10 Things You Should Know About Singapore''s Energy Story

Oct 17, 2024 · To mitigate the intermittent nature of renewable energy sources like solar, we are deploying Energy Storage Systems (ESS), which function like giant batteries that store energy

Singapore Invests $1 Billion In New Hydrogen Power Plant

Jan 6, 2025 · Singapore is embarking on a significant energy transition with the construction of a groundbreaking hydrogen power plant. PacificLight Power is spearheading this initiative with a

Singapore Energy Storage Market (2025-2031) | Trends

Singapore Energy Storage Market Challenges In the Singapore Energy Storage Market, some key challenges include high upfront costs for implementing energy storage systems, limited

EMA and SP Group to pilot thermal energy storage system at

Aug 29, 2022 · Thermal energy storage system will increase power grid resilience and facilitate the incorporation of more renewable energy sources in Singapore Pilot to include installation

S''pore pressing ahead with R&D on emerging energy

Jul 28, 2025 · SINGAPORE - Singapore is considering all possible options to reduce emissions from its carbon-intensive energy sector. But some technologies, such as those relating to

Singapore to import more low-carbon power from

Sep 5, 2024 · Singapore will issue conditional approval to import 1.4 gigawatts (GW) of electricity from two solar power projects in Indonesia as the country ramps up low-carbon power supply,

Programme to Accelerate Energy Storage Deployment in Singapore

Oct 30, 2018 · We look forward to optimising energy use and developing new solutions for a smarter grid management system in the port." The programme will also help Sembcorp

Singapore poised to be the ''core'' of 25GW

Jun 5, 2025 · Singapore could sit at the "core" of new regional electricity grids in Southeast Asia, with proposed interconnections to neighbouring countries set

Singapore Launches Largest Energy Storage System in

Jul 28, 2023 · announced in a joint media release the opening of Sembcorp Energy Storage System ("ESS"), which is the largest ESS in Southeast Asia. The utility-scale ESS was

6 FAQs about [Singapore New Energy Storage]

What is Singapore's biggest battery storage project?

Singapore has surpassed its 2025 energy storage deployment target three years early, with the official opening of the biggest battery storage project in Southeast Asia. The opening was hosted by the 200MW/285MWh battery energy storage system (BESS) project’s developer Sembcorp, together with Singapore’s Energy Market Authority (EMA).

How much energy storage will Singapore have by 2025?

With just one project, EMA has achieved and exceeded Singapore’s deployment target of 200MWh of energy storage by 2025. The target was set as part of the EMA programme, Accelerating Energy Storage Access for Singapore (ACCESS), through which the EOI solicitation was held.

Will a large-scale energy storage system complement Singapore's efforts to maximise solar adoption?

Energy Market Authority (EMA) chief executive Ngiam Shih Chun said that the large-scale energy storage system will complement Singapore’s efforts to maximise solar adoption, by storing and delivering energy despite the intermittent nature of solar power.

Could Singapore sit at the 'core' of new energy grids in Southeast Asia?

Singapore could sit at the “core” of new regional electricity grids in Southeast Asia, with proposed interconnections to neighbouring countries set to bring 25GW of new renewable power and energy storage projects online. This is according to Rystad Energy, which published a report into Singapore’s role in the Southeast Asian energy mix this week.

Does Singapore have a resilient energy grid?

The Singapore government has implemented a good number of initiatives to ensure the resilience of the energy grid, including the use of energy storage systems (“ESS”).

Does Singapore have a reliable electricity grid?

Although Singapore has one of the most reliable electricity grids in the world, However, as Singapore looks to renewable energy and power imports to transition to a low-carbon energy system, and moves towards the electrification of its transport system, it is increasingly vital to ensure that its grid infrastructure remains stable and resilient.

Update Information

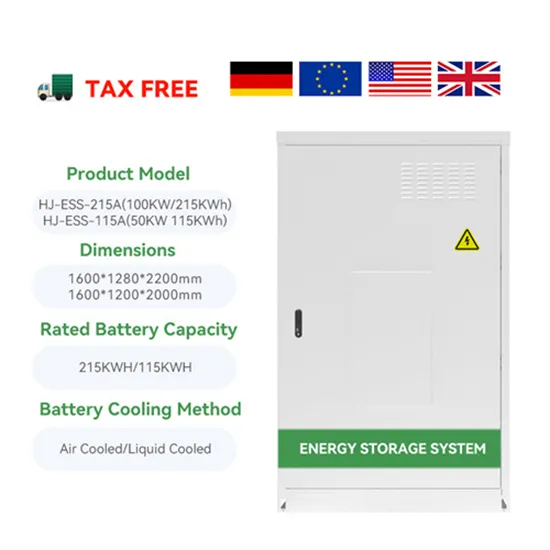

- New energy storage solar photovoltaic battery cabinet

- Belize New Energy Storage

- Profits from new energy supporting energy storage

- New energy storage metal oxide

- Cambodia s wind solar and energy storage new energy industry

- Energy storage configuration for Guyana s new energy project

- Warsaw New Energy Storage Price

- New Zealand energy storage container equipment manufacturer

- New Delhi Energy Storage Lithium Battery Pack Manufacturer

- Bolivia Energy Storage New Energy

- Riyadh New Energy Company Energy Storage

- Singapore Industrial Energy Storage Device Manufacturer

- New energy battery storage cabinet processing manufacturer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.