Genesis Energy Launches Construction of 200MWh Battery Storage

Jun 7, 2025 · Genesis Energy, a publicly traded energy generation, wholesale, and retail company in New Zealand, has officially begun the construction of a 100MW/200MWh battery

New Zealand welcomes first big battery to

Mar 13, 2024 · New Zealand''s transition to a renewable energy future has taken a significant step forward with the nation''s first grid-scale battery energy storage

Storage Options for the New Zealand Electricity Sector

This report has been prepared at the request of MBIE, as a contribution towards developing a comprehensive framework for understanding and assessing options for managing a large

Genesis Energy Initiates Construction of 200MWh Battery Storage

Jun 7, 2025 · Genesis Energy Begins Construction on 200MWh BESS in New Zealand By George Heynes June 6, 2025 Genesis Energy, a publicly listed energy company in New Zealand, has

New Zealand''s SMEs: A Snapshot

Oct 7, 2022 · With around 550,000 small and medium sized enterprises (SMEs) in New Zealand1, the sector comprises a broad range of businesses that are at the heart of our economy and

Electricity wholesale price

Oct 24, 2024 · Definition of Electricity wholesale price This report analyses the wholesale price of electricity in the spot market. The prices shown are an average across all market regions in

Saft wins 200MWh Genesis Energy New Zealand BESS contract

September 19, 2024 Saft, a subsidiary of TotalEnergies, has won a contract to deliver a turnkey, utility-scale 100MW / 200MWh battery energy storage system (BESS) for Genesis Energy, a

BATTERY STORAGE IN NEW ZEALAND

Sep 7, 2023 · We considered hosting our own trial of grid-connected battery storage, but first we chose to investigate the benefits of battery storage across the electricity supply chain. We did

Energy storage systems as instantaneous reserve | Our

May 6, 2021 · Enabling energy storage systems to participate and compete in the national reserves market. We decided to finalise the Code amendment published on 6 July 2021 as a

Backup to Backbone: The Electricity Authority''s Battery Energy Storage

Jul 21, 2025 · Solving that intermittency issue is a fantastic opportunity for those developing or investing into firming technologies such as Battery Energy Storage Systems (BESS). A BESS

Ernest Energy – The future of energy, designed for New Zealand

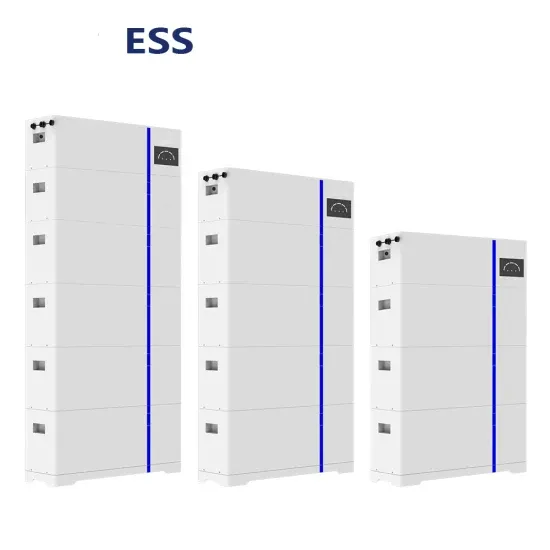

At Ernest Energy, we provide smart storage systems that help you make the most of the energy you already have—reducing reliance on the grid, supporting sustainability goals, and giving

Backup to Backbone: The Electricity Authority''s Battery Energy Storage

Jul 21, 2025 · The Electricity Authority (EA) has released its regulatory roadmap for battery energy storage systems. It is clear that the EA recognises the value of BESS and will continue to

Meridian completes 200MWh Ruakākā BESS in New Zealand

May 23, 2025 · Meridian Energy, a New Zealand state-owned energy company, has completed the development of its 100MW/200MWh 2-hour duration Ruakākā BESS.

