Energy storage container manufacturers ranking

Energy storage container manufacturers ranking to meet all levels of energy storage demands. Optimized price performance for every usage scenario: customized design to offer both

Energy Storage Container Price: Unraveling the Costs and

Oct 1, 2024 · V. Conclusion The price of energy storage containers is influenced by a variety of factors, including battery technology, capacity, power requirements, quality, market conditions,

Multi-purpose energy storage container manufacturers

At BMarko Structures, we understand the importance of battery energy storage in the transition to renewable energy. That''''s why we have made it our mission to provide our customers with the

Ranking of energy storage container companies

Energy storage container spray paint manufacturers ranking Energy storage container spray paint manufacturers ranking Nippon Paint Holdings Co., Ltd. is a Japanese manufacturer of paint

Ranking of mainstream manufacturers of energy storage containers

Who makes the best battery energy storage system? As the top battery energy storage system manufacturer, The company is renowned for its comprehensive energy solutions, supported by

2024 Global and non-China shipments of energy storage

Feb 14, 2025 · Chinese manufacturers continued to dominate non-China markets, while Samsung SDI and LG Energy Solution from South Korea held important positions, ranking sixth and

Skopje energy storage cabinet manufacturer ranking

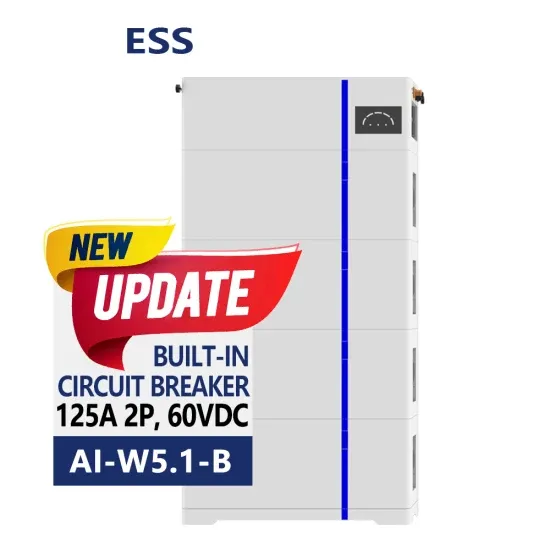

The energy storage cabinet is equipped with multiple intelligent fire protection systems, ensuring optimal DIY Solar Energy Storage Battery | Easy Assemble 48V LiFePO4 Seplos

Best Energy Storage Container Manufacturers in China

May 13, 2025 · TOP 10 Energy Storage Container Manufacturers 1. Shenzhen Rock New Energy Co., Ltd 2. Shandong Huiyao Laser Technology Co., Ltd. 3. TSTY ELECTRIC CO., LTD. 4.

Energy Storage Container Manufacturer in China: Find

Discover the top Energy Storage Container manufacturer in China, servicing wholesale demands for efficient power storage solutions. Trust the expertise of leading suppliers to provide high

top 10 Chinese companies for container of energy storage

Apr 25, 2024 · Shuangdeng presents its 20-foot 5.015MWh liquid-cooled container energy, offering cost savings, reduced footprint, and improved performance. With enhanced safety

ranking of energy storage container custom manufacturers

Unlocking The Power Of Energy Storage Containers: Diverse Applications Energy storage containers are versatile solutions that address diverse energy challenges across industries,

Ranking of energy storage container OEM manufacturers

Top energy storage manufacturers of 2023 revealed. The energy storage sector reached new heights in 2023, as showcased at the annual Energy Storage Carnival and the release of the

Top 10 Global BESS Manufacturers – BESSfinder

May 19, 2025 · Introduction The Battery Energy Storage System (BESS) industry has experienced remarkable growth in recent years, driven by the global shift toward renewable energy and the

2024 Global and non-China shipments of energy storage

Feb 14, 2025 · In 2024, global utility-scale energy storage cell shipments reached 283 GWh, up 68% YoY and 22.6% QoQ in Q4. The top five manufacturers were CATL, EVE Energy,

Energy storage container manufacturers ranking list

This article will mainly explore the top 10 energy storage manufacturers in the world including BYD, Tesla, Fluence, LG energy solution, CATL, SAFT, Invinity Energy Systems, Wartsila,

6 FAQs about [Energy storage container manufacturer ranking and price]

What are the top 10 energy storage manufacturers in the world?

This article will mainly explore the top 10 energy storage manufacturers in the world including BYD, Tesla, Fluence, LG energy solution, CATL, SAFT, Invinity Energy Systems, Wartsila, NHOA energy, CSIQ. In recent years, the global energy storage market has shown rapid growth.

Which Chinese energy storage manufacturers are the best for 2023?

In a highly anticipated release, Black Hawk PV has disclosed the top ten rankings of Chinese energy storage manufacturers for 2023. Leading the pack is CATL with an impressive 38.50% market share and a robust shipment volume of 50 GWh.

