Global Photovoltaic Inverter Market Report 2025 Edition, Market

Global Photovoltaic Inverter market size 2025 was XX Million. Photovoltaic Inverter Industry compound annual growth rate (CAGR) will be XX% from 2025 till 2033.

Global PV Inverter Market Size, Trends, Share 2025

PV Inverter Market Size, Trends and Insights By Product (String PV Inverter, Central PV Inverter, Micro PV Inverter), By End-use (Commercial & Industrial, Utilities, Residential), and By Region

PV Inverter Market Size, Share & Trends Analysis, 2025-2033

Aug 4, 2025 · The global PV inverter market size was valued at USD 13.78 billion in 2024 and is projected to reach USD 14.74 billion in 2025, growing further to USD 25.11 billion by 2033,

Global Photovoltaic Inverter Market Research Report 2024

Jan 16, 2024 · The global Photovoltaic Inverter market was valued at US$ 5776.2 million in 2023 and is anticipated to reach US$ 5889.2 million by 2030, witnessing a CAGR of 0.2% during the

Global surge in solar PV inverter shipments highlights

The global energy landscape saw a significant shift in 2023, marked by a 56% increase in solar photovoltaic (PV) inverter shipments, to reach 536 GWac. China, a powerhouse in solar

Global solar PV inverter landscape 2024 Report

Oct 24, 2024 · This annual report provides insight into the global solar PV inverter and module-level power electronics (MLPE) landscape, including regional and

Solar Photovoltaic Inverter Market Forecasts to 2030

Oct 10, 2024 · Solar Photovoltaic Inverter Market Forecasts to 2030 - Global Analysis By Product, Connectivity, Phase, Power Rating, Sales Channel, End User and By Geography - According

PHOTOVOLTAIC MODULES AND INVERTERS

Mar 5, 2025 · The different inverter types available in the market are central inverters, string inverters, micro inverters, smart inverters and battery-based inverters. Central inverters are

Huawei, Sungrow and SMA dominate global inverter market

Apr 29, 2020 · The global solar inverter market grew 18% in 2019, according to new data from U.S.-owned analyst Wood Mackenzie. The WoodMac analysts said two trends were critical:

Solar PV Inverter Market Size, Growth & Industry

Jul 7, 2025 · Solar PV Inverter Market Size & Share Analysis - Growth Trends & Forecasts (2025 - 2030) The Solar PV Inverter Market Report is Segmented

Global Photovoltaic Inverter Market Research Report 2023

Jun 12, 2023 · This report, based on historical analysis (2018-2022) and forecast calculation (2023-2029), aims to help readers to get a comprehensive understanding of global

Utility On Grid PV Inverter Market | Global Market Analysis

Aug 6, 2025 · Utility On Grid PV Inverter Market is forecasted to reach USD 41.8 billion by 2035 and exhibiting a remarkable 7.7% CAGR between 2025 and 2035.

Solar PV Inverter Market Size, Growth & Analysis Report by

The global solar PV inverter market size was valued at USD 16.3 billion in 2024 and is estimated to reach USD 35.4 billion by 2033, growing at a CAGR of 10.2% during the forecast period

Solar PV Inverter Market Size, Trend & Industry

Nov 23, 2021 · The global solar PV inverter market size was valued at USD 7.7 billion in 2020, and is expected to reach USD 17.9 billion by 2030, registering

Global Photovoltaic Pv Inverter Market Analysis

Explore a comprehensive evaluation of the Global Photovoltaic (PV) Inverter market, delving into key trends, growth drivers, and demand factors. This detailed examination provides an in

Photovoltaic Inverter

Feb 21, 2025 · The global market for Photovoltaic Inverter was estimated to be worth US$ 5829 million in 2024 and is forecast to a readjusted size of US$ 5910 million by 2031 with a CAGR

Photovoltaic (PV) Inverter Market Size, Share and Forecast

Jun 19, 2025 · The Photovoltaic (PV) Inverter Market demonstrates strong geographical diversification, with Asia Pacific leading in terms of installations due to large-scale solar

6 FAQs about [Global Photovoltaic Inverter Market]

What is the global photovoltaic inverter market?

Photovoltaic Inverter, also known as power regulator and power regulator, is an indispensable part of the photovoltaic system. The global Photovoltaic Inverter market was valued at US$ 5776.2 million in 2023 and is anticipated to reach US$ 5889.2 million by 2030, witnessing a CAGR of 0.2% during the forecast period 2024-2030.

How did solar inverter market share grow in 2021?

Global top 10 solar photovoltaic (PV) inverter vendors shored up 82% of market share in 2021, increasing by 2 percentage points compared to 2020, says Wood Mackenzie, a Verisk business (Nasdaq:VRSK). Global PV inverter shipments grew 22% or 40,250 MWac (mega-watt, alternating current) to 225,386 MWac in 2021 compared to 2020.

What are the major players in global PV inverter market?

