5G Base Station Market Size, Share, Growth by 2030

With a rise in frequency, the attenuation during signal propagation increases, leading to a higher base station density of the 5G network. In May 2022, China built ~1.6 million 5G base stations

5G Wireless Communication Technology Concepts and

Oct 15, 2024 · Abstract: With the rapid advancement of information technology, 5G wireless communication technology, as the fifth generation of mobile communication, is profoundly

5g Base Station Market Size & Share Analysis

Jul 8, 2025 · The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market

The Development of 5G Networks in China:

Jan 27, 2025 · China''s Leadership in 5G Development The Chinese leadership wants to construct a new development that includes the ability to store and analyse a great deal of data using

Ambitious 5G base station plan for 2025

Aug 17, 2025 · China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the

China''s strides in advancing 5G development

Jun 7, 2024 · Here are some notable facts and figures about the country''s 5G development. -- In April 2020, China Mobile established a 5G base station at an altitude of 6,500 meters on

5G Base Station RF Device Market Trends: Growth

Jan 27, 2025 · The 5G base station radio frequency (RF) device market plays a pivotal role in the ongoing rollout of 5G networks worldwide. These RF devices are critical components that

China builds world''s largest 5G network with 475 million users

Aug 26, 2022 · China has built nearly 1.97 million 5G base stations and reached 475 million 5G mobile users by the end of this July, said the country''s Ministry of Industry and Information

China to push ahead with 5G-A deployments

Jun 27, 2024 · These advancements have positioned China as a global leader in 5G technology, with over 50 percent of mobile communication users in the country now utilizing 5G services,

What Are the Growth Trends in the 5G Base Station Radio

Mar 3, 2025 · 5G Base Station Radio Frequency Device Market Overview The global expansion of 5G networks has significantly increased the demand for base station radio frequency (RF)

Market Outlook for 5G Base Station RF Devices:

Jan 27, 2025 · Key Players in the Market Several companies are leading the development of 5G base station RF devices. These key players include: Qualcomm: Known for its leadership in

Research and Implementation of 5G Base Station

Oct 28, 2023 · Especially with the development and promotion of national 5G technology, the construction of 5G base stations is an important part of the future communication

China''s strides in advancing 5G development

Jun 6, 2024 · Today, with over 3.7 million 5G base stations installed nationwide, the large-scale application of 5G in China has greatly benefited both individuals and businesses, bringing

China to accelerate 5G revolution, 6G innovation

Aug 16, 2025 · China plans to build 4.5 million 5G base stations and develop more future industries in 2025, said the Ministry of Industry and Information

5G Communication Base Station Body Market Size, Share

Mar 12, 2025 · The 5G communication base station body market plays a crucial role in the deployment of 5G networks by providing the physical infrastructure for wireless communication.

Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · With the rapid development of 5G communication technology, global telecom operators are actively advancing 5G network construction. As a core component supporting

What has China achieved in 5G development so far?

Apr 15, 2021 · A white paper released by the China Center for Information Industry Development predicts that by 2030, the number of 5G base stations in China will reach 15 million.

5G Base Station Chips: Driving Future Connectivity by 2025

Nov 27, 2024 · 5G base station chips are the lifeblood of base stations, which are pivotal in transmitting high-speed data across vast networks. These chips enable: High bandwidth:

6 FAQs about [The development of 5G base station communication industry]

Which segment dominates the 5G base station market in 2024?

The industrial segment maintains its dominance in the global 5G base station market, commanding approximately 27% market share in 2024. This significant market position is driven by the accelerating adoption of Industry 4.0 initiatives and the growing integration of IoT devices in manufacturing facilities.

Will China build a 5G base station next year?

Technicians from China Mobile check a 5G base station in Tongling, Anhui province. [Photo by Guo Shining/For China Daily] China aims to build over 4.5 million 5G base stations next year and give more policy as well as financial support to foster industries that can define the next decade, the country's top industry regulator said on Friday.

How big is the 5G base station market?

The 5G Base Station Market is expected to reach USD 37.44 billion in 2025 and grow at a CAGR of 28.67% to reach USD 132.06 billion by 2030. Huawei Technologies Co., Ltd., ZTE Corporation, Nokia Corporation, CommScope Holding Company, Inc. and QUALCOMM Incorporated are the major companies operating in this market.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

What is Europe's 5G base station growth rate?

