Communication Base Station Energy Storage Systems

As global 5G deployments surge to 1.3 million sites in 2023, have we underestimated the energy storage demands of modern communication infrastructure? A single macro base station now

Energy Storage Equipment, Energy storage solutions, Lithium battery

We Group''s Home Energy Storage Solution integrates advanced lithium battery technology with solar systems. Ranging from 5kWh to 20kWh, it caters to households of varying sizes. It

BESS (Battery Energy Storage Systems)

Boost energy storage with Industrial/Commercial & Home BESS, powered by lithium batteries. Ensure grid stability, savings, & backups. Plus, power base stations with We Energy

Communication Base Station Battery Cabinets | We

Behind every communication base station battery cabinet lies a complex engineering marvel supporting our hyper-connected world. As 5G deployments surge 78% YoY (GSMA 2023),

What is Solar Power Station Energy Storage System LFP Battery

How to Make Solar Power Station Energy Storage System LFP Battery Cell 372kwh with Inverter All-in-One Solution, Honle Solar Battery Production Line manufacturers & suppliers on Video

Communication Base Station Battery Disposal | We Group

The Silent Crisis in 5G Expansion As global 5G infrastructure grows by 19% annually, communication base station battery disposal emerges as a critical yet overlooked challenge.

Communication Base Station Energy Solutions

A telecommunications company in Central Asia built a communication base station in a desert region far from the power grid. Due to harsh climate conditions and the absence of on-site

Belarus 200KW 372KWH Industrial And Commercial Energy

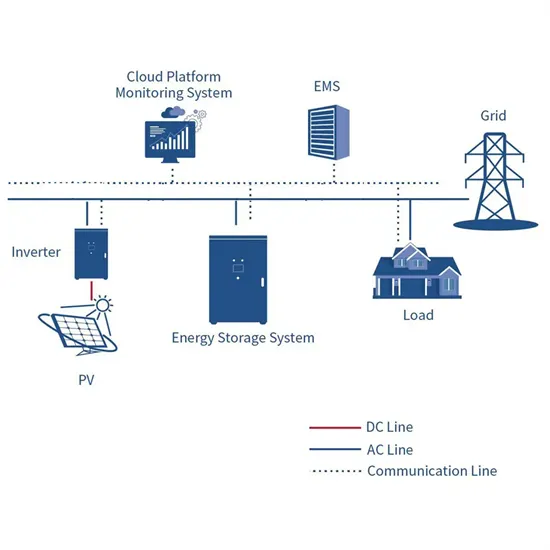

Jul 22, 2024 · Two 200KW 372KWH industrial and commercial energy storage units are used to power two residential buildings. This BESS connects photovoltaic power and the grid to

CATL EnerOne 372.7KWh Liquid Cooling battery energy

Aug 3, 2023 · It has a nominal capacity of 372.7 kWh with a floor space of just 1.69 square meters. The system is suitable for inverters with operating voltages ranging from 600 to 1500

Communication Base Station Battery Market Size, Share

Aug 6, 2025 · The Communication Base Station Battery Market is experiencing significant growth driven by the rapid expansion of telecommunication infrastructure, advancements in battery

Update Information

- What does wind power and photovoltaic power generation include in the San Salvador communication base station

- Gaborone communication base station lead-acid battery energy storage cabinet manufacturer

- Lithium battery communication base station price

- Communication base station energy storage 48v battery

- Can the lead-acid battery of a communication base station use 220v

- Current price of communication base station battery module

- Battery energy storage system of communication base station disturbs residents

- News about the battery of the migration communication base station

- How much does it cost to build a communication base station lead-acid battery

- Gabon communication base station battery energy storage system bidding

- Does the flywheel energy storage fiber of the communication base station have a battery

- Cambodia Communication Base Station Flow Battery Construction Regulations

- China Communication Base Station Supercapacitor Battery Testing

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

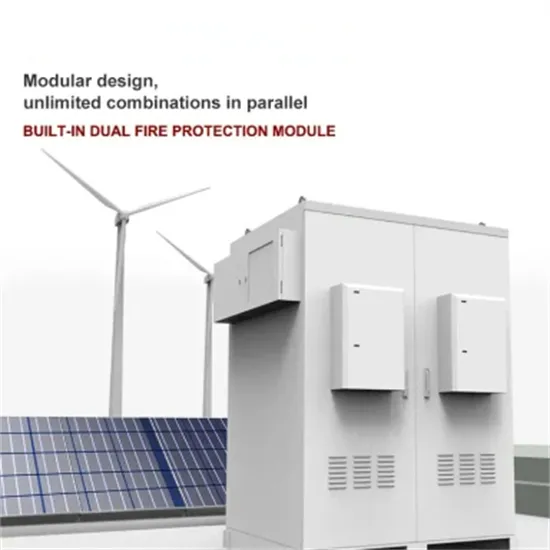

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.