Solar Company in North Korea | Solar EPC Companies in North Korea

Solar Company in North Korea | Solar EPC Companies in North Korea | Solar Installation Company in North Korea | Solar Energy Company in North Korea | Solar Panel Company in

Opportunities and Challenges of Solar and Wind

May 1, 2018 · In this context, this study discusses the future of solar and wind energy in South Korea in four key aspects: (i) opportunities and potential

SOUTH KOREA''S SOLAR POWER INDUSTRY: STATUS

Jan 2, 2024 · South Korea''s National Assembly has recently passed legislation to encourage further solar PV deployment. Under the Special Act on the Promotion of Distributed Energy,

System Integration of Renewables and Smart Grids in

Feb 9, 2021 · In Chapter 4, the status and perspectives of renewable energy sources integration and smart grids in South Korea are discussed, presenting various demonstrative examples,

Why are farmers against solar panels in Korea?

Jan 11, 2022 · Korea''s recent rise in solar power capacity has earned the country plaudits. But many, including environmentalists, are criticising Moon Jae-in''s

North Korea Plans to Dig Deep Into Renewable Energy Alternatives

Dec 7, 2021 · North Korea''s mountainous terrain and strong coastal winds provide an ideal environment for generating wind and solar energy, especially during the harsh winter season

Installation Of Household Photovoltaic Systems

May 27, 2025 · By opting for solar power, households can reduce their reliance on fossil fuels, thereby reducing carbon emissions that contribute to climate

Renewable Energy Options for a Rural Village in

Mar 20, 2020 · The national electrification rate of North Korea is extremely low and the situation in rural areas is even worse. Thus, this study designs a

Solar power generation in rural North Korea

In this new series, 38 North will look at the current state of North Korea''''s energy sector, including the country''''s major hydro and fossil fuel power stations, the state''''s push for local-scale hydro,

Solar power generation by PV (photovoltaic) technology: A

May 1, 2013 · Solar power is the conversion of sunlight into electricity, either directly using photovoltaic (PV), or indirectly using concentrated solar power (CSP). The research has been

Exploring solar and wind energy resources in North Korea

Mar 1, 2020 · Although the region''s mountainous terrain may be an obstacle for future development of renewable energy infrastructure, these initial annual mean solar and wind

North Koreans Install Solar Panels As Regime Fails To Provide Power

Aug 28, 2023 · Solar energy is making inroads into North Korea''s power sector as residents are looking to install panels to have the lights on, at least partially, as the regime is failing to supply

Full solar system for home North Korea

In this installment of our series on North Korea''''s energy sector, we move away from official and commercial uses of solar and seek to understand the growing use of solar power for personal

How many solar panels does North Korea have? | NenPower

Jan 8, 2024 · 1. North Korea possesses approximately 25,000 solar panels.2. The nation has made efforts to increase renewable energy utilization.3. Solar energy is essential for North

6 FAQs about [North Korea s small home solar power generation system]

Does North Korea still use solar power?

In this installment of our series on North Korea’s energy sector, we move away from official and commercial uses of solar and seek to understand the growing use of solar power for personal energy consumption in a country where its people still suffer from an unreliable power supply nationwide.

How many solar panels are there in North Korea?

The Korea Energy Economics Institute in Seoul estimates that 2.88mn solar panels, mostly small units used to power electronic devices and LED lamps, are now in use across North Korea, accounting for an estimated 7 per cent of household power demand.

Are solar panels a real thing in North Korea?

Larger solar installations have also sprung up at factories and government buildings over the past decade. Jeong-hyeon, a North Korean escapee, told the Financial Times that many residents in Hamhung, the second-most populous city, “relied on a solar panel, a battery and a power generator to light their houses and power their television”.

How much do solar panels cost in North Korea?

This has allowed many North Koreans to install small solar panels costing as little as $15-$50, bypassing the state electricity grid that routinely leaves them without reliable power for months. Larger solar installations have also sprung up at factories and government buildings over the past decade.

Can solar power solve North Korea's energy problems?

Jeong-hyeon, a North Korean escapee, told the Financial Times that many residents in Hamhung, the second-most populous city, “relied on a solar panel, a battery and a power generator to light their houses and power their television”. But solar power is still only a partial solution to the country’s energy woes.

How do solar panels work in North Korea?

Private solar panels on buildings in North Korea as photographed from China and uploaded to Chinese social media site Ixigua. (Source: Ixigua) How It Works A typical installation of solar panels is simple: a solar panel on a roof or balcony is connected via regulator to a large battery.

Update Information

- 650W solar home photovoltaic power generation system

- Rural home solar power generation system

- Solar fan power generation system for home use complete set

- Small solar power generation system

- Try out home solar power generation system

- Solar panel home power generation system

- Home solar power generation system in Mombasa Kenya

- Solar small household power generation system

- Solar power generation small lighting system

- Small solar power generation system in Tampere Finland

- Azerbaijan Home Solar Power Generation System

- Bishkek home solar power system

- One watt of solar power generation

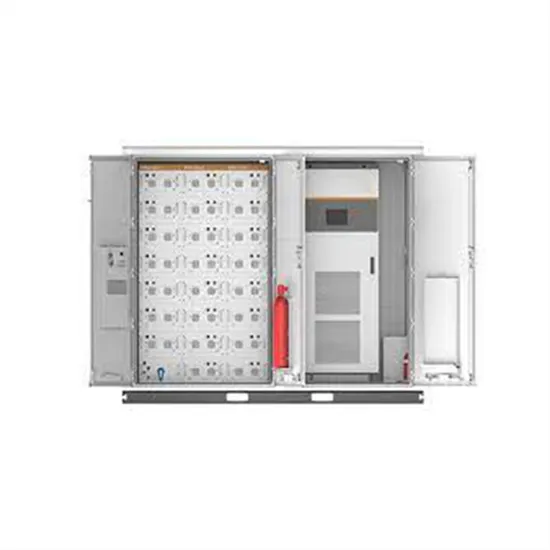

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.