PSU designs. The higher the frequency, the shorter the signals travel, which means mmWave-based 5G will require a much higher density of small cells compared to 4G. Many 5G sites will also need to be close to street level, where people are.

What is the work difficulty of 5G network & powering solution?

work difficulty. 1) 5G Network general descriptions, cells 2) Powering solution divided into local powering, remote coverage, and impact on powering strategy, powering and share infrastructures in three different type of 5G network and feeding solutions cases and there will be very technical specifications.

What is the coverage area of 5G high-frequency base stations?

The radius of coverage area of 5G high-frequency base stations will be less than one-tenth of that of 4G base stations, and the coverage area of 5G high-frequency base stations will be less than one percent of that of 4G base stations. The deployment of macro base stations is difficult and the site resources are not easy to obtain.

Should a 5G power amplifier be combined with a power amplifier?

For 5G, infrastructure OEMs are considering combining the radio, power amplifier and associated signal processing circuits with the passive antenna array in active antenna units (AAU). While AAUs improve performance and simplify installation, they also require the power supply to share a heatsink with the power amplifier for cooling.

Update Information

- Paramaribo reverse power supply 5g base station

- 5g communication base station wind and solar hybrid power supply required

- Integrated 5g base station power supply bidding

- Address of Ngerulmud 5G base station power supply factory

- 5g base station power distribution cabinet work

- Base station 5g communication power supply

- 5g base station power supply ratio

- 5g base station power supply design process

- 5g base station power supply optimization and transformation

- 5G base station power supply related regulations

- Sierra Leone 5g base station battery power supply

- Is it difficult to convert 5G base station power supply to direct current technology

- 5g base station acceleration power supply

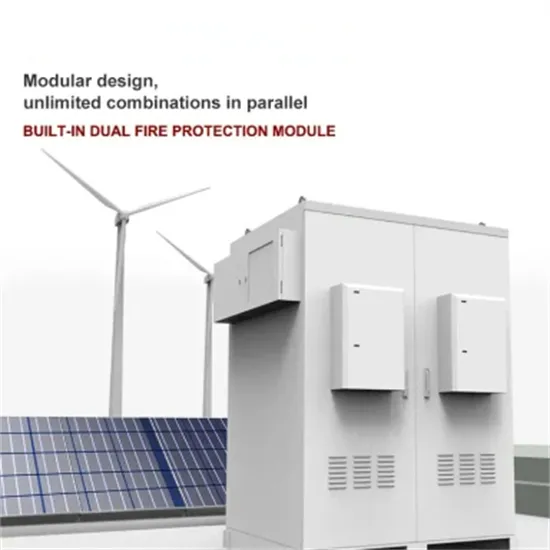

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.