What are the top 5 energy storage cell shipments in 2024?

The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients. Stability: With years of industry experience, CATL maintains a clear market advantage and firmly holds the top position in the industry.

Which energy storage cell manufacturers grew the most in 2024?

In 2024, global utility-scale energy storage cell shipments reached 283 GWh, up 68% YoY and 22.6% QoQ in Q4. The top five manufacturers were CATL, EVE Energy, Hithium, BYD, and CALB. CR5 has surpassed 75%, signaling a highly concentrated market with limited growth opportunities for new entrants.

What was the energy storage industry like in 2024?

In 2024, industry concentration remains high, with CR10 reaching 90.9%, roughly the same as in the first three quarters of the year. The top five companies in global energy storage cell shipments for 2024 were: CATL, EVE Energy, BYD, Hithium Energy Storage, and CALB. The top themes for the year were: stability, market shift, and key clients.

Who makes the best battery energy storage system?

As the top battery energy storage system manufacturer, The company is renowned for its comprehensive energy solutions, supported by advanced industrial facilities in Shenzhen, Heyuan, and Hefei. Grevault, a subsidiary of Huntkey, is a leader in the battery energy storage sector.

Update Information

- Container energy storage battery manufacturer ranking

- Barbados container energy storage manufacturer price

- Freetown container energy storage manufacturer

- Micronesia container energy storage cabinet manufacturer

- Ngerulmud sodium sulfur battery energy storage container price

- Energy storage container power station manufacturers ranking

- Rabat energy storage container price inquiry

- Ranking of Energy Storage Container Power Stations in Papua New Guinea

- Harare energy storage container installation manufacturer

- Price of energy storage container in Hamburg Germany

- Monaco energy storage container custom manufacturer

- East Timor Energy Storage Container Battery Manufacturer

- Microgrid Energy Storage Manufacturer Price

Solar Storage Container Market Growth

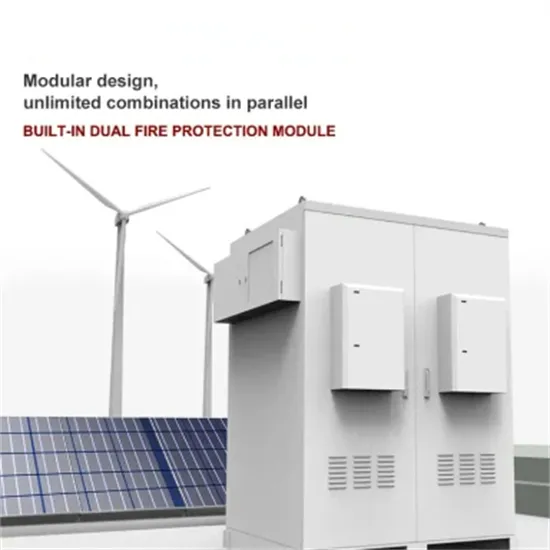

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

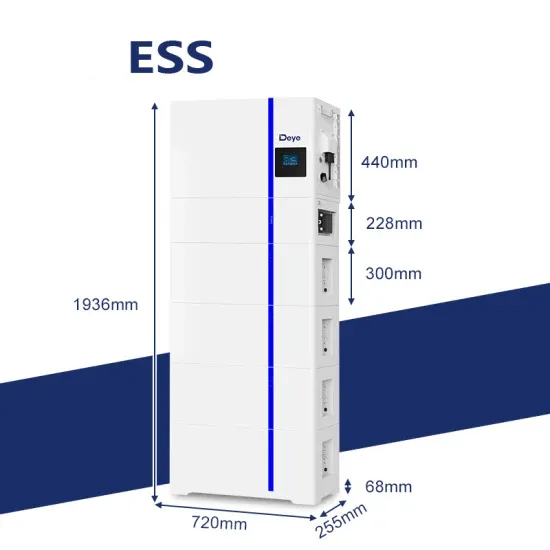

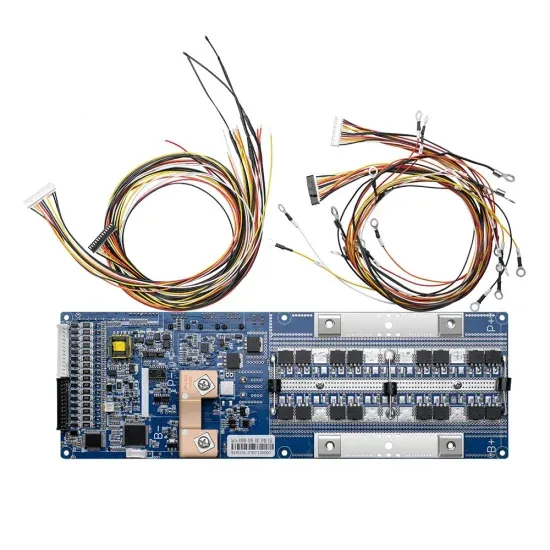

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.