Portable Energy Storage for Events Market Research Report

As per our latest research, the global Portable Energy Storage for Events market size stood at USD 1.42 billion in 2024, reflecting a robust surge in demand for reliable, sustainable, and

Portable Power Station Market Size | Research Report [2032]

Jul 28, 2025 · Portable Power Station Market Trends Rising Emphasis on Renewable Energy to Boost the Portable Power Station Market Development The amalgamation of renewable

Electrical Energy Storage (EES) in North America: Market

Mar 27, 2025 · The Electrical Energy Storage (EES) market is experiencing robust growth, driven by the increasing demand for renewable energy integration, grid modernization initiatives, and

Long Duration Energy Storage Startups in North America

Jul 7, 2025 · There are 157 Long Duration Energy Storage startups in North America which include Form Energy, ESS, Ambri, Hydrostor, Electrified Thermal. Out of these, 84 startup s

U.S. Hydropower Market Report

Oct 2, 2023 · In terms of energy storage capabilities, PSH accounts for 96% of the U.S. total because the typical storage duration of a PSH plant—the number of hours it takes to empty

Top 10 Energy Storage Companies in North America | PF Nexus

Jul 14, 2025 · In this article, PF Nexus highlights the Top 10 energy storage companies in North America driving the renewable energy transition. North America is leading a global energy

North America''s EV Battery Manufacturing and Energy Storage

This facility will support North America''s EV battery manufacturing needs and improve energy storage capabilities, providing a critical component for renewable energy systems in Canada.

Pumped Storage Facilities in the USA | The Center for Land

5 days ago · Pumped Storage Hydroelectric Projects in the USA There are 41 utility-scale hydroelectric plants currently online in the USA that have reversible pump/turbines, and qualify

Who are the top 5 US storage companies by operating

Dec 7, 2023 · But which companies are driving the rapid increase in US storage deployment? First let''s look at the top 5 US companies by operating storage capacity: 1. NextEra Energy

BESS in North America_Whitepaper_Final Draft

Apr 23, 2021 · Introduction Battery energy storage presents a USD 24 billion investment opportunity in the United States and Canada through 2025. More than half of US states have

Top US Energy Storage Power Companies in 2025: Leaders

Jul 22, 2019 · We''re judging contenders by three key metrics: Here''s where the rubber meets the renewable road: 1. The Tesla Megapack Mafia. Tesla''s not just about cars anymore – their

North America Energy Storage Market 2025-2034

Aug 19, 2025 · The North America Energy Storage Market is a critical sector within the region''s energy landscape, playing a pivotal role in enhancing grid stability, promoting renewable

About | Intersolar & Energy Storage North America

4 days ago · Intersolar & Energy Storage North America highlights the latest energy technologies, services, companies, and organizations striving to create

6 FAQs about [Which companies have energy storage power stations in North America ]

Which country is the largest market for energy storage in North America?

The United States is expected to be the largest market for energy storage in North America with an increasing demand for uninterrupted energy demand within the country. The country's power generation is dominated by coal and gas-fired power plants, and it is witnessing a shift from coal-based power generation to cleaner sources of energy.

Which energy storage segment will be the largest in North America?

Pumped-storage hydroelectricity (PSH) segment is expected to be the largest market during the forecast period in North America, owing to its ability to store large amount of energy as compared to other energy storage options and existing installed base. The Compressed air energy storage (CAES) can achieve an efficiency of 70-80%.

How many battery storage sites are there in the United States?

In the United States, 16 operating battery storage sites have an installed power capacity of 20 MW or greater. Out of the 899 MW of installed operating battery storage reported by the states, as of March 2019, California, Illinois, and Texas accounted for a little less than half of that storage capacity.

What is the largest battery storage facility in the world?

In the first quarter of 2019, 60 MW of utility-scale battery storage power capacity came online, and an additional 108 MW of installed capacity was expected to become operational. Out of these planned 2019 installations, the largest is the Top Gun Energy Storage facility in California, with 30 MW of installed capacity.

What is energy storage?

Energy storage can refer to a wide range of technologies and approaches to power management. Below are some of the most common systems used: Compressed air: Usually located in large chambers, surplus power is used to compress air and store it. When energy is needed, compressed air is released, passing through air turbines to generate electricity.

Are grid-connected energy storage systems a new concept?

As renewable power generation accelerates and concerns around the capacity and resiliency of energy grids grow, companies are increasingly exploiting and developing energy storage systems. But grid-connected energy storage systems are not a novel concept and have existed for years. Why is energy storage important?

Update Information

- Which companies have energy storage power stations in Haiti

- Which companies have energy storage power stations in Niger

- Which companies have flywheel energy storage for Uruguayan communication base stations

- Safety distance standards for independent energy storage power stations

- Can lithium batteries be used as energy storage power stations

- Nano-ion batteries for energy storage power stations

- Individuals can invest in energy storage power stations

- What are the lithium battery energy storage power stations in Sri Lanka

- Portable energy storage power supply price in North Africa

- North Korea electromagnetic energy storage power station

- Safety requirements for energy storage power stations

- What are the 20 kW energy storage power stations in Djibouti

- What are the containerized energy storage power stations in Luxembourg City

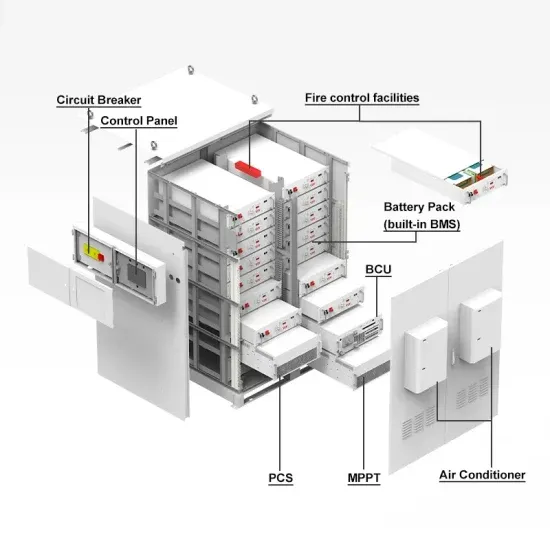

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.