Myanmar commercial and industrial energy storage

The transition from traditional fuel-dependent energy systems to renewable energy-based systems has been extensively embraced worldwide. Demand-side flexibility is essential to

SOLIS UNVEILS GROUNDBREAKING OFF-GRID BESS SYSTEM IN MYANMAR

Myanmar – [January 24, 2025] – Solis, a global leader in renewable energy solutions, has once again set a new benchmark in sustainable energy with the successful deployment of an

the prospects of photovoltaic power generation and energy storage

Development of photovoltaic-electrolyzer-fuel cell system for hydrogen production and power generation The system consists of photovoltaic arrays, electrolyzer cells, high-pressure gas

Myanmar: Power System Efficiency Project Brings Country Closer

May 29, 2020 · The World Bank approved $350 million to increase power generation and improve the electricity system''s resilience to climate change and disasters. The Board also approved

Myanmar mechanical energy storage system

The document discusses three types of mechanical energy storage: pumped hydroelectric storage (PHS), compressed air energy storage (CAES), and flywheels. PHS involves pumping water to

Myanmar solar power Initiative: 16 Projects to

Mar 26, 2025 · Myanmar solar power projects aim to tackle the energy crisis, but political instability hinders progress. Can the junta attract investors? Explore

Energy Outlook and Energy Saving Potential in East Asia

In 2017, Myanmar''s total primary energy supply (TPES) was 20.12 million tonnes of oil equivalent (Mtoe). Natural gas is mainly used for electricity generation and in industry. In the power

Myanmar''s Solar Photovoltaic & Energy Storage Revolution:

Sep 19, 2021 · Myanmar''s energy poverty isn''t just inconvenient – it costs the economy $2.8 billion annually in lost productivity [1]. But here''s where solar photovoltaic (PV) and energy

Energy cooperation between Myanmar and China under One

Jan 15, 2021 · However, studies focused on China-Myanmar energy cooperation under OBOR has not been explored yet, Myanmar usually acts as a geo-strategic link along OBOR while its

Integrating 100% renewable energy into electricity systems:

Nov 1, 2023 · The results show that the three countries can integrate 100% renewable energy into their power systems by optimizing hydropower potential and deploying non-hydro renewables

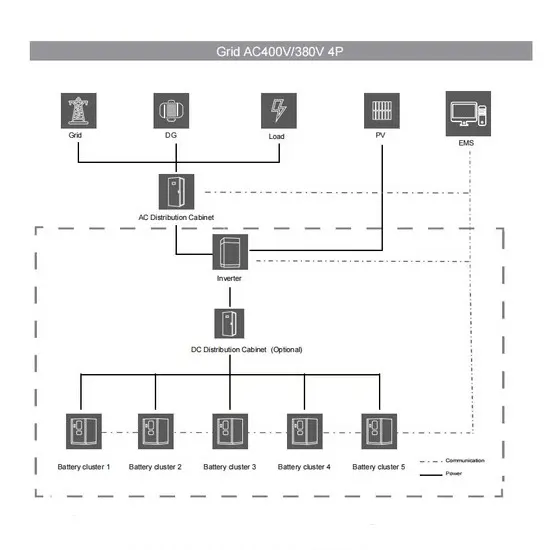

Myanmar Grid-Level Energy Storage Power Station

Currently, Myanmar has a total installed capacity of around 4 GW within the grid system which is mostly based on hydropower, natural gas power plant, and coal-fired power plants.

Myanmar launches second tender for utility

Jun 4, 2021 · The country''s Ministry of Electricity and Energy (MOEE) is accepting proposals for utility-scale PV projects built on an independent power producer

SOLIS UNVEILS GROUNDBREAKING OFF-GRID BESS SYSTEM IN MYANMAR

Feb 5, 2025 · Solis, a global leader in renewable energy solutions, has once again set a new benchmark in sustainable energy with the successful deployment of an advanced off-grid

What are the energy storage power stations in Myanmar

What is the energy demand supply situation in Myanmar? The Myanmar energy demand supply situation indicates that power generation mix must shift to more coal and hydropower,

6 FAQs about [Myanmar Energy Storage Power Generation System]

What is the energy saving potential of Myanmar?

According to the 2015 Asian Development Bank report ‘National Energy Eficiency and Conservation Policy, Strategy and Roadmap of Myanmar’, electricity consumption in all sectors and achievable energy saving potential should reach 12% by 2020, 16% by 2025, and 20% by 2030.

How much power does Myanmar produce?

In the power sector, Myanmar has 5,848 megawatts (MW) of installed generation capacity, and produced almost 22 terawatt-hours (TWh) of electricity in 2018. In the same year, thermal power (coal, natural gas, and oil) accounted for 44% of total electricity generation and hydropower accounted for 56%. Table 12.1.

What energy sources are available in Myanmar?

Myanmar is endowed with rich natural resources for producing commercial energy. Currently, the available energy sources in Myanmar are crude oil, natural gas, hydropower, biomass, and coal. Wind energy, solar, geothermal, bioethanol, biodiesel, and biogas are other potential energy sources.

Will hydropower generation increase in Myanmar?

Hydropower generation will increase but at a slower average annual rate of 3.4% over the same period. Myanmar’s primary energy intensity (TPES/GDP) has been declining since 1990. In 2017, the primary energy intensity was 253.1 tonnes of oil equivalent per million dollars (toe/$ million), lower than 1990 when it was 1,333 toe/$ million.

Does Myanmar have a power plant plan?

Myanmar’s yearly plan for the construction of power plants from 2018 to 2022 (Table 12.2) mostly covers gas-based power plants (including liquefied natural gas), along with some hydropower and solar power plants. The yearly plan excludes coal-based power plants, of which the country currently has 120 MW of installed capacity.

How is commercial energy consumption projected in Myanmar?

In Myanmar, commercial energy consumption is projected on the basis of the energy requirements of major sectors (industry, transport, and agriculture)). Choice of fuel type is determined by available supply, since energy demand must be met mainly by domestic Figure 12.10.

Update Information

- Myanmar High Quality Energy Storage Power Company

- Greece air energy storage power generation project

- Energy storage power generation in Zurich Switzerland

- Gabon price photovoltaic energy storage power generation

- Off-grid photovoltaic power generation and energy storage system device

- Huawei Niamey Photovoltaic Energy Storage Power Generation Project

- Solar power generation and energy storage quotation in Sydney Australia

- Danish energy storage photovoltaic power generation

- Customized home photovoltaic power generation and energy storage equipment

- San Jose s first energy storage power generation

- Finland power generation and energy storage

- Yerevan power generation and energy storage methods

- Benefits of photovoltaic power generation and energy storage in Somaliland

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.