What does enterprise energy storage include? | NenPower

Apr 30, 2024 · Enterprise energy storage encompasses various technologies and methodologies designed to optimize energy use, enhance efficiency, and provide backup during peak

Private equity targets battery energy storage, driven largely

Aug 17, 2025 · In the largest transaction, battery storage company NineDot Holdings Inc. raised $225 million in a round of funding led by Manulife Investment Management Ltd., with

How do private enterprises do energy storage? | NenPower

Mar 6, 2024 · Private enterprises engage in energy storage through various significant strategies, showcasing their innovative capabilities. 1. Investment in advanced technol

How is the profit of enterprise energy storage power station?

Apr 7, 2024 · The profit of an enterprise energy storage power station hinges upon several critical factors: 1. Initial investment cost, 2. Operational efficiency, 3. Market dynamics, 4. Regulatory

Evaluation and optimization for integrated photo-voltaic and

Oct 20, 2024 · Evaluation and optimization for integrated photo-voltaic and battery energy storage systems under time-of-use pricing in the industrial park

Three business models for industrial and commercial

Aug 16, 2025 · In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management contracts, and financial

Capacity planning and optimization of business park-level

Dec 15, 2019 · According to the three schemes of equipment investment without constraint, equipment investment with soft constraint and equipment investment with hard constraint, the

Eos Energy Enterprises Reports Third Quarter 2022 Financial

Aug 12, 2025 · Company has delivered 258 Energy Blocks since manufacturing inception; shifting strategy to maximize IRA benefits for Eos and its customers EDISON, N.J., Nov. 07, 2022

Eos Energy Enterprises Reports Second Quarter 2024

Aug 6, 2024 · Successful commissioning of state-of-the-art (SotA) manufacturing line and up to $315.5 million strategic investment from Cerberus provide capacity and capital to significantly

Influences of mechanisms on investment in renewable

Oct 9, 2023 · The main conclusions drawn are as follows: (1) Compared with RPSM, SM is more conducive to investment in renewable energy storage equipment and results in greater profit

How does the government subsidize enterprises to install energy storage

Aug 25, 2024 · The government provides financial support through various mechanisms to encourage enterprises to invest in energy storage, including 1. direct grants, 2. tax incentives,

The impact of the government''s new energy storage policy

Our results remain consistent after a series of robustness tests. Heterogeneity analysis shows that the NES policy has a more significant impact on non-state-owned enterprises (non

The Ministry of Finance has issued tax policies on digital and

Jul 17, 2024 · The Zhitong Finance App learned that on July 17, the Ministry of Finance announced that an enterprise''s investment in the digitization and intelligent transformation of

EOS ENERGY ENTERPRISES, INC 2023 ANNUAL REPORT

May 3, 2025 · We continue to be excited about long duration energy storage''s future as every global demand forecast reveals that the world needs more reliable, affordable, and sustainable

How can private enterprises become energy storage enterprises?

Feb 13, 2024 · 1. Private enterprises can transform into energy storage enterprises through strategic investments, technological innovation, and engaging supply chain collaborations. The

Three Investment Models for Industrial and

Sep 30, 2023 · In this article, we''ll take a closer look at three different commercial and industrial energy storage investment models and how they play a key role

Comprehensive economic analysis of adiabatic compressed air energy

Dec 10, 2024 · In this research, the return on investment (ROI) and internal rate of return (IRR) is higher than 8 %, which proves that the A-CAES has good economics. Through the sensitivity

Energy storage in China: Development progress and

Nov 15, 2023 · Even though several reviews of energy storage technologies have been published, there are still some gaps that need to be filled, including: a) the development of energy storage

Configuration optimization of energy storage and economic

Sep 1, 2023 · In this work, the optimal configuration of energy storage and the optimal energy storage output on typical days in different seasons are determined by considering the objective

Exploring the Global Expansion of Domestic Energy Storage Enterprises

Nov 10, 2023 · The company has forged enduring partnerships with numerous local enterprises to meet the increasing demand for renewable energy in the United States. As the global energy

New energy policy and green technology innovation of new energy

Aug 1, 2024 · The New Energy Demonstration City Policy (NEDCP) is a green development strategy with Chinese characteristics, while new energy enterprises (NEEs) are micro

Eos Energy Enterprises Records Highest Quarterly Revenue

May 6, 2025 · Post quarter end, Eos signed two new memorandums of understanding (MOUs) that expand its international presence and reinforces demand for its long-duration storage

Recent Storage M&A Transactions and Investment News

Jul 1, 2025 · United States Jun 24th: CleanCapital, a leading independent power producer focused on distributed clean energy, announced the successful acquisition of a portfolio of

The Enterprise Income Tax Policies for the Digital and

In accordance with the requirements of the Notice by the State Council of Issuing the Action Plan for Promoting Large-scale Equipment Renewals and Consumer Goods Trade-ins (No. 7

How much electricity is suitable for energy storage in enterprises

Aug 20, 2024 · Analyzing an enterprise''s operational hours reveals the necessary balance in energy usage and storage. During high operational hours, particularly in industries such as