The need for energy storage: Firming New Zealand''s

Jul 28, 2025 · Concept Consulting''s modelling shows that without thermal generation from the Rankine units as part of New Zealand''s energy storage solution, wholesale electricity prices

The need for energy storage

5 days ago · Concept Consulting''s modelling shows that without thermal generation from the Rankine units as part of New Zealand''s energy storage solution, wholesale electricity prices

New Zealand''s electricity future: generation and

Feb 14, 2023 · New Zealand''s future is electric. More electricity generation is needed to meet increasing demand and to replace fossil fuel-fired generation.

Report: Unlocking the potential of community

Jan 13, 2025 · Aotearoa New Zealand faces a critical energy transition, balancing carbon reduction, affordability and resilience. This Climate Connect Aotearoa

6 FAQs about [Wholesale smes energy storage in New-Zealand]

How is electricity sold in New Zealand?

Electricity is bought and sold on the wholesale market. There are about 330 participants in New Zealand's wholesale electricity market. The wholesale market is where generators sell electricity and retailers buy electricity. Retailers then on‑sell that electricity to businesses and households across New Zealand.

What is a battery energy storage system?

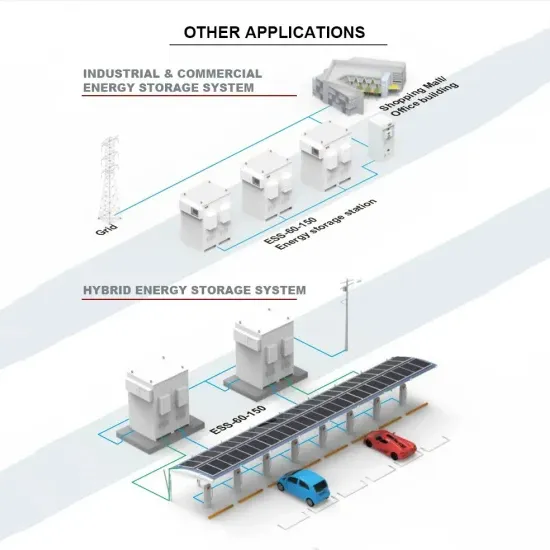

Solving that intermittency issue is a fantastic opportunity for those developing or investing into firming technologies such as Battery Energy Storage Systems (BESS). A BESS captures, stores and discharges electricity.

How many wholesale companies are there in New Zealand?

There are about 80 generation companies, 62 retailers and 6 gentailers (generator-retailers) in New Zealand's wholesale market. The remaining wholesale market participants comprise distribution and network companies and traders in secondary markets, such as financial hedges.

What is the wholesale market in New Zealand?

The wholesale market is where generators sell electricity and retailers buy electricity. Retailers then on‑sell that electricity to businesses and households across New Zealand. There are about 80 generation companies, 62 retailers and 6 gentailers (generator-retailers) in New Zealand's wholesale market.

Why does New Zealand need 'flexible' energy?

has largely displaced thermal generation assets from baseload duty. As with other electricity markets around the world, the use of renewables means the market faces great exposure to climatic conditions – the amount of rain, wind, and sunshine in particular locations – and therefore New Zealand requires significant amounts of ‘flexible’

Does New Zealand need flexible thermal generation?

e 1: Modelled 2035 thermal generation for the Renewable push scenarioTo deliver the flexible generation required, New Zealand needs a solution that can bala ce the trilemma of security, affordability, and environmental impact. An optimal solution would: Have suff ient storage capacity to be able to cover

Update Information

- Wholesale smes energy storage in Tanzania

- Wholesale smes energy storage in Namibia

- Wholesale smes energy storage in America

- Korea lithium energy storage power supply wholesale

- Gambia lithium battery wholesale energy storage manufacturer

- Pretoria energy storage power wholesale price

- What is the wholesale price of energy storage vehicles in Lesotho

- Tehran energy storage cabinet battery wholesale

- Georgetown Industrial Energy Storage Cabinet Wholesale

- Latvian large energy storage cabinet wholesale

- Czech energy storage high power supply wholesale price

- Moscow Industrial Energy Storage Cabinet Wholesale Manufacturer

- Kuala Lumpur Sunshine Energy Storage Power Wholesale

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.