Sungrow and CEEC Complete Central Asia''s Largest Energy Storage

Jan 27, 2025 · Sungrow, the global leading PV inverter and energy storage system (ESS) provider, in partnership with China Energy Engineering Corporation (CEEC), are proud to

Southeast Asia''s emerging energy storage opportuniti

Dec 17, 2022 · Southeast Asia''s emerging energy storage opportunities Southeast Asia''s emerging energy storage opportunities Southeast Asia | There has been an uptick in energy

China''s Battery Energy Storage System Manufacturers Set

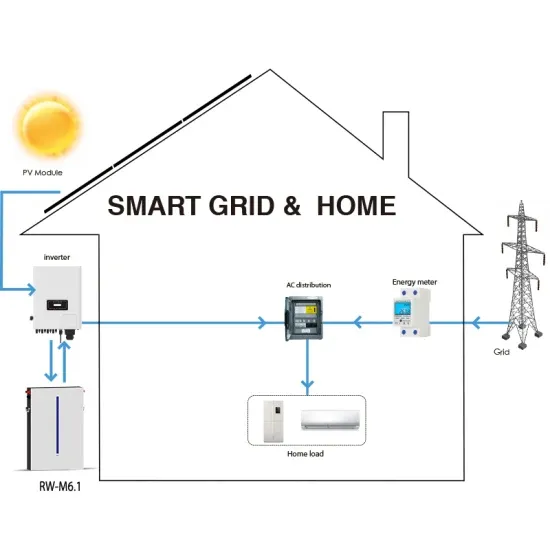

Jun 23, 2025 · Chinese battery energy storage system manufacturers are enabling smart grids by offering solutions that absorb excess energy and release it during peak hours. This supports

Top 10 Global Power & Storage Battery Manufacturers 2024

Apr 2, 2025 · Among the top 10 global battery manufacturers (power + energy storage) in 2024, six are Chinese companies: CATL, BYD, EVE Energy, CALB, Gotion High-Tech, and

Top 10 Energy Storage Developers in Asia | PF Nexus

Jul 14, 2025 · Discover the current state of energy storage developers in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

BATTERY MANUFACTURING: THE EMERGING GLOBAL SCENARIO | Industry-Asia

Sep 12, 2024 · Consequently, the demand for batteries – the secondary, rechargeable type – is increasing. Though there are many different types of batteries, when it comes to electric

Asia-Pacific Battery Energy Storage System Companies

This report lists the top Asia-Pacific Battery Energy Storage System companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive

3 FAQs about [Battery energy storage manufacturers in Central Asia]

Which is the largest storage battery manufacturer in India?

Exide Industries Limited is the largest storage battery manufacturer in the country and has pioneered battery technology in India for over 60 years. It is the only company in South and South East Asia which designs and manufactures lead acid batteries from 2.5 Ah to 20400 Ah.

What is the largest battery energy storage project in the world?

SAN DIEGO, August 19, 2020 – LS Power today unveiled the largest battery energy storage project in the world – Gateway Energy Storage. The 250 megawatt (MW) Gateway project, located in the East Otay Mesa community in San Diego County, California, enhances grid reliability and reduces customer energy costs.

Where is the first battery-based energy storage facility in the Philippines?

The plant, which will be the first battery-based energy storage facility in the Philippines, will be located next to the Masinloc power plant in Zambales. The energy storage array will enhance grid reliability by providing fast response ancillary services like frequency regulation.

Update Information

- Battery Energy Storage in Central Asia

- European energy storage lithium battery sales manufacturers

- Western European energy storage battery system manufacturers

- Niger battery energy storage cabinet manufacturers ranking

- What are the Freetown container energy storage battery manufacturers

- Mozambique imported energy storage battery manufacturers

- Central Asian battery energy storage manufacturer

- What are the manufacturers of battery energy storage system equipment for emergency communication base stations

- North Asia Energy Storage Container Battery

- Energy storage battery manufacturers have carbon benefits

- Which communication base stations in South Asia have the most battery energy storage systems

- How many energy storage battery manufacturers are there in Hamburg Germany

- Huawei Asia Energy Storage Battery Factory

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.