Brazil''s Energy Revolution: Scaling Wind, Solar & Storage for

Why Brazil''s Renewable Boom Needs Smart Storage Solutions You know, Brazil''s already generating over 60% of its electricity from renewables—a global leader in hydropower. But

Brazil innovates in the energy transition with technology that

Apr 3, 2023 · Brazilian company develops first energy storage project focused on renewable sources. The "storage wind" project will play a major role in the Brazilian energy transition.

Brazil''s onshore wind power sector slows in 2024, growth to

Jan 17, 2025 · (Reuters) – Brazil''s wind power sector lost steam in 2024, local association ABEEolica said on Friday, noting that it expects continued downward pressure before growth

BRAZIL WINDPOWER 2023 CALL FOR TECHNICAL PAPERS

Feb 1, 2025 · BRAZIL WINDPOWER 2023 CALL FOR TECHNICAL PAPERS ABEEólica (Brazilian Wind Energy Association) is pleased to announce the rules for the submission of

The complementary nature between wind and photovoltaic generation

Oct 1, 2020 · Solar and wind resources have a relevant temporal complementarity in the Brazilian NE. Energy mix 40% wind and 60% solar requires minimal storage capacity to supply Brazilian

Brazil''s Energy Storage Auction to Attract $450M in

Feb 4, 2025 · The auction aims to boost Brazil''s grid reliability by integrating energy storage for wind and solar power. Brazil is set to conduct its first auction for adding batteries and storage

Brazil Park Energy Storage Project 2025: Powering the Future

Jun 1, 2022 · Enter the Brazil Park Energy Storage Project 2025, a game-changing initiative that''s making waves in the renewable energy sector. Designed to tackle energy intermittency (you

Brazil''s First Energy Storage Regulatory Framework to Be

Jul 6, 2025 · At a public hearing held by the Chamber of Deputies'' Mines and Energy Committee, Daniel Danna, Director of the National Electric Energy Agency (ANEEL), stated that the

Brazil: renewable energy and system preferences

Feb 25, 2025 · Our trend report reveals Brazil''s solar power and renewable energy preferences, including bifacial modules, central inverters, trackers, and

Brazil''s energy storage auction to attract $450m in investments

Jan 23, 2025 · Brazil is set to conduct its first auction for adding batteries and storage systems to the national power grid, as reported by Reuters. The auction, to take place in June 2025, will

Brazilian government to propose full opening of energy

May 14, 2025 · From pv magazine Brazil The reform of the electricity sector is moving forward with a proposal circulating among industry players. Among the provisions is the opening of the

Hydrogen storage in depleted offshore gas fields in Brazil:

Dec 30, 2023 · This article estimates the potential of using depleted offshore gas fields in Brazil for hydrogen storage and the effects this may have in terms of energy security. Brazil is

Advances, Progress, and Future Directions of Renewable Wind

May 19, 2025 · Brazil is prominent in the ranking of global installed onshore wind power capacity. According to 2023 data (Figure 1), the country is among the top ten in the world, alongside

Techno-economic analysis of hydrogen production from offshore wind

Dec 15, 2024 · Bonacina et al. [8] investigated liquid hydrogen production from offshore wind power in the Mediterranean Sea for ship refueling. A parametric analysis is performed by

Brazil Windpower 2024

Sep 16, 2024 · From October 22-24, we will bring our RES Lounge to the largest wind event in Latin America. For 15 years, Brazil Windpower has been demonstrating its great potential for

6 FAQs about [Brazil wind power storage]

What are the benefits of wind energy in Brazil?

Emissions Reduction: Wind energy has helped Brazil reduce its dependence on fossil fuels, lowering greenhouse gas emissions and contributing to the country’s climate commitments. Local Impacts: Although it is a clean energy source, installing wind farms can affect local ecosystems, such as wildlife (especially birds and bats) and vegetation.

Will Brazil conduct the first energy storage auction?

Brazil is set to conduct the country's first-ever energy storage auction for adding batteries and storage systems to the national power grid.

Which Brazilian wind farms produce the most energy a year?

Comparative graph for annual energy production and capacity factor for onshore wind farms in Brazil. As indicated in Figure 19, the highest annual energy production comes from Alto do Sertão, with approximately 3855 GWh, while Chuí has the lowest, with 1786 GWh. The capacity factors range between 0.35 (Chuí) and 0.43 (Chafariz).

What is the average capacity of a wind farm in Brazil?

In Brazil, the average capacity factors of onshore and offshore wind farms typically range between 0.35 and 0.50, figures that are among the highest in the world, thanks to the consistency and quality of the winds .

Will Brazil's first electricity auction drive $450m investment?

Brazil is set to conduct its first auction for adding batteries and storage systems to the national power grid, as reported by Reuters. The auction, to take place in June 2025, will include 300MW energy capacity purchase that could drive an estimated $450m in investments from winning bidders, according to consultants Oliver Wyman.

Does Brazil have a wind energy potential?

Based on the 100 m wind speed map the Global Wind Atlas (GWA) provided, Brazil possesses significant wind energy potential. The most favorable wind resource conditions are concentrated mainly in the Northeast and South regions (Figure 3).

Update Information

- Wind power combined with energy storage frequency regulation

- The price of wind power generation and energy storage

- Managua s first wind and solar power storage base

- Wind energy storage power station for home use

- Is the wind and solar energy storage power station cost-effective

- Madrid s largest wind power storage project

- Western Europe dual wind and solar energy storage power station

- Wind power frequency regulation energy storage project

- Yemen Wind Power Storage System

- Brasilia wind power generation and energy storage

- Energy storage container wind power cabinet manufacturer

- Wind power storage type

- Lilongwe Wind Power Storage

Solar Storage Container Market Growth

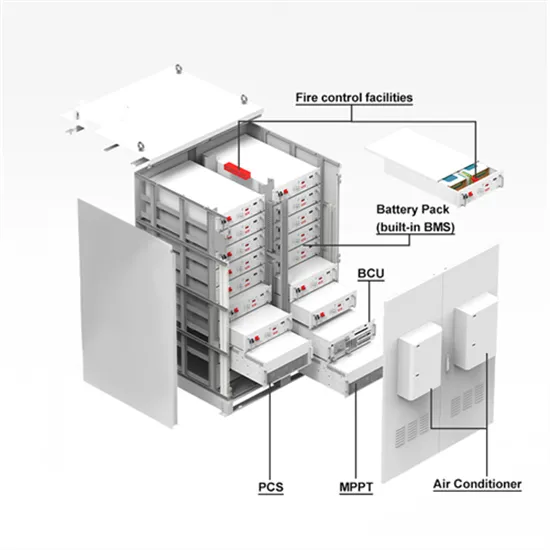

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.