Ghana Photovoltaic Market (2025-2031) | Analysis

In the Ghana Photovoltaic Market, several challenges are faced including high initial costs of installing solar panels, limited access to financing for solar projects, inconsistent government

Solar PV in Africa Costs and Markets

The report discusses challenges in policy making and proposes a co-ordinated effort to collect data on the installed costs of solar PV in Africa, across all market segments to improve the

The price of solar modules is increasing. What does this

For example, a container of solar modules being shipped from China to Ghana has quadrupled in price, adding 10% to the landed cost of a solar PV module compared to the previous level of

Techno-economic analysis of solar photovoltaic (PV) and

Oct 1, 2021 · This paper assesses the technical and economic viability of a hybrid water-based mono-crystalline silicon (mc-Si) photovoltaic-thermal (PVT) module in comparison with a

Solarbetriebenes Kakaoschälgerät: Neue Wege

Feb 10, 2025 · Solarenergie trifft Kakao: Warum jetzt der Wendepunkt für PV-Kakaoschälgeräte in Ghana ist Das PV-Kakaoschälgerät rückt aktuell in den

Solar Panel Prices in Ghana: 2025 Buyer''s Guide

Let''s cut to the chase: average prices range from $0.50 to $1.20 per watt as of March 2025, but that''s just the tip of the iceberg. This article breaks down the real costs, hidden factors, and

Global solar module prices mixed on varying

Jan 17, 2025 · In a new weekly update for <b>pv magazine</b>, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global

African solar installers feel the pinch of rising panel prices – pv

Apr 26, 2021 · With Chinese manufacturers having warned they will pass on escalating component costs, and shipping expenses soaring since last summer, the rising price of solar is

Top Solar Panel Manufacturers Suppliers in Ghana

Aug 19, 2025 · Top Solar Panel Manufacturers in India Vikram Solar. Formerly known as Vikram Solar Pvt. Ltd. is a company that specializes in high-efficiency PV module manufacturing

Photovoltaic Module Retail Businesses in Ghana

Photovoltaic Module Retail Businesses in Ghana.HR Engineering and Services HR Engineering and Services represents a leading Project Management company with experts that provide

Energiebau-Sunergy Gh

Oct 8, 2020 · In our warehouse in Ghana we permanently stock a selection of price competitive products and the best international brands in different power ranges. To make life easier for

Analysis Of Photovoltaic Module Price Trends And Industry

Dec 31, 2024 · The current round of photovoltaic module price adjustments has imposed significant operational pressure on industry players. Leading companies, with their high R&D

Update Information

- Photovoltaic module prices in Kathmandu

- Photovoltaic module prices for industry and commerce

- Albania crystalline silicon photovoltaic module prices

- Photovoltaic module manufacturers inventory prices

- Sao Tome double-glass photovoltaic module prices

- India Mumbai multicrystalline photovoltaic module prices

- Transparent photovoltaic panels and prices

- Bolivia photovoltaic module export companies

- Grid-connected photovoltaic inverter prices in Osaka Japan

- Photovoltaic panel prices in Mexico

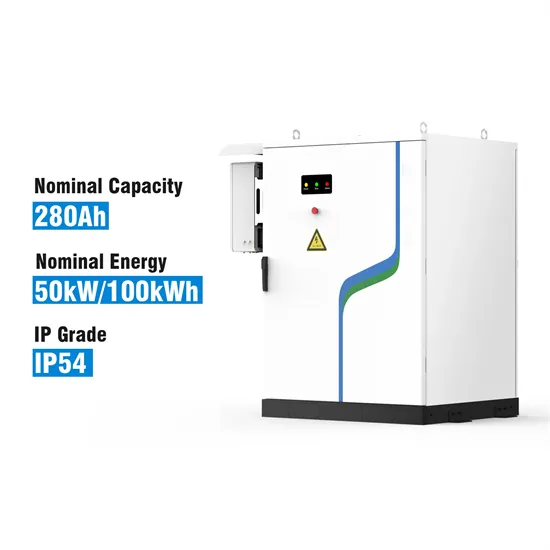

- Photovoltaic energy storage cabinet solar energy prices and China

- Andorra solar photovoltaic module customization

- Bhutan Photovoltaic Module Procurement Project

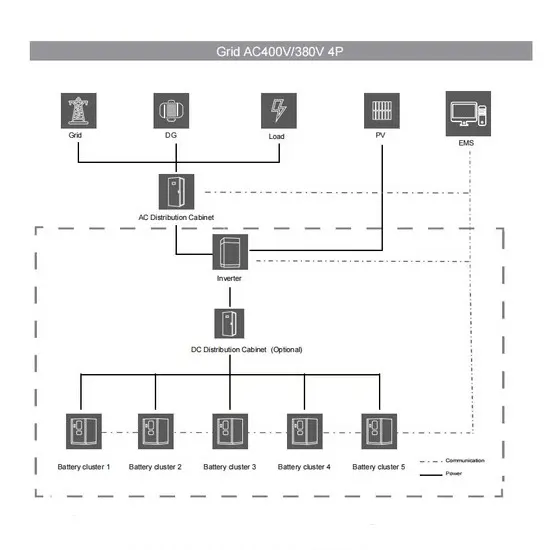

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.