Timor Leste Solar Microinverter and Power Optimizer Market

Timor Leste Solar Microinverter and Power Optimizer Market (2024-2030) | Share, Trends, Companies, Analysis, Industry, Size & Revenue, Outlook, Growth, Value, Competitive

Top Microinverter Suppliers in Timor-Leste

Jul 11, 2025 · For high power output, bulky inverters are required, but to convert a very small level of DC from panels requires small compact Microinverters. Microinverters are connected to the

Grid tie inverter specifications Timor-Leste

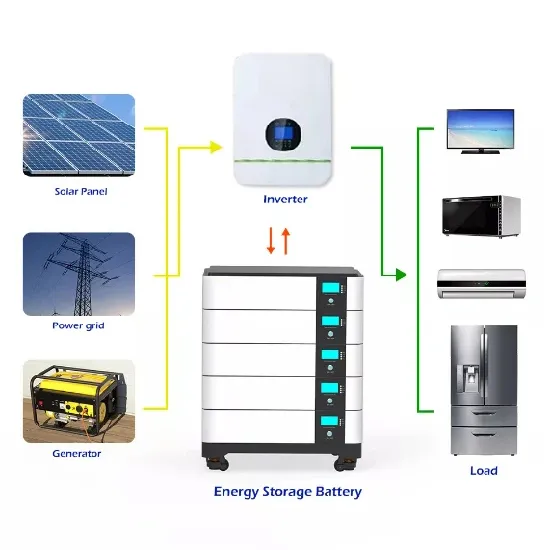

What is a grid-tie inverter? A grid-tie inverter converts direct current (DC) into an alternating current (AC)suitable for injecting into an electrical power grid,at the same voltage and

Industrial uninterruptible power supply in Timor-Leste

How will EDTL improve the power supply infrastructure in Timor-Leste? The project will support EDTL improve the power supply infrastructure in Timor-Leste. The principal weaknesses in the

1000 Watt Pure Sine Wave Power Inverter DC 12V to Timor-Leste

Shop 1000 Watt Pure Sine Wave Power Inverter DC 12V to 110V120V AC Converter with 2 AC,18W USB, and 30W Type-C Charging Ports, Car Solar Power Inverters with LCD Display

1kva solar system price Timor-Leste

What is a 1kVA Solar Inverter? A 1kVA (Kilovolt-Ampere) solar inverter is a small-capacity inverter designed to handle low-power applications. The term "1kVA" refers to its capacity to handle a

Wholesale Solar Inverter from Supplier | Timor Leste

Can a solar inverter be used with solar panels in a floating installation? We are a Solar Inverter supplier in the Timor Leste, providing a variety of Solar Inverter, if you are interested in the

renewable energy Timor Leste | gokoval

May 16, 2025 · In Timor-Leste, unreliable electricity and rising costs make daily life harder. Gokoval''s residential solar systems are designed to provide affordable, off-grid power tailored

Renewable Energies: Timor-Leste invests in Solar Panels

Just as the remaining renewable energies sources that are being explored by the Government in Timor-Leste, the photovoltaic units (or solar project) implementation project is specially

Grid tie inverter specifications Timor-Leste

A grid-tie inverter converts direct current (DC) into an alternating current (AC)suitable for injecting into an electrical power grid,at the same voltage and frequency of that power grid. Grid-tie

Top Solar inverter Manufacturers Suppliers in Timor-Leste

Apr 14, 2025 · Solar power inverters have a crucial role to play in a solar system as they convert the electricity of solar panels to make them usable for running various appliances, lighting, and

Going Green

Jul 9, 2024 · Timor-Leste offers a compelling opportunity to invest in solar energy Timor-Leste has rapidly expanded electricity access to more than 83 per cent of the population but the country

2000 Watt Pure Sine Wave Power Inverter 12V DC to Timor

Shop 2000 Watt Pure Sine Wave Power Inverter 12V DC to 110V 120V AC with UL Approved Fiuses and 20A AC Hardwire Terminal Compatible with Lithium Battery for Home RV Truck Off

6 FAQs about [Timor-Leste small power inverter]

Does Timor-Leste need a roof-top solar energy system?

In addition, most of Timor-Leste's electricity is generated through costly and polluting diesel generators. Australia's Market Development Facility (MDF) and ITP Renewables conducted an assessment of the potential market for roof-top solar energy systems in Timor-Leste.

Why is solar energy maintenance important in Timor-Leste?

Maintenance tends to be limited to repairing malfunctioning system components, instead of preventative care or servicing, which can reduce the effectiveness of solar energy systems and increase costs. Technicians in Timor-Leste have experience in small-scale, off-grid solar energy systems.

Is Timor-Leste a good country for solar energy?

Timor-Leste has a high-quality solar resource. The global horizontal irradiance in Dili is higher than on the east coast of Australia, where the solar market is mature and installation costs are higher. The cost of electricity in Timor-Leste for commercial and industrial consumers is high compared to ASEAN countries.

How long does a solar system last in Timor-Leste?

High electricity costs and readily available solar radiation mean that the average payback period for a rooftop photovoltaic (PV) solar energy system in Timor-Leste is only 1.5 to 3 years instead of the global average of 6-10 years. Transitioning to solar can also help the country meet environmental commitments.

Does Timor-Leste have electricity?

Timor-Leste has rapidly expanded electricity access to more than 83 per cent of the population but the country has yet to achieve energy security.1 Consumer costs, even with government subsidy, remain high and outages are common. In addition, most of Timor-Leste's electricity is generated through costly and polluting diesel generators.

What is a photovoltaic project in Timor-Leste?

Just as the remaining renewable energies sources that are being explored by the Government in Timor-Leste, the photovoltaic units (or solar project) implementation project is specially directed for the families that live in remote areas, where difficulties still exist in the national energy network installation.

Update Information

- Approximate price of small power inverter

- Basic price of small power inverter

- Inverter power is small

- Civilian small power inverter

- Small power inverter for RV

- Pretoria small power inverter manufacturer

- Small to large inverter power

- Djibouti power inverter manufacturer

- Average power of inverter

- Lithium battery power supply suitable for inverter

- Wind power generation grid-connected inverter power generation

- Best China 500 watt power inverter Seller

- Tskhinvali photovoltaic power generation 150kw off-grid inverter enterprise

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.