储能EPC:为何成为目前最受青睐的选择?

Jun 5, 2024 · Energy storage EPC is an integrated contracting model service for engineering design, procurement, and construction of energy storage projects. It covers the entire process

DISTRIBUTED ENERGY IN CHINA: REVIEW AND

Nov 9, 2021 · In China, over the past 15 years, policies for distrib-uted energy have greatly evolved and expanded. Dur-ing the period 2020–25, current policy supports will be phased

Energy Storage Installation: Europe is the First-Mover, China

Aug 15, 2023 · In the first half of 2023, the average prices of two-hour energy storage systems and EPC services dropped by nearly 27% and 11% respectively, in comparison to the figures

Energy Storage Industry EPC Price Ranking: Trends, Players,

In 2024 alone, China added enough new energy storage capacity to power 78 million smartphones simultaneously [1]. But here''s the kicker: while everyone''s racing to build these

Key factors impacting energy storage pricing to

Feb 27, 2025 · Anza published its inaugural quarterly Energy Storage Pricing Insights Report this week to provide an overview of median list-price trends for

Energy Storage System EPC Market Forecast: Size, Trends,

May 6, 2025 · Energy Storage System EPC Market size was valued at USD 9.5 Billion in 2024 and is projected to reach USD 22.4 Billion by 2033, exhibiting a CAGR of 10.2% from 2026 to

Distributed solar photovoltaics in China: Policies and

Aug 1, 2015 · However, China''s current distributed PV industry still has a series of problems and restrictions. Distributed PV power generation remains in its infancy whose development mainly

Latest price of epc for industrial and commercial energy

ge systems enable energy storage in multiple ways for later use. Various factors contribute to the need for energy storage, including the uptake of distributed solar, increased electrification of

Optimal price-taker bidding strategy of distributed energy storage

Sep 13, 2024 · Allocated electricity quantities (AEQs) for both buyers and sellers will be obtained, and the marginal clearing price (MCP) can be determined (Figure 1A). In the ESM, the

Energy storage EPC prices continue to decline in China, with

May 14, 2024 · The lowest EPC price for energy storage in China in May 2024 was 0.96 yuan/Wh, while the average bid price for lithium iron phosphate (LFP) energy storage EPC was 1.35

Overview of China''s New Energy Storage Market

Jul 30, 2025 · Winning bid prices for Energy Storage EPC saw a slight decline. For LFP projects with a 2-hour duration, the annual average winning bid price was ¥1.2065 / Wh, with a

Battery Energy Storage EPC Market Research Report 2033

According to our latest research, the global Battery Energy Storage EPC market size in 2024 stands at USD 18.4 billion, reflecting robust growth driven by the accelerating integration of

Advanced Technology Container-Type Energy Storage Epc

Distributed energy station refers to a clean and environmentally friendly power generation facility with low power (tens of kilowatts to tens of megawatts), small and modular, and distributed

Energy Storage System EPC XX CAGR Growth Analysis 2025

Jun 29, 2025 · The Energy Storage System (ESS) Engineering, Procurement, and Construction (EPC) market is experiencing robust growth, driven by the increasing global demand for

Latest energy storage epc winning bid price

Second,independent energy storage systems are better able to aggregate,creating greater value through energy storage sharing. This changes the conventional business model of providing

How much is the unit price of energy storage power station EPC

Jul 28, 2024 · The unit cost for energy storage power station EPC (Engineering, Procurement, and Construction) can vary significantly based on several influencing factors. 1. Geographic

Solar energy storage epc price

Investing in solar energy stocks requires careful consideration of several factors: Approaches to energy storage in the Gulf include the CSP + TES facility, which forms the largest component

EPC for Energy Storage System

Feb 23, 2024 · The global market for EPC for Energy Storage System was estimated to be worth US$ million in 2023 and is forecast to a readjusted size of US$ million by 2030 with a CAGR of

''Mind-blowing'' bids in Power China''s 16GWh BESS tender

Dec 19, 2024 · EPC firm Power China''s recent 16GWh BESS supply tender has seen very low prices bid, amidst a squeeze of market share from state-owned firms.

