Mexico Switchgear Market: Market Size, Share & Growth [2028]

Trends, opportunities and forecast in Switchgear Market in Mexico to 2028 by voltage (high voltage, medium voltage, and low voltage), product (other low voltage switchgear, metal

Vertiv Announces Integrated Manufacturing and

Nov 4, 2021 · Vertiv (NYSE: VRT), a global provider of critical digital infrastructure and continuity solutions, today announced plans for a major new facility in

Siemens Announces Next-Generation Medium-Voltage Metal-Clad Switchgear

Oct 2, 2006 · The GM-SG is to be manufactured at the Siemens switchgear factory in Queretaro, Mexico. Siemens has made a considerable investment in the existing Queretaro operation to

Hitachi Energy invests $155M into 3 manufacturing facilities in Mexico

Sep 30, 2024 · Additionally, Hitachi Energy will invest over $25 million to expand its transformer factory in South Boston, Virginia, increasing the production capacity for large distribution

Hitachi Energy expands transformer and switchgear

Sep 30, 2024 · The company plans to expand its high-voltage switchgear and breakers factory in Mount Pleasant, Pennsylvania, a distribution, power, and traction transformer factory in South

Mexico Switchgear Market (2019-2025) by Voltage, Type,

Jan 27, 2020 · Medium voltage switchgear segment is anticipated to dominate the overall Mexico switchgear market share, in terms of revenues, on account of demand for such products in

Siemens doubles production capacity at Queretaro plant

Nov 30, 2017 · "This plant specializes in the production of switchboards and electrical infrastructure and is integrated into the distribution and transmission projects in Mexico, as

Eaton products distributor

Aug 6, 2025 · Eaton''s Medium Voltage Switchgear provides centralized control and protection of medium-voltage power equipment and circuits in industrial, commercial, and utility installations

Hitachi Energy bolsters manufacturing capacity in North

New York/Zurich, September 23, 2024 – At Climate Week NYC, Hitachi Energy announced plans to invest an additional $155 million USD to expand its manufacturing capacity in North

Understanding Industrial Switchgear: The Backbone of

Aug 27, 2024 · In the realm of electrical infrastructure, industrial switchgear plays a crucial role in ensuring the safe and efficient operation of power distribution systems. This article will delve

Industrial Switches | Newark Electronics Mexico

Our control switch and switch gear components are found in nearly all industrial control and factory automation applications. Browse leading manufacturers including Eaton Cutler

G&W Electric expands power grid component

Nov 25, 2024 · G&W Electric, a manufacturer of components for the power grid, announced the opening of its new manufacturing facility in San Luis Potosí,

Eaton builds sixth production plant in Chihuahua

Nov 19, 2021 · Eaton, an energy management company, announced its sixth assembly plant in Ciudad Juárez, Chihuahua, in which it will be generating an

Hitachi Energy High Voltage Switchgear (Xiamen) Co., Ltd.

Aug 19, 2025 · Hitachi Energy High Voltage Switchgear (Xiamen) Co., Ltd.Hitachi Energy, the global technology leader, introduced the gas-insulated switchgear (GIS) technology over 50

6 FAQs about [Industrial switchgear factory in Mexico]

What factors affect the switchgear industry in Mexico?

When exploring the Switchgear industry in Mexico, several key considerations come into play. The regulatory environment is crucial, as adherence to standards set by entities like the Mexican Electrical Standards (NOM) is mandatory. Companies must also navigate local and federal regulations concerning safety and environmental impacts.

What is a medium voltage switchgear?

Eaton's Medium Voltage Switchgear provides centralized control and protection of medium-voltage power equipment and circuits in industrial, commercial, and utility installations involving generators, motors, feeder circuits, and transmission and distribution lines. These products also qualify for LEED credits

What is gelectro switchgear?

Gelectro is a specialized distributor of electrical solutions, including medium-voltage switchgear, which is compact, environmentally friendly, and maintenance-free, making it suitable for various applications.

Which switchgear is best for medium voltage applications?

Max. The company, Ufara Power Networks, offers a range of switchgear, including various types of disconnectors designed for medium voltage applications. Their products feature stainless steel enclosures for weather resistance and utilize vacuum switches with magnetic actuators for reliable mechanical operation.

What is Elastimold ® switchgear used for?

