Alkaline Battery Market In Myanmar (Burma) from China TDRFORCE Factory

Sep 5, 2023 · At the forefront of Myanmar''s alkaline battery market is its ability to meet the increasing energy needs of consumers across various sectors. Alkaline batteries offer a

Myanmar Mandalay Power and Energy Storage Battery

As Myanmar''s second-largest city, Mandalay faces growing energy demands from industrial expansion and urbanization. A reliable power and energy storage battery manufacturer plays a

Alkaline Battery Seller In Myanmar (Burma) from China TDRFORCE Factory

Sep 4, 2023 · Myanmar (Burma) is experiencing rapid technological advancements across various sectors, resulting in a growing demand for reliable power sources. Alkaline batteries play a

How Solar Battery Groups and LiFePO4 Technology Empower Myanmar

Apr 10, 2025 · Explore Myanmar''s solar energy transition with LiFePO4 battery solutions. Discover solar battery groups benefits, supplier options, and market insights tailored for

Myanmar 5KW Hybrid Solar Power Inverter For Home

Sep 25, 2024 · Xindun 5KW hybrid solar power inverter use for home in Myanmar. We not only provide 5kw hybrid solar inverter, but also can be extended up to 45KW. It has promoted the

Alkaline Battery Producer In Myanmar (Burma)

Sep 2, 2023 · China TOP Battery Factory or Manufacturer : TDRFORCE, which has 25 years manufacturing, write the Article " Alkaline Battery Producer In Myanmar (Burma) " about

Battery | Product categories | Myanmar Padauk

May 14, 2025 · Today it has grown into an empire of diverse portfolio for electrical and power sector under the banner of Myanmar Padauk Power Company Limited, offering robust

Power Up Your Business with Advanced myanmar battery

Experience efficiency and sustainability through innovative myanmar battery technology. These batteries offer optimum energy storage while maintaining environment friendliness. These

Will this startup finally crack the code on flow

Nov 13, 2023 · Fellow flow-battery-maker ESS, which already has a real factory and real installations, raised a total of $ 57 million from venture investors

Battery Metals | Myanmar Dynasty Trading Co.,Ltd

Dec 23, 2024 · Myanmar is also rich in battery metals, which are critical for the renewable energy and electric vehicle (EV) markets. Myanmar is emerging as a potential source of lithium with

Myanmar liquid flow battery energy storage company

n its proprietary liquid metal battery technology. The company touts its battery as being low-cost, durable and safe as well as suitable for large-s adium pentoxide for the steel and battery

Alkaline Battery Distributor In Myanmar (Burma)

Sep 4, 2023 · In conclusion, Myanmar''s (Burma''s) expanding consumer electronics market, coupled with the increasing need for portable power sources, presents significant business

Top Solar Battery Manufacturers & Suppliers in Myanmar

Jul 28, 2025 · Discover trusted solar battery manufacturers and suppliers in Myanmar. GSL ENERGY provides LiFePO₄ battery storage solutions for off-grid and hybrid solar systems.

Myanmar Redox Flow Battery Market (2024-2030) | Value,

Historical Data and Forecast of Myanmar Redox Flow Battery Market Revenues & Volume By Industrial for the Period 2020- 2030 Myanmar Redox Flow Battery Import Export Trade

Alkaline Battery Importer In Myanmar (Burma)

Sep 5, 2023 · China TOP Battery Factory or Manufacturer : TDRFORCE, which has 25 years manufacturing, write the Article " Alkaline Battery Importer In Myanmar (Burma) " about

6 FAQs about [Myanmar Flow Battery Factory]

Does Myanmar have a battery market?

Yes, Myanmar has a battery market. Myanmar's battery market depends majorly on automotive application segment.

Who are the major players in Myanmar battery market?

The Myanmar battery market is consolidated, with some of the major players including Siam GS Battery Myanmar Limited, Schneider Electric SE, Toyo Battery Myanmar Co. Ltd, and Panasonic Corporation.

