What energy storage products are profitable to sell

How can energy storage be profitable? Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates,

How much money can energy storage make a profit

Sep 30, 2024 · Energy storage can generate significant profits, influenced by factors such as 1. market demand fluctuations, 2. technology advancements, 3. regulatory frameworks, and 4.

How is Energy Storage Profitable? Unlocking the Billion

Nov 19, 2023 · In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030. So, how do companies turn giant batteries into cash machines? Grab your hard hats – we''re

Large energy storage profitable enterprises

Jul 14, 2024 · Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage

How much profit can be gained from exporting energy storage equipment

Jan 21, 2024 · Exporting energy storage equipment presents a lucrative opportunity, driven by the increasing global demand for sustainable energy solutions. 1. Potential profit margins vary

In-depth explainer on energy storage revenue and effects

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the

How To Sell Energy Storage Projects

Feb 13, 2025 · Selling energy storage with home solar is becoming increasingly important, but it can be challenging to design a system that meets customers'' needs and fits their budget.

What Profit Analysis Does Energy Storage Include? A 2025

Mar 25, 2021 · Ever wondered how those giant battery installations make money while you''re sleeping? Let''s crack open the profit pizza of energy storage - where every slice represents a

Is it profitable to replace electric energy storage charging piles

Transforming public transport depots into grid-friendly profitable energy hubs using solar photovoltaic and battery energy storage Transportation is undergoing rapid electrification, with

Is energy storage profitable? – Miellec

Feb 26, 2025 · Are you wondering whether energy storage is worth it? In times of rising electricity prices and dynamic market changes, solutions that allow you to store energy are becoming

Is it easy to sell energy storage and new energy

Energy storage can make moneyright now. Finding the opportunities requires digging into real-world data. Energy storage is a favorite technology of the future--for good reasons. What is

Is battery energy storage profitable

Against the backdrop of swift and significant cost reductions, the use of battery energy storage in power systems is increasing. Not that energy storage is a new phenomenon: pumped hydro

Don''t Be Intimidated: Sell Your Excess Electricity Back To The

Dec 11, 2023 · Learning to interpret the data from your monitoring system is essential. Optimizing Energy Production Battery Storage Systems Explore the benefits of battery storage systems,

Large energy storage profitable enterprises

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Profitable ways of supporting energy storage

The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial customers in each of the four most important applications--demand-charge

Is energy storage profitable?

Nov 15, 2023 · Energy storage increases the profitability of photovoltaic installations by allowing excess energy production to be stored for use during times of energy shortage or when it is

Can energy storage power stations be profitable

How can energy storage be profitable? Where a profitable application of energy storage requires saving of costs or deferral of investments,direct mechanisms,such as subsidies and

Profitable ways of supporting energy storage

How can energy storage be profitable? Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates,

Can lithium battery energy storage be profitable

Battery energy storage systems (BESS) have been playing an increasingly important role in modern power systems due to their ability to directly address renewable energy intermittency,

What energy storage power generation is the most profitable

Jun 18, 2024 · Energy storage power generation varies in profitability based on several factors influencing market dynamics, technology efficiency, and regulatory environments. The most

How much profit does the energy storage equipment have?

Aug 6, 2024 · 1. PROFIT POTENTIAL OF ENERGY STORAGE EQUIPMENT: The profitability of energy storage equipment can vary significantly based on diverse factors. 1. Market Dynamics

Can energy storage charging piles be bought and sold

Optimal Scheduling Method for PV-Energy Storage-Charging With the strong support of national policies and funds, renewable energy power generation technology, energy storage

HOW TO MARKET AND SELL YOUR ENERGY STORAGE

Is buying and selling shipping containers profitable? Yes, the business of buying and selling shipping containers is profitable if you''re aware of the market prices, and the best places to

Which parts of energy storage are profitable? | NenPower

Feb 29, 2024 · The profitability of energy storage encompasses various aspects that significantly impact both individual and commercial stakeholders involved in energy sectors. 1. Cost

6 FAQs about [Is it profitable to sell energy storage equipment ]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Which technologies convert electrical energy to storable energy?

These technologies convert electrical energy to various forms of storable energy. For mechanical storage, we focus on flywheels, pumped hydro, and compressed air energy storage (CAES). Thermal storage refers to molten salt technology. Chemical storage technologies include supercapacitors, batteries, and hydrogen.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Can energy storage provide multiple services?

The California Public Utilities Commission (CPUC) took a first step and published a framework of eleven rules prescribing when energy storage is allowed to provide multiple services. The framework delineates which combinations are permitted and how business models should be prioritized (American Public Power Association, 2018).

Update Information

- Profitable Home Energy Storage Cabinet

- Proportion of air energy storage equipment

- BESS energy storage equipment price

- Manufacturers of energy storage equipment in New York USA

- Energy storage container solar photovoltaic module factory photothermal equipment

- Vientiane Container Energy Storage Equipment Company

- Latest unit price of energy storage equipment

- Fiji energy storage equipment exports

- Romanian container energy storage equipment company

- Vertical energy storage equipment

- Roman energy storage equipment in the field

- How much does energy storage equipment cost in the UK

- Romanian intelligent energy storage equipment company

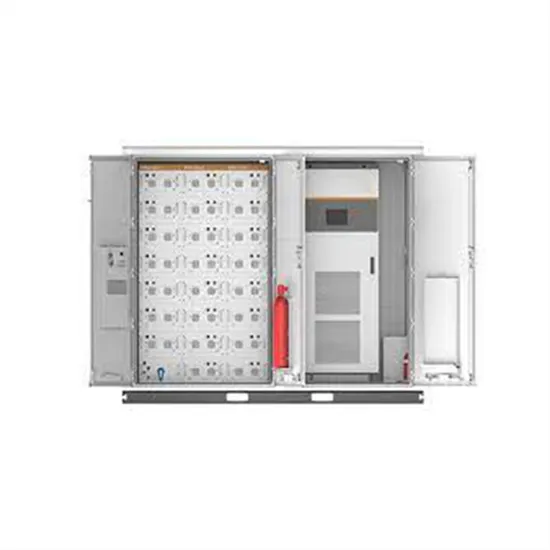

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.