Kigali Energy Storage Project Latest Updates and Impact on

The Kigali Energy Storage Project continues to make headlines as a transformative initiative in Africa''s renewable energy landscape. Designed to stabilize Rwanda''s power grid and support

Where is the kigali pumped hydro energy storage station

Pumped hydro storage systems have gained prominence as viable energy storage solutions, owing to their potential to integrate renewable energy sources and provide grid stability [ The

KIGALI POWER GRID ENERGY STORAGE POWER STATION

Energy storage power station put into operation The world''s first immersion liquid-cooled energy storage power station, China Southern Power Grid Meizhou Baohu Energy Storage Power

Kigali Energy Storage Policy: Powering Rwanda''s Green

Oct 3, 2020 · Rwanda''s leveraging methane-rich Lake Kivu for a storage twofer: Early results? A 40% reduction in diesel backup usage across Western Province. Not too shy for a country

Kigali new mobile energy storage power supply manufacturer

Are mobile battery energy storage systems a viable alternative to diesel generators? Mobile battery energy storage systems offer an alternative to diesel generators for temporary off-grid

Kigali Power Grid Energy Storage Power Station

The power station is located on leased land, at the campus of Agahozo Shalom Youth Village, in Rwamagana District, Eastern Rwanda, approximately 58 kilometres (36 mi), by road,

Energy Storage Technologies for Modern Power Systems: A

May 9, 2023 · Power systems are undergoing a significant transformation around the globe. Renewable energy sources (RES) are replacing their conventional counterparts, leading to a

Kigali Mobile Energy Storage Power Plant Operation

In the high-renewable penetrated power grid, mobile energy-storage systems (MESSs) enhance power grids'''' security and economic operation by using their flexible spatiotemporal energy

China Southern Power Grid Energy Storage Co.,Ltd (南方

China Southern Power Grid Energy Storage Co., Ltd is a power company located in Guangzhou. The company specializes in hydroelectric power generation and power supply services. They

Lebanon and Kigali Energy Storage Policy: Powering the

Why Energy Storage Policies Matter in 2025 (and Why You Should Care) a world where blackouts are as outdated as flip phones, and renewable energy flows as reliably as your morning coffee.

Kigali Air Energy Storage Power Station A Game-Changer for

Meta Description: Explore how the Kigali Air Energy Storage Power Station revolutionizes renewable energy storage, addresses grid stability, and supports Rwanda''s sustainability

KIGALI ENERGY STORAGE POWER STATION

Although using energy storage is never 100% efficient—some energy is always lost in converting. . The most common type of energy storage in the power grid is pumped hydropower. But the

Update Information

- China Southern Power Grid 100MW Energy Storage

- China Southern Power Grid supports distributed generation and energy storage

- China Southern Power Grid exceeds energy storage standards

- Energy storage company cooperating with China Southern Power Grid

- China Southern Power Grid Energy Storage Station

- Energy storage and China Southern Power Grid cooperation

- Bhutan Power Grid Energy Storage System

- How long will it take for large-scale energy storage in the power grid

- Photovoltaic surplus power into the grid energy storage

- Haiti Power Grid Energy Storage Equipment Manufacturer

- Huawei Power Grid Energy Storage Components

- Can distributed energy storage power stations be connected to the grid

- Energy storage on the power grid side of Port Louis

Solar Storage Container Market Growth

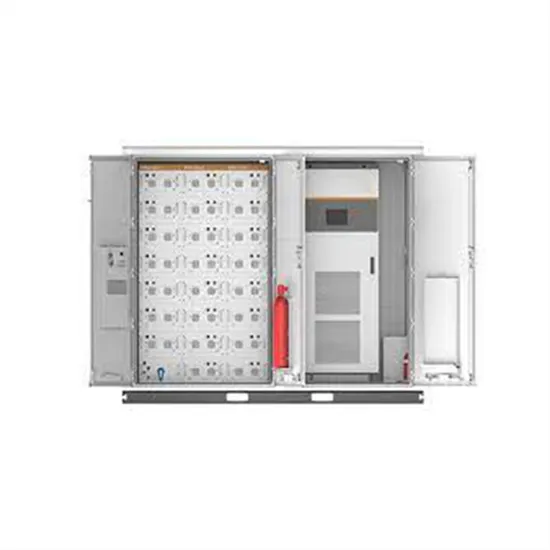

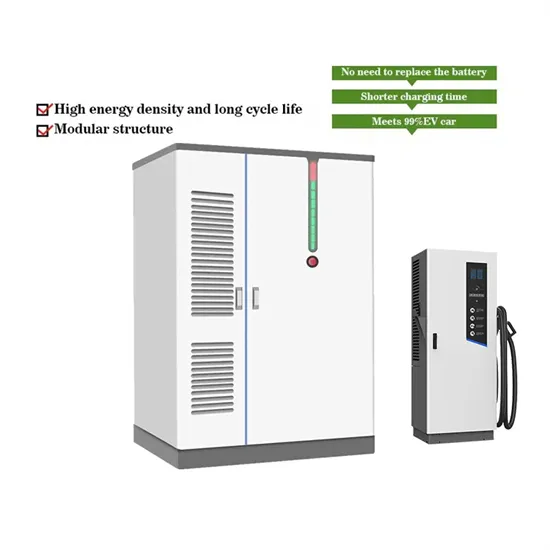

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

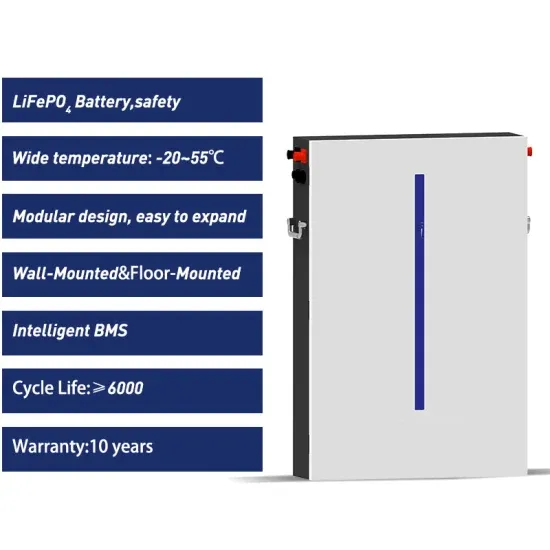

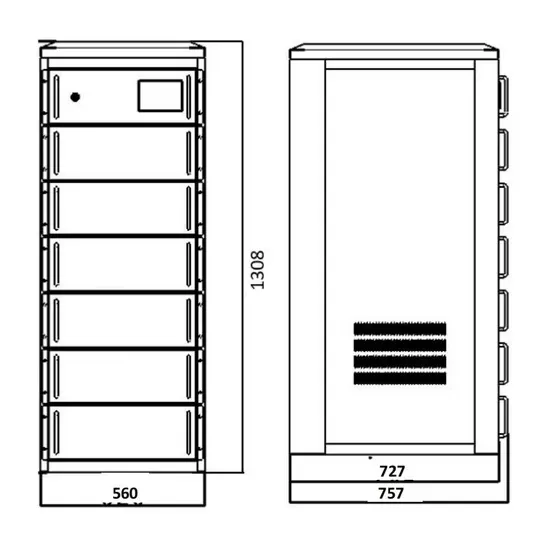

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.