Uninterruptible Power Supply, UPS Devices | Power Supplies

Cost Efficiency and Reduced Downtime: By minimising the downtime caused by power disturbances, UPS systems help reduce the economic impact associated with outages and

Bulk-buy Explosion Proof Mining Emergency UPS Power Supply

Abou the Explosion proof uninterruptible power system (UPS) The explosion-proof lithium-ion battery power supply for mines integrates advanced lithium battery matching technology,

Uninterruptible Power Supply (UPS) Market Regional Insights

The Europe region is anticipated to have a substantial market share of the global Uninterruptible Power Supply (UPS)s market in 2033, driven by increasing investments in renewable energy

Uninterruptible Power Supply System

Aug 3, 2022 · Businesses today invest large sums of money in their IT infrastructure, as well as the power required to keep it functioning. Uninterruptible power supplies (UPS) are an

Europe Uninterruptible Power Supply (Ups) Market Forecast

Jul 20, 2023 · The Europe uninterruptible power supply (UPS) market growth analysis entails the assessment of Belgium, Germany, Spain, France, United Kingdom, Italy, and Rest of Europe.

Eximpower | UPS | Uninterruptible Power Supply

Sep 10, 2018 · eximpower product range varies from Static & Dynamic Uninterruptible Power Supplies, Servo & Static Voltage Regulators to Renewable Energy Products, DC Power

UPS-Systems, UPS-Solutions, Industrial UPS and Battery

Swiss Quality for UPS Solutions and Battery Systems Since 50 years, Statron is THE partner for uninterruptable power supply (UPS) solutions and battery systems. More than 30''000 UPS

Power supplies & UPS for mining | Phoenix Contact

The power supply devices, DC/DC converters, redundancy modules, and uninterruptible power supplies from Phoenix Contact reliably supply your systems. Their scope of functions and

Uninterruptible Power Supply Market Size, Forecast 2025

The uninterruptible power supply market size exceeded USD 12.1 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2034, driven by the rapid expansion of data centers

A kind of new type mining uninterrupted power supply

Jan 21, 2019 · Abstract The utility model discloses a kind of new type mining uninterrupted power supply, including the first transformer, throw electric controller, executing agency, peripheral

Global Uninterruptible Power Supply Market Size, Trend

Global Uninterruptible Power Supply Market Size, Trend & Forecast to 2031-2031 - The Research Insights is a responsible company that is a global pioneer in market research, business

Uninterruptible Power Supply Market Size, Growth and

Aug 18, 2025 · The Uninterruptible Power Supply Market is valued at USD 8,235 million and is projected to grow at a CAGR of 4.7% over the forecast period, reaching approximately USD

6 FAQs about [Uninterruptible power supply price for mining in Eastern Europe]

What is Europe uninterruptible power supply (UPS) market size in 2025?

On the basis of type, the Europe Uninterruptible Power Supply (UPS) market is segmented into non-data center and data center. In 2025, the non-data center segment is expected to dominate the market with share 64.16% due to its healthcare, manufacturing, transportation, and commercial buildings.

Which country has the largest uninterruptible power supply market?

U.S. accounted for over 75% share in North America uninterruptible power supply market, generating revenue of USD 3.6 billion in 2024. The US has the biggest national market of UPS systems, which have been prompted by the presence of key technology firms and advanced data facility build-up.

Which country will dominate the UPS (uninterruptible power supply) market?

Germany is expected to dominate the UPS (Uninterruptible Power Supply) with market share 19.88% due to its strong engineering legacy, exceptional product reliability, and commitment to innovation and sustainability.

Should you invest in an uninterruptible power supply (UPS)?

When considering the investment in an uninterruptible power supply (UPS), it's crucial to evaluate UPS price points meticulously. The market offers a range of UPS solutions catering to diverse business needs and budgets.

What is the uninterruptible power supply market?

Based on application, the uninterruptible power supply market is segmented into BFSI, data center, healthcare, telecommunication, industrial applications, government & defense, and others. The data center segment was valued at USD 3.9 billion in 2024 and is expected to grow at a rate of around 6.2% till 2034.

How big is the uninterruptible power supply market in 2024?

The solution segment dominated with over 80% market share, generating around USD 9.5 billion in 2024. What is the market size of the uninterruptible power supply (UPS) market in 2024? The market was valued at USD 12.1 billion in 2024, with a projected CAGR of 5.6% from 2025 to 2034. What is the projected value of the UPS market by 2034?

Update Information

- Myanmar home ups uninterruptible power supply price

- How much is the price of uninterruptible power supply in Taipei

- Burundi Flexible Uninterruptible Power Supply Price

- Uninterruptible power supply wholesale price in Mauritius

- Kiev high frequency uninterruptible power supply price

- Uninterruptible power supply cabinet price

- Congo ups power supply uninterruptible power supply price

- Estonia high-tech UPS uninterruptible power supply sales price

- St Johns DC Uninterruptible Power Supply Price

- Vienna UPS Uninterruptible Power Supply Agency Price

- Micronesia large UPS uninterruptible power supply price

- Ngerulmude ups uninterruptible power supply agent price

- China-Africa UPS Uninterruptible Power Supply Price

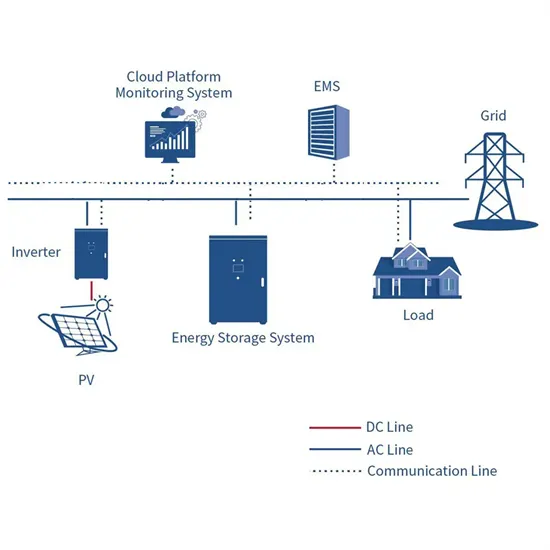

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

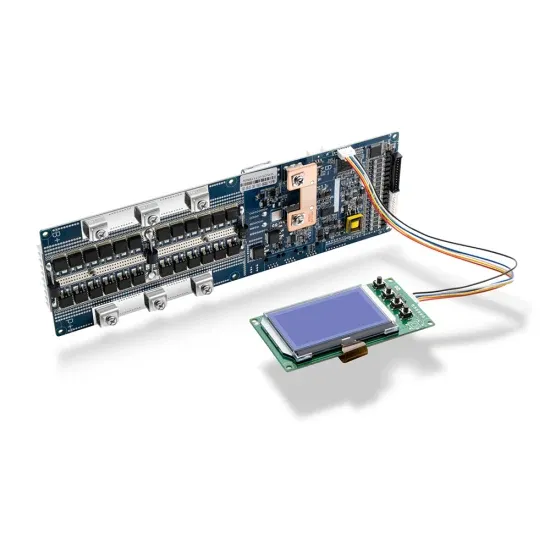

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.