List of Asian Food Wholesale Distributors in U.S.

1 day ago · List of Asian Food / Grocery Wholesale Distributors and Importers in U.S. - California, New York, Florida, New Jersey, Georgia, Illinois and other states. The list includes Chinese

Top Asian Container Companies: Leaders driving global

Aug 19, 2025 · The top Asian container companies shape the future of global shipping, both through their market share and their commitment to fleet modernization. From mega-carriers

Asia''s Container Shipping Market: Challenges and

Jan 29, 2025 · As 2025 approaches, Asia''s container shipping market is at a pivotal moment. The region, which plays a dominant role in global trade, is grappling with economic shifts,

MKV International Trading

6 days ago · MKV International Trading is a Vancouver, BC based international shipping container wholesale and trading company, and one of Canada''s leading suppliers of shipping and

List Of Container suppliers in Western Asia

There are 131 Container suppliers in Western Asia as of October 1, 2024; which is an 4.76% increase from 2023. Of these locations, 125 Container suppliers which is 95.42% of all

Shipping Container Wholesale Suppliers, 3rd Party

Looking for top-notch shipping container wholesale suppliers? WFH has got you covered! We also specialize in 3rd party logistics services, connecting you with reliable Chinese freight

Container Shipping News | Seatrade Maritime News

4 days ago · Explore the latest news and updates from the world of the container shipping industry covering technology, freight rates, fleet capacity, new buildings and services.

Western Asia Large Containers Tenders and RFPs

Daily, new procurement opportunities for Large Containers are uploaded from thousands of sources including all Western Asia official websites, Western Asia local websites, newspapers

APL launches new West Asia service

Mar 25, 2020 · The new weekly WA6 is set to facilitate trade between Asian and Middle Eastern economies. APL says the new service will offer direct connectivity from Xiamen to the Middle

6 FAQs about [West Asia new container wholesale]

What will Asia's container shipping market look like in 2025?

As 2025 approaches, Asia's container shipping market is at a pivotal moment. The region, which plays a dominant role in global trade, is grappling with economic shifts, regulatory changes, and sustainability initiatives that will define the industry's trajectory. 1. Overcapacity and Rate Volatility

Is Asia a growing alternative to China for manufacturing & shipping?

Growing alternative to China for manufacturing & shipping. As 2025 approaches, Asia's container shipping market is at a pivotal moment. The region, which plays a dominant role in global trade, is grappling with economic shifts, regulatory changes, and sustainability initiatives that will define the industry's trajectory.

What services does a shipping container company offer?

With a primary business focus on shipping containers, we offer a wide range of services including cross-border container leasing, container wholesale, depot, and multimodal transport worldwide. Our company is dedicated to supplying top-quality new and used shipping containers in Asia, Europe, and North and South Americas.

How much does a 20ft container cost in India?

As of March 2025, the average price of a cargo-worthy 20ft container in India is $1,120, reflecting a slight decrease from $1,190 in February. Where does the data for our monthly reports come from?

How much does it cost to lease a container in China?

Beijing has also signaled potential non-tariff restrictions on US businesses operating in China, continuing a pattern of tit-for-tat trade measures. The average container leasing rate for a 40ft high cube container from Shanghai to New York was $590 in March 2025, while the rate from Shanghai to Los Angeles reached $600.

What is a monthly container logistics update?

Your monthly container logistics update is here! This is a report on container prices, availability, and market trends. It covers ports in Asia, the Indian sub-continent and Middle East, Europe, and the US. It also includes: What’s happening in March?

Update Information

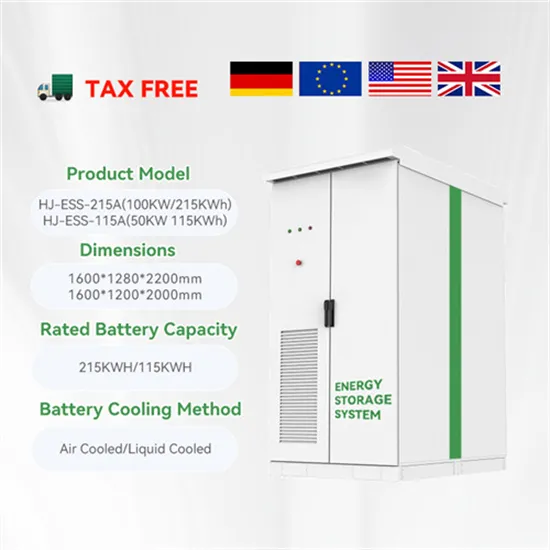

- West Asia Power Container Wholesale

- West Asia Energy Storage New Energy Prices

- USA New York Power Photovoltaic Folding Container Wholesale

- West Asia PV Container BESS Price

- Oman brand new container wholesale

- Abuja Container Shelters Wholesale

- Container energy storage in Auckland New Zealand

- Wholesale new circuit breaker in Malaysia

- Russian photovoltaic folding container house wholesale

- Single-layer container wholesale in Nepal

- Guyana Flexible Photovoltaic Folding Container Wholesale

- Ljubljana non-standard photovoltaic folding container wholesale

- Libya container custom wholesale

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.