What is driving the growth of the Myanmar battery market?

The automotive segment is expected to witness significant growth during the forecast period, owing to the increasing demand for new vehicles produced in the country. Potential growth of lithium-ion batteries in electric vehicle (EV) market is expected to create immense opportunities for the Myanmar battery market in the coming years.

Will lithium-ion battery market grow in Myanmar?

The potential growth of lithium-ion batteries in the electric vehicle (EV) market is expected to create immense opportunities for the Myanmar battery market in the coming years. The automotive segment is expected to witness significant growth during the forecast period, owing to the increasing demand for new vehicles produced in the country.

Which application segment dominates the Myanmar battery market?

The Myanmar battery market is expected to register a CAGR of greater than 1.5% during the forecast period of 2021 – 2026. Myanmar's battery market depends majorly on automotive application segment. With the COVID-19 pandemic in 2020, the market witnessed a significant decrease in sales.

What is the outlook for Myanmar battery market in 2021 – 2026?

The Myanmar battery market is expected to grow at a CAGR of greater than 1.5% from 2021 to 2026. The market is projected to register steady growth, driven primarily by the automotive application segment. However, the market witnessed a significant decrease in sales in 2020 due to the COVID-19 pandemic.

Update Information

- Gigawatt-scale liquid flow battery smart factory

- Lithium battery production factory in Sudan

- Marshall Islands UET All-Vanadium Liquid Flow Battery

- 4G communication base station flow battery budget

- Liquid Flow Battery Iron

- Safe iron flow battery manufacturing in Gabon

- FeCN flow battery

- Serbia vanadium flow battery grid connected

- Hechu New Material Liquid Flow Battery

- Swaziland Liquid Flow Energy Storage Battery

- Factory price battery breaker in Sydney

- Battery cabinet current flow direction base station

- Cheap factory price battery storage for sale

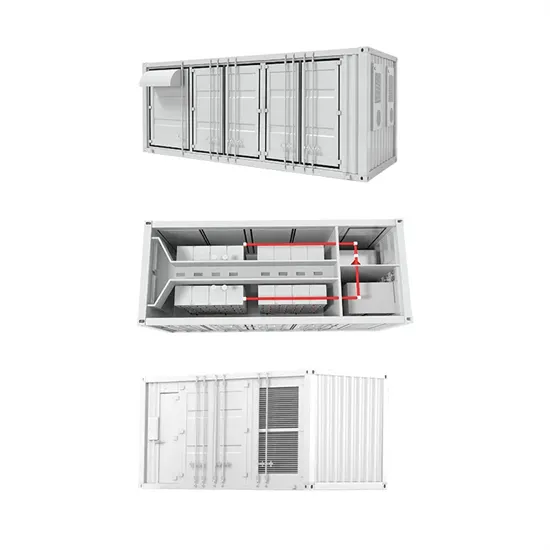

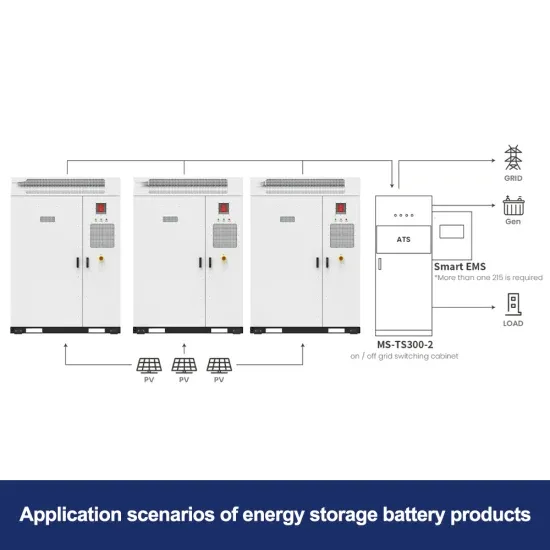

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.