Europe has demonstrated remarkable progress in 5G base station deployment, with a substantial growth rate of approximately 38% from 2019 to 2024. The region's market development is characterized by strong governmental support and strategic initiatives across multiple countries, particularly in the United Kingdom, Germany, France, and Italy.

What are 5G base station chips?

5G base station chips play a critical role in the construction of 5G networks. As technology continues to advance, base station chips will demonstrate higher performance and provide support for the comprehensive coverage of 5G networks. At the same time, the market demand for these chips creates new development opportunities for related industries.

Update Information

- Estonia 5G communication green base station area

- Ukrainian 5G communication base station battery energy storage system solution

- 5g communication base station inverter grid-connected construction facilities

- Hargeisa Communication 5g base station construction

- 5g communication base station EMS equipment list

- Chisinau Communication 5g signal tower base station construction

- Cameroon 5G communication base station lithium ion battery cost

- Ministry of Industry and Information Technology s communication base station flow battery construction specifications

- 5g base station communication is better or better

- Malaysia 5g communication base station wind power construction project

- Communication 5g base station and sharing

- Beirut 5g communication base station 125kWh

- Communication 5g base station manufacturers ranking

Solar Storage Container Market Growth

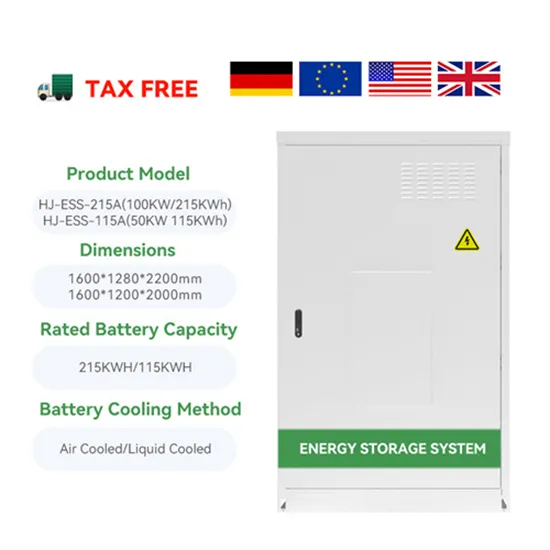

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

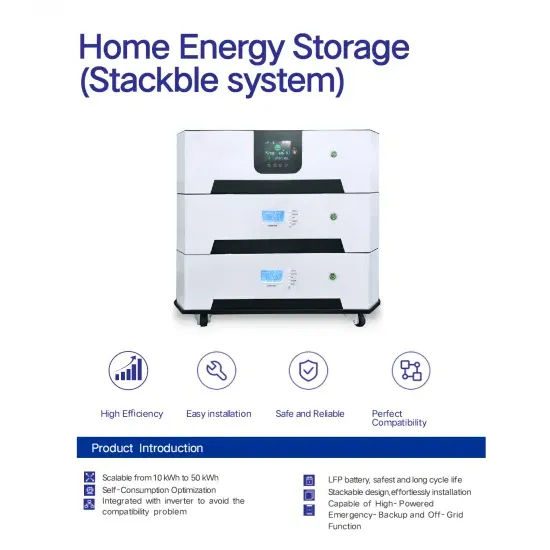

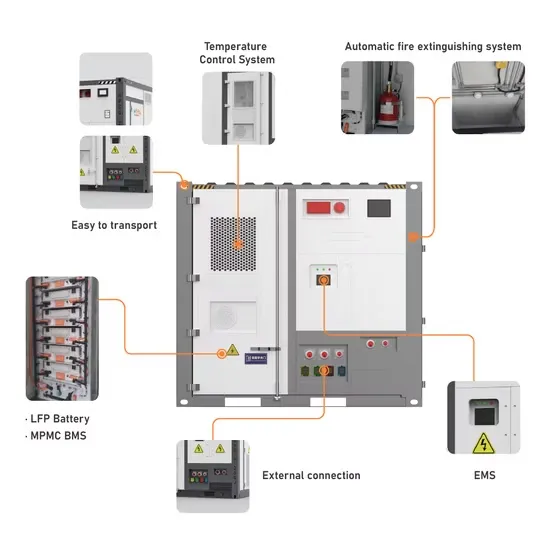

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.