Tokyo Electron to discontinue solar PV panel manufacturing

Tokyo Electron has announced that its board of directors has given the consent to its proposal to discontinue the solar photovoltaic (PV) panel production business by the end of March 2014.

Top Solar Panel Suppliers in Japan

6 days ago · Wholesale Solar Panels For Sale Homeowners and all types of businesses these days are seeking ways to cut down on their power consumption bill and reduce the overall

72 companies for Solar Panel Manufacturing in Japan

TMEIC offers a range of systems solutions including photovoltaic inverters, which are essential for solar panel applications. Their commitment to innovative technologies positions them to

Top 10 Flexible Thin Film Solar Panel Brands in

Jun 6, 2023 · This is why scientists and leading solar panel manufacturers are developing flexible thin-film solar panels with high efficiency and sustainability.

Top 7 Japanese Solar Panel Manufacturers : 2024 Guide

Jan 10, 2024 · Explore Japanese solar panel manufacturers, their product including inverters offerings, and unique advantages. Uncover key certifications guiding Japan''s

Portable Photovoltaic Panels Manufacturers | OKEPS

Aug 11, 2024 · Looking for a reliable and efficient portable photovoltaic panel manufacturer? Look no further than Shenzhen MooCoo Technology Co., Ltd, Our portable photovoltaic panels are

Japan Solar Panel Manufacturing Report | Market Analysis

Explore Japan solar panel manufacturing landscape through detailed market analysis, production statistics, and industry insights. Comprehensive data on capacity, costs, and growth.

Japan Unveils Titanium Solar Panels That Are 1,000 Times

Feb 24, 2025 · Japanese scientists have developed the world''s first titanium solar panel, which promises to be 1,000 times more powerful than traditional photovoltaic panels. This

Sellers in Japan | PV Companies List | ENF Company Directory

Japanese wholesalers and distributors of solar panels, components and complete PV kits. 214 sellers based in Japan are listed below. List of Japanese solar sellers. Directory of companies

Best 5 Manufacturers for off grid solar panel

Aug 28, 2024 · This is your trusty guide, steering you to the top manufacturers of portable solar power who happen to be excelling at capturing sun from distant

Top 10 photovoltaic manufacturers in Japan

Feb 29, 2024 · In this comprehensive article, we explore the top 10 photovoltaic (PV) manufacturers in Japan, shedding light on their significance in driving the nation''s solar energy

HJ 20F Solar Container Folding Solar Container with 600-650W Panels

Product name:Foldable Solar Array Container;Keyword:Photovoltaic Solar Energy System;Type:Off-grid System AC;Length (feet):20'';Capacity:40Ft;External Dimensions (l x

Photovoltaic Cell Manufacturers in Japan

This enhances the efficiency of power generation, and produces up to 30% higher power output than conventional thin-film amorphous silicon panels. Business type: manufacturer Product

6 FAQs about [Tokyo portable photovoltaic panel manufacturer]

What makes Japan's solar panel manufacturing industry unique?

In conclusion, Japan’s solar panel manufacturing industry is renowned for its innovation, quality, and commitment to sustainability. Leading companies like Primroot.com, Sharp, Kyocera, Mitsubishi Electric, and Panasonic produce high-performance solar products that meet stringent safety and efficiency standards.

Are solar panels and inverters safe in Japan?

In Japan, solar panel and inverter manufacturers must adhere to specific certifications to ensure their products meet safety and performance standards. The Japan Electrical Safety & Environment Technology Laboratories (JET) provides certification for photovoltaic power generation systems, including solar panels and inverters.

Why is Japan a leader in photovoltaic technology?

In the dynamic landscape of renewable energy, Japan stands at the forefront of innovation, particularly in the field of photovoltaic (PV) technology. As the demand for clean and sustainable energy sources continues to rise, the role of PV manufacturers in Japan becomes increasingly crucial.

What role do PV manufacturers play in Japan?

As the demand for clean and sustainable energy sources continues to rise, the role of PV manufacturers in Japan becomes increasingly crucial. These companies not only drive technological advancements but also contribute significantly to the nation’s energy transition and global environmental efforts.

Who makes Kyocera solar panels?

Known for their durable and reliable products, Kyocera designs and manufactures high-performance solar panels that cater to both residential and commercial markets. The company is headquartered in Kyoto, Japan, with manufacturing facilities in Japan and China, and has a long-standing reputation for innovation in solar technology.

Who is the largest solar developer in Japan?

Pacifico Energy has more than 1.5GW of operating projects and another 7GW in development. As a leader in the emerging Pacific renewable energy market, it is currently the largest solar developer in Japan. Vena Energy is a leading independent power producer (IPP) focused on renewable energy generation across the Asia-Pacific region.

Update Information

- Tokyo Solar Photovoltaic Panel Manufacturer

- Tokyo flexible photovoltaic panel manufacturer

- Jamaica household photovoltaic panel manufacturer

- Photovoltaic panel fixing parts manufacturer in Lyon France

- Dominica Photovoltaic Panel Source Manufacturer

- Nauru Photovoltaic Panel Agent Manufacturer

- Ankara photovoltaic panel manufacturer

- Mongolia single glass photovoltaic panel manufacturer

- Caracas photovoltaic panel new panel manufacturer

- Photovoltaic panel sorting manufacturer in Guatemala City

- Harare photovoltaic panel export manufacturer

- Tunisia small photovoltaic panel manufacturer

- Austria Photovoltaic Panel Maintenance Manufacturer

Solar Storage Container Market Growth

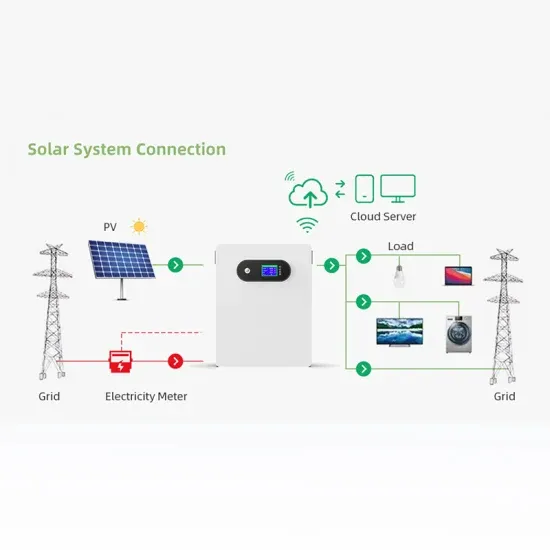

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.