Asian Battery Manufacturers: Leading Companies to Expand

Aug 29, 2022 · Enhanced Cost Pass-Through Mechanisms: The profitability of EV battery suppliers has been pressured since 2H21 due to rapidly rising input costs of key raw materials,

Who Are the Top 10 Lithium Battery Manufacturers in 2025?

Feb 27, 2025 · The top lithium battery manufacturers in 2025 include CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK Innovation, Tesla, EVE Energy, CALB, and BAK

Top 21 Lithium Ion Battery Manufacturing Companies

Aug 18, 2025 · Explore innovations from lithium ion battery manufacturing companies like Northvolt and Clarios, shaping the future of energy storage solutions.

Asian Battery Manufacturers: Leading Companies to Expand

Aug 29, 2022 · Fitch expects the world''s top electric-vehicle battery suppliers to maintain their leading market share given high barriers to entry, including technology leadership and

2024 Market Review of China''s Top 6 Forklift Lithium Battery Manufacturers

Dec 6, 2023 · We searched these Six Chinese forklift lithium battery brands online for hours. Some of China''s most well-known brands are vying for a growing share of the market for

Top 15 Lithium-ion Battery Manufacturers: A Global Review

Jun 26, 2025 · Discover the top 15 lithium-ion battery manufacturers for 2025 in our global guide. We compare the best companies for EV, industrial, and custom lithium batteries to find your

Global Market for Li-ion Battery Recycling 2025-2045, with

May 7, 2025 · The global market for lithium-ion battery recycling has seen surging growth in recent years driven by escalating consumption of lithium-ion batteries in electric vehicles,

Asian lithium-ion energy storage battery companies

The report covers Asia-Pacific Lithium-ion Battery Manufacturers and the market is segmented by Application (Automotive Batteries, Industrial Batteries, Consumer Electronics Batteries, and

11 Leading China Lithium Battery Manufacturers

Aug 18, 2025 · DEFORD New Power Co., Ltd addresses common battery performance challenges through systematic engineering solutions and customer-focused development

Top 10 Lithium ion battery manufacturers in

Aug 15, 2023 · So far, it can be said that China has been the leading country in lithium ion battery technology, and many companies are at the world''s leading

Top 10 Global Power & Storage Battery Manufacturers 2024

Apr 2, 2025 · Among the top 10 global battery manufacturers (power + energy storage) in 2024, six are Chinese companies: CATL, BYD, EVE Energy, CALB, Gotion High-Tech, and

Top 15 Leading Lithium-Ion Battery Manufacturers in China

Jul 22, 2025 · Leading Lithium-Ion Battery Manufacturers in China dominate 70% global supply. CATL, 比亚迪, CALB drive EV/storage innovation with scale, tech & supply chain control.

6 FAQs about [North Asia recommended lithium battery manufacturers]

What are the top lithium battery manufacturers in 2025?

The top lithium battery manufacturers in 2025 include CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK Innovation, Tesla, EVE Energy, CALB, and BAK Battery. These companies dominate due to their technological innovation, production capacity, and market share in automotive, energy storage, and consumer electronics sectors.

What makes a good lithium battery manufacturer?

The top lithium battery manufacturers combine scale, innovation, and strategic partnerships. As demand for EVs and renewable energy storage grows, sustainability and regional policies will reshape the competitive landscape. Who is the largest lithium battery manufacturer? CATL is the largest, with a 35% global market share.

Where are lithium batteries made?

Asia-Pacific holds 80% of production capacity, driven by China and South Korea. North America and Europe are expanding via policies like the U.S. Inflation Reduction Act and EU Battery Alliance. Lithium Battery Manufacturer

Who makes the most lithium batteries in the world?

CATL is the largest, with a 35% global market share. Are lithium batteries recyclable? Yes, companies like Redwood Materials and Li-Cycle specialize in recycling. What is the future of lithium batteries? Prev post Who Are the Leading Lithium Battery Manufacturers Globally? Next post What Should You Know Before Buying Crown Forklift Batteries?

Who makes lithium forklift batteries?

