Battery Energy Storage Systems Market Size| Forecast to 2033

Aug 4, 2025 · Battery Energy Storage Systems Market Size, Share, Growth, and Industry Analysis, By Type (Lithium-ion Battery, Lead-Acid Battery, Flow Battery), By Application

Battery Industry Strategy

May 20, 2022 · The battery supply chain : Importance of securing the manufacturing base Risks exist in the supply chain of mineral resources and materials which support battery cell

European Market Outlook for Battery Storage 2025-2029

May 7, 2025 · The European Market Outlook for Battery Storage 2025–2029 analyses the state of battery energy storage systems (BESS) across Europe, based on data up to 2024 and

BYD Achieves 30% Market Share in European Battery Storage Market

Aug 30, 2024 · Data shows that BYD held a 30% market share in the European battery energy storage market in the first half of 2024. In 2023, more than 50% of battery storage systems

New analysis reveals European solar battery storage market

Jun 11, 2024 · Latest analysis from SolarPower Europe reveals that, in 2023, Europe installed 17.2 GWh of new battery energy storage systems (BESS); a 94% increase compared to 2022.

Brazil Battery Energy Storage System Market to 2032

Brazil Battery Energy Storage System Market Industry is expected to grow 16.46 USD Billion by 2032. The Brazil Battery Energy Storage System Market Growth is registered at a CAGR

Brazil bets big on batteries

10 hours ago · Brazil bets big on batteries Energy storage in Brazil is entering a period of accelerated growth. Despite the lack of a legal framework for project operations, companies

''Brazil could have $3.8bn battery energy storage

Mar 4, 2025 · A study by Brazilian consultancy Greener has indicated that the country installed 269 MWh of energy storage capacity in 2024, growth of 29%

Brazil Energy Storage System Market Size and Forecasts 2030

Apr 26, 2025 · Battery Energy Storage Systems (BESS): Expected to dominate the market due to widespread adoption in residential, commercial, and utility applications in Brazil. Pumped

Battery energy storage systems in Brazil: current regulatory

Explore Brazil''s battery energy storage systems, focusing on current regulations, investment opportunities, and the role of these systems in the energy transition.

Brazil Battery Energy Storage System Market Report With

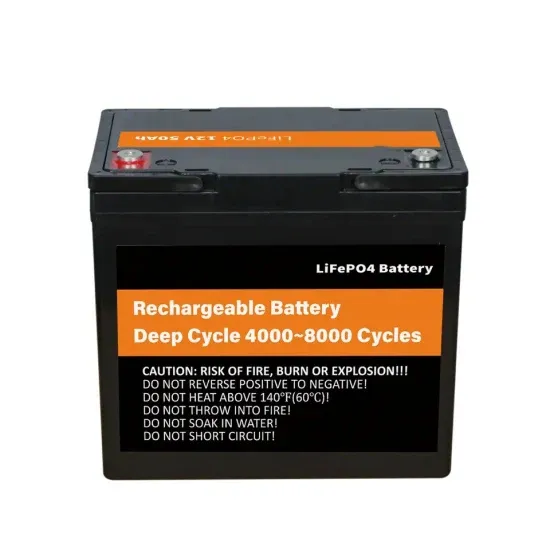

Flow Batteries segment is anticipated to reach $242.8 Million by 2032 with the highest CAGR of 32.22%. Lithium-Ion Batteries and Lead-Acid Batteries segments collectively expected to

Brazil Battery Energy Storage Systems Market Report

The Brazil Battery Energy Storage Systems (BESS) market in the first quarter of 2025 is characterized by robust growth driven by the country''s expanding renewable energy sector.

6 FAQs about [Battery storage market share in Brasilia]

Will Brazil install a battery energy storage system in 2024?

A study by Brazilian consultancy Greener has indicated that the country installed 269 MWh of energy storage capacity in 2024, growth of 29% from 2023. Demand for battery energy storage system (BESS) components grew 89% in Brazil from 2023 to 2024 and most of the resulting systems are likely to be installed in 2025.

Can Brazil be a big battery storage country?

With well-designed policies and regulations, Brazil has significant potential to follow in the footsteps of jurisdictions like California and Chile for large-scale battery storage, Germany for distributed and large-scale storage, and Australia for both pumped hydro and large-scale battery systems.

What is driving Brazilian energy storage demand?

An unreliable grid is driving Brazilian energy storage demand. The world is set to have more than 760 GWh of energy storage capacity by 2030, led by Chinese and United States markets dominated by utility-scale systems.

Can foreigners invest in battery storage businesses in Brazil?

Investment, incentives and taxation scenarios According to Brazilian law, there are no legal restrictions on direct foreign investment in the battery storage businesses or in the power sector (except in very specific segments or sectors of the economy).

Are battery energy storage systems at a premium in the future?

Flexible generation and correlated solutions, including battery energy storage systems (BESS), are therefore likely to be at a premium in the future.

Is the storage market a key component of the energy transition?

“The storage market is a key component of the energy transition in Brazil, enabling the integration of renewable [energy generation] sources into the electricity grid and providing greater system stability,” said Greener CEO Marcio Takata.

Update Information

- Mauritius energy storage battery market share

- Overseas market share of energy storage cabinet batteries

- Bess battery storage for sale in Brasilia

- Energy storage battery cost per kilowatt

- Photovoltaic energy storage battery module

- Jakarta battery energy storage system

- Supercapacitor energy storage solid-state battery

- Dodoma imported energy storage lithium battery

- Is lithium battery prohibited in Kampala Energy Storage Station

- How much is the price of Vientiane energy storage battery

- How to cooperate 1500v energy storage battery and PCS

- How much current does the energy storage cabinet battery output

- 12v400ah energy storage battery price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.