The major players in global PV Inverter market include SMA, Huawei, etc. The top 2 players occupy about 30% shares of the global market. Asia-Pacific is main market, and occupies over 60% of the global market. String Inverter is the main type, with a share about 60%. Public Utilities is the main application, which holds a share about 45%.

What is the global demand for PV inverters in 2022?

The global PV demand of 201 gigawatt alternating current (GWac) in 2022 contributed to 48% growth year-over-year for PV inverters. In terms of inverter shipments, strong growth in Europe, Asia Pacific, and the United States where government support bolstered to meet clean energy goals led to a total of 333 GWac of global shipments in 2022.

Which PV inverter vendors shipments grew the most in 2022?

The top five vendors – Huawei, Sungrow, Ginlong Solis, Growatt, and GoodWe – shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, growing 8% from 2021. Huawei’s shipments saw a significant increase of 83% in 2022 compared to 2021, while Sungrow’s shipments expanded 56% in the same period.

Which region has the most inverter shipments in the world?

The Asia Pacific (APAC) region held 50% of the global market with a 44% year-over-year growth in shipments, with total shipments to the region reaching 167 GWac. China led the market with 78% of inverter shipments to APAC directed to the country as installations reach an all-time high.

Update Information

- EK photovoltaic inverter wifi

- Photovoltaic inverter enterprise working hours

- Inverter vs Photovoltaic

- Photovoltaic inverter reverse development

- Photovoltaic energy storage inverter centralized

- Photovoltaic off-grid inverter self-operation

- Tajikistan Solar Photovoltaic Inverter Manufacturer

- Photovoltaic inverter wave-by-wave current limiting

- Uzbekistan photovoltaic module inverter manufacturer

- Communication base station inverter photovoltaic classification

- Photovoltaic modules on communication base station inverter

- Estonia home photovoltaic inverter quotation

- Inverter used in photovoltaic panels

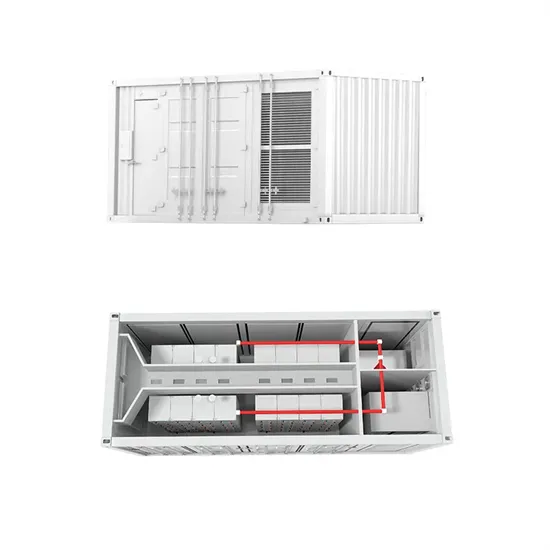

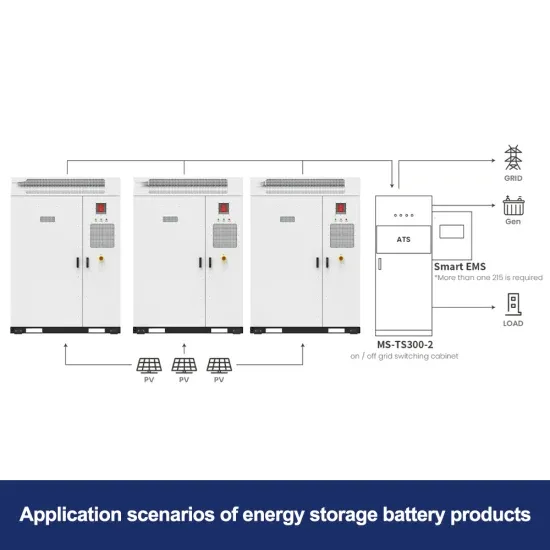

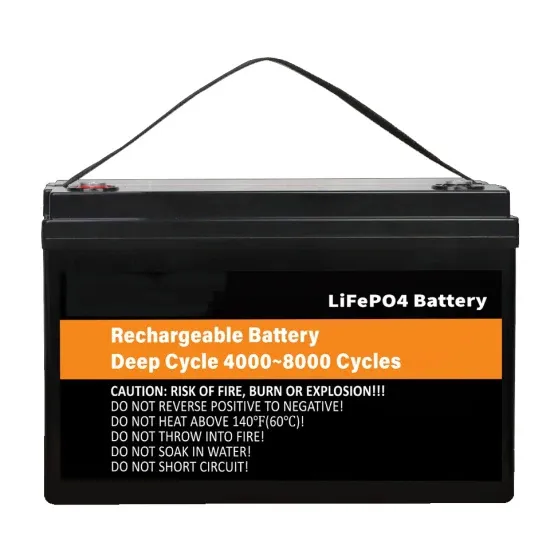

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.