Europe grid-scale energy storage pricing 2024

Jul 17, 2024 · This report analyses the cost of lithium-ion battery energy storage systems (BESS) within Europe''s grid-scale energy storage segment, providing a 10-year price forecast by both

New energy storage winning bid price

The main reasons for the low utilization of the "new energy + storage" application model lie in the overreach of local planning for energy storage construction, cost pressure resulting in more

CNESA Global Energy Storage Market Tracking

Nov 16, 2024 · In the first three quarters, the average bid price for domestic non-hydro energy storage systems (0.5C lithium iron phosphate systems) was 622.90 RMB/kWh, a year-on-year

Optimal investment of distribution energy resources via energy

Nov 1, 2024 · Investment in distributed energy resources (DERs) is crucial for the expansion of distribution networks. However, traditional methods often lack comprehensive project

How do split EPC structures impact the financing of energy storage

Oct 20, 2024 · Overview of Split EPC Structures Split EPC structures involve dividing the traditional full-wrap EPC contract into multiple contracts with separate contractors and

GE''s Reservoir Solutions

Jul 25, 2025 · GE APPROACH GE''s broad portfolio of Reservoir Solutions can be tailored to your operational needs, enabling efficient, cost-effective storage distribution and utilization of

Updated report and data illustrate distributed solar pricing

Aug 29, 2024 · Figure 4. Installed-Price Distributions for Stand-Alone PV Systems Installed in 2023 We thank the U.S. Department of Energy Solar Energy Technologies Office for their

Energy storage epc price breakdown

The cost categories used in the report extend across all energy storage technologies to allow ease of data comparison. Direct costs correspond to equipment capital and installation, while

6 FAQs about [Distributed energy storage epc price]

What was the average bid price for non-hydro energy storage systems in Q3?

In the first three quarters, the average bid price for domestic non-hydro energy storage systems (0.5C lithium iron phosphate systems) was 622.90 RMB/kWh, a year-on-year decline of 50%. While bid prices remained relatively stable in the first half of the year, they reached a historic low of 578.11 RMB/kWh in Q3, particularly in September.

How did EPC bidding perform in Q3?

In the first three quarters of 2024, the bidding volumes for battery systems, energy storage systems, and EPC projects all exceeded the same period of 2023 in terms of energy capacity. Among these, EPC bidding reached its highest-ever quarterly volume in Q3, approaching 50 GWh.

Did EPC bidding reach its highest-ever quarterly volume in Q3?

Among these, EPC bidding reached its highest-ever quarterly volume in Q3, approaching 50 GWh. Large-scale projects, particularly those exceeding 500 MWh and even GWh-level, saw a significant increase in EPC bidding announcements. State Power Investment Corporation (SPIC) led with a bidding volume exceeding 7 GWh.

How big is non-hydro energy storage in 2024?

In the first three quarters of 2024, newly operational non-hydro energy storage installations reached 20.67 GW/50.72 GWh, representing year-on-year growth of 69% in power capacity and 99% in energy capacity.

Will additional storage technologies be added?

Additional storage technologies will be added as representative cost and performance metrics are verified. The interactive figure below presents results on the total installed ESS cost ranges by technology, year, power capacity (MW), and duration (hr).

How much battery storage does the UK have in 2024?

United Kingdom: Q3 Marks Installation Peak for 2024 As of September 2024, the U.K. reached 4.3 GW/5.8 GWh in cumulative operational battery storage, with an average duration of 1.33 hours. In the first three quarters, 19 new battery projects totaling 579 MW were added, a year-on-year decline of 52%.

Update Information

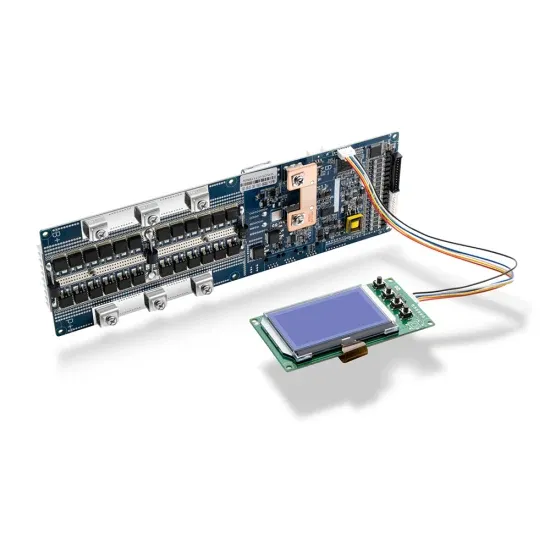

- Distributed containerized energy storage system

- Price of photovoltaic energy storage cabinet in Port Louis

- Villa energy storage equipment price

- Uzbekistan lithium energy storage power supply price

- Ngerulmud sodium sulfur battery energy storage container price

- Price of lithium rechargeable battery for energy storage cabinet

- Price of station-type energy storage system in Azerbaijan

- Roman ems energy storage system pcs price

- Tehran solar power generation and energy storage unit price

- Roman Energy Storage Emergency Power Supply Wholesale Price

- Danish multifunctional energy storage power supply price

- Botswana emergency energy storage power supply price

- Bahamas integrated energy storage cabinet custom price

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.