PRODUCTS PRODUCTS MEDIUM VOLTAGE SWITCHGEAR SECCIONADOR DE MEDIA TENSIÓN ELASTIMOLD - The Elastimold® switchgear is compact enough to be used as a fix register. It is an environment-friendly, maintenance-free, oil and gas leak-free, scalable modular device. It ranges up to 38 kV that me used in Looking for more accurate results?

Who installs Elastimold ® switchgear?

In 2018 , working through local distributor Consorcio AMESA, won a $6.4 million contract to install 62 units of Elastimold ® switchgear systems along 9.1 miles of the street.

Update Information

- Industrial switchgear factory in Yemen

- Industrial switchgear factory in Malta

- Metal clad switchgear factory in Iran

- Factory price main switchgear in Spain

- Factory price 15kv switchgear in Colombia

- China factory price acme switchgear manufacturer

- Factory price 33kv switchgear in Jamaica

- Factory price 11kv switchgear in Botswana

- Best factory price real switchgear for sale

- Factory price 480v switchgear in Brunei

- Cheap switchgear equipment in China Factory

- Cote d Ivoire industrial energy storage cabinet factory price

- Quad circuit breaker factory in Mexico

Solar Storage Container Market Growth

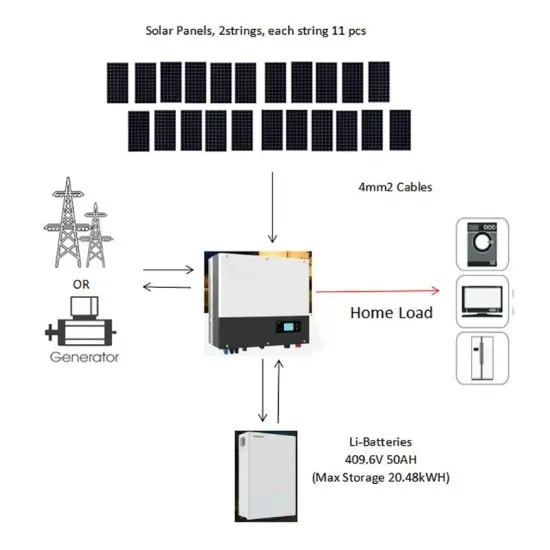

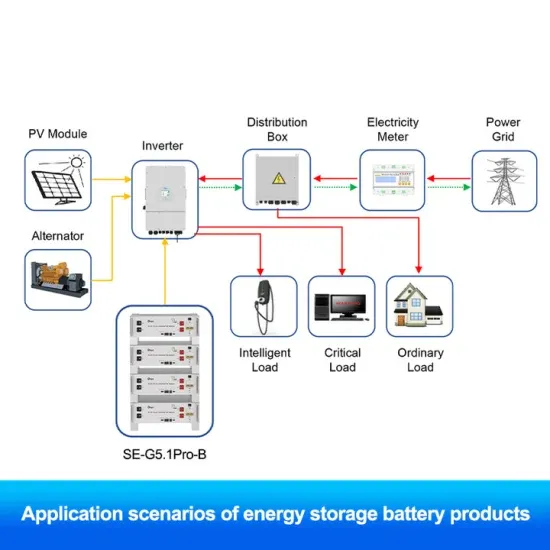

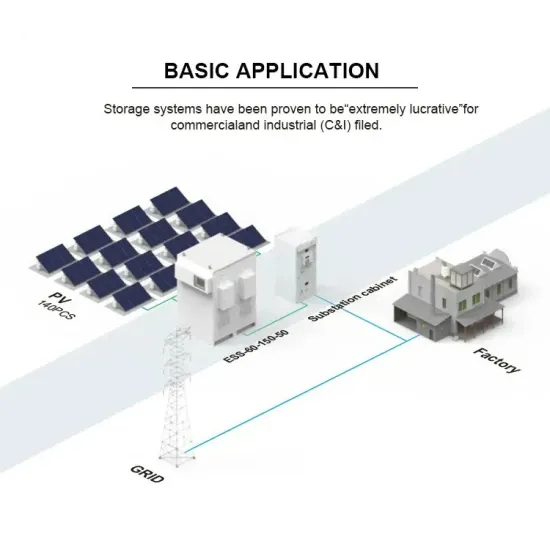

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.