Lithium Forklift Battery Manufacturer CATL’s dominance is reinforced by its strategic partnerships with European automakers, including a recent $2 billion deal to supply batteries for BMW’s next-generation EVs. BYD has expanded its global footprint by opening factories in Brazil and Thailand, targeting emerging EV markets.

Which countries dominate the lithium battery industry in 2025?

The lithium battery industry is rapidly evolving, and choosing the right partners is crucial for success. In 2025, a mix of Chinese, South Korean, and Japanese giants dominate the lithium battery landscape.

Update Information

- Mauritania Energy Storage Lithium Battery Recommended Company

- North Macedonia custom lithium battery pack

- North Korea pack lithium battery project

- Tbilisi energy storage battery recommended manufacturers

- East Asia assembles EK lithium battery pack

- East Asia lithium battery inverter custom manufacturer

- Tirana Energy Storage Lithium Battery Recommended Company

- North Cyprus 72V lithium battery station cabinet

- European cylindrical lithium battery manufacturers direct supply

- Large cylinder of lithium battery

- Japanese lithium battery bms maintenance company

- Does the battery pack contain lithium batteries

- Lithium battery energy storage frequency modulation response time

Solar Storage Container Market Growth

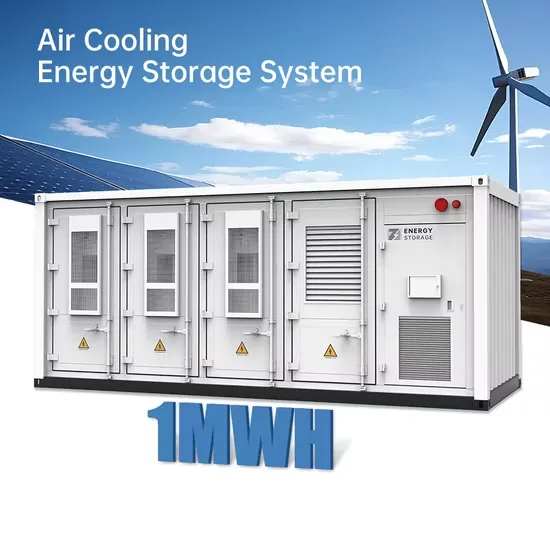

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

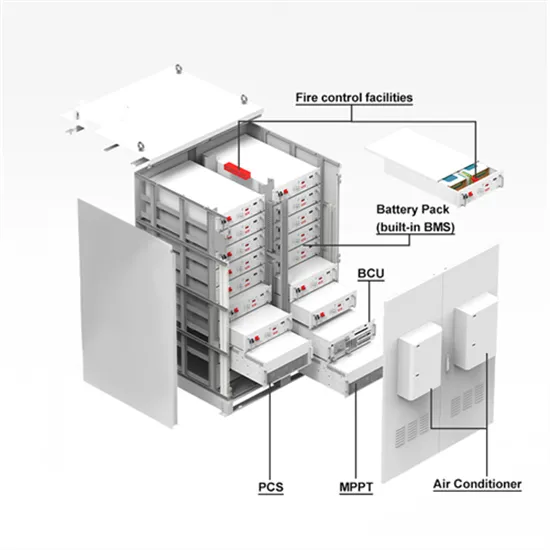

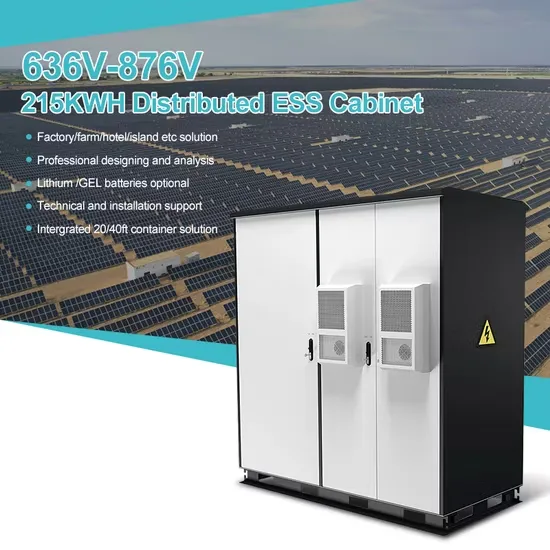

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.