The Impact of New Energy Storage Technology Application

Jan 12, 2025 · Third, previous studies have compared the energy efficiency of various energy storage technologies from the technical level (Zhang et al. 2021), while this study investigates

China Offers Tax Incentive to Encourage Green, Smart

Aug 21, 2024 · On 18 July, the Ministry of Finance and the State Taxation Administration jointly announced a new enterprise income tax incentive to encourage companies to invest in digital

How much is the foreign trade income of energy storage

Oct 4, 2024 · The foreign trade income derived from energy storage technologies stems from diverse sources. Batteries, pumped hydro storage, and thermal energy storage systems

Energy Storage Financial Model Analysis: Key Trends and Investment

Jul 30, 2022 · The global energy storage market is projected to balloon to $490 billion by 2032 [1], making it the ultimate playground for investors and engineers alike. But how do you separate

30 new energy enterprises are set to emerge in the energy storage

May 28, 2024 · In the past two years, the energy storage business has developed rapidly, and the company''s operating income of energy storage products in 2021 will be 142 million yuan, a

Eos Energy Enterprises Meets 2024 Revised Revenue Guidance

Mar 5, 2025 · Eos Energy Enterprises Meets 2024 Revised Revenue Guidance and Reports Fourth Quarter & Full-Year 2024 Financial Results; Reaffirms 2025 Revenue Guidance March

How can enterprises make profits by investing in energy storage

Jun 20, 2024 · Investment in energy storage systems is paramount for enterprises seeking to enhance profitability and operational efficiency. Fostering sustainability, unlocking market

The Energy Storage Market in Germany

ISSUE 2019 Energy storage systems are an integral part of Germany''s Energiewende ("Energy Transition") project. While the demand for energy storage is growing across Europe, Germany

6 FAQs about [Enterprise energy storage equipment investment income]

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Does storage capacity improve investment conditions?

Recent deployments of storage capacity confirm the trend for improved investment conditions (U.S. Department of Energy, 2020). For instance, the Imperial Irrigation District in El Centro, California, installed 30 MW of battery storage for Frequency containment, Schedule flexibility, and Black start energy in 2017.

Can energy storage provide multiple services?

The California Public Utilities Commission (CPUC) took a first step and published a framework of eleven rules prescribing when energy storage is allowed to provide multiple services. The framework delineates which combinations are permitted and how business models should be prioritized (American Public Power Association, 2018).

Update Information

- Busan South Korea energy storage equipment new energy enterprise

- Photovoltaic energy storage enterprise income

- Discharge of enterprise energy storage equipment

- Türkiye mobile energy storage vehicle equipment

- Algeria Energy Storage Vehicle Equipment

- Equipment required for the operation of energy storage power stations

- Can electric energy storage equipment be placed in the basement

- Energy Storage Equipment Production Scheduling Letter

- Centralized power station energy storage equipment standards

- Energy storage rare metal power supply equipment

- Multi-energy complementary energy storage equipment

- Suriname Energy Storage Equipment Manufacturer

- Energy storage equipment triple cabin

Solar Storage Container Market Growth

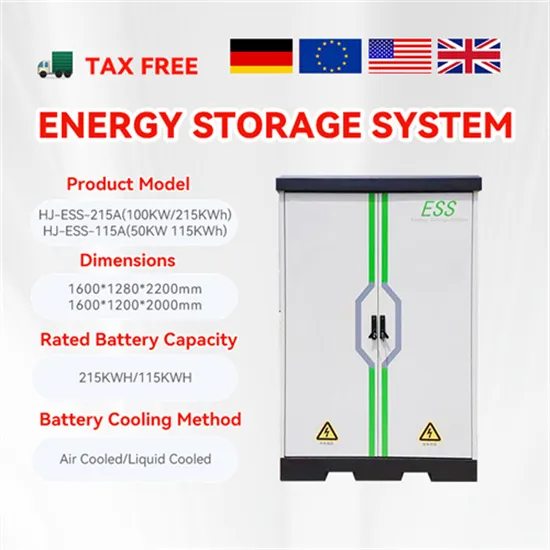

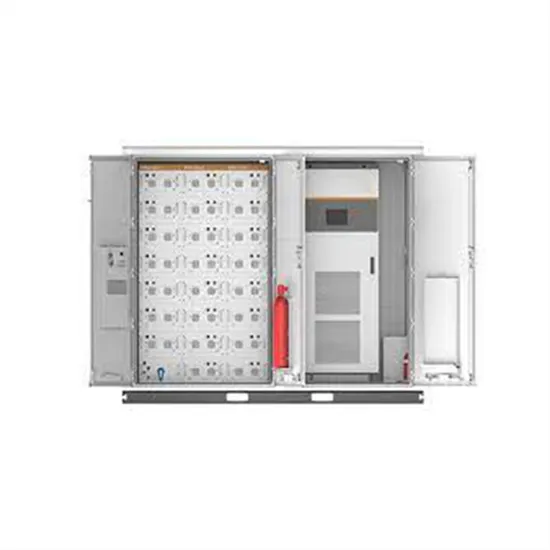

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.