Energy Storage Cabinet Bidding Information: How to

Aug 9, 2025 · With projects like State Grid Gansu''s 291kWh solid-state battery cabinet procurement (¥645,000 budget) [1] and Southern Power Grid''s 25MWh liquid-cooled cabinet

Ethio telecom invites all interested and eligible bidders by

Nov 2, 2021 · Hence, ethio telecom invites all interested and eligible bidders by this International Competitive Bid (ICB) for the procurement of "Different Capacities of Lithium ion Batteries with

How to Prevent Condensation in Battery Cabinets

The Silent Threat in Energy Storage Systems Have you ever wondered how moisture forms inside sealed battery enclosures? Condensation in battery cabinets causes 23% of premature lithium

Procurement_Cliburn_09_2021.pptx

Sep 30, 2021 · The challenges of procurement for utility-side storage and solar-plus projects center largely on early-stage decisions: defining the top-priority use case, but also exploring

Key Considerations for Utility-Scale Energy

Mar 8, 2023 · It''s generation . . . it''s transmission . . . it''s energy storage! The renewable energy industry continues to view energy storage as the superhero

Battery Backup Cabinets Market

Jun 12, 2025 · Primary End-User Industries Driving Battery Backup Cabinet Demand The demand for battery backup cabinets, essential for providing uninterrupted power supply (UPS) during

U.S. energy storage industry commits $100 billion in domestic batteries

May 1, 2025 · The ongoing growth in energy storage deployment is driving investment in U.S. battery manufacturing facilities. The energy storage industry is making significant progress in

DOE Issues Notice of Intent for Funding in Strengthening Domestic

Jan 10, 2025 · Additional investments intended to boost domestic manufacturing of battery supply chains for defense, transportation, and grid resilience.

Lithium Battery Formation and Capacity Grading Cabinet

Oct 9, 2024 · Quick Q&A Table of Contents Infograph Methodology Purchase/Customization Electric Vehicle (EV) Manufacturing Surge The rapid expansion of EV production directly fuels

Ecosafe 105 Minute Lithium Battery Cabinets – 1950H x

Description Ecosafe EC-795+LI is a 105-minute safety cabinet for storing and charging lithium-ion batteries to ensure the safety of people and property. Li-ion batteries present certain risks, the

What are the bidding documents for energy storage cabinets

Mar 14, 2021 · Guidelines for Procurement and Utilization of Battery Energy Storage Systems as part of Generation, Transmission and Distribution assets, along with Ancillary Services dtd

Report: U.S. BESS suppliers to double as tariff

Jan 28, 2025 · Suppliers of U.S.-made battery modules will more than double in the next two years, according to a new report on domestic content trends from

Battery Industry Strategy

May 20, 2022 · Establish a domestic manufacturing base for batteries and materials Strengthen investment in domestic manufacturing base for batteries and materials through public-private

Key Considerations for Utility-Scale Energy

Mar 8, 2023 · Delays in the procurement of batteries could lead to failures to comply with regulatory mandates, or, for utilities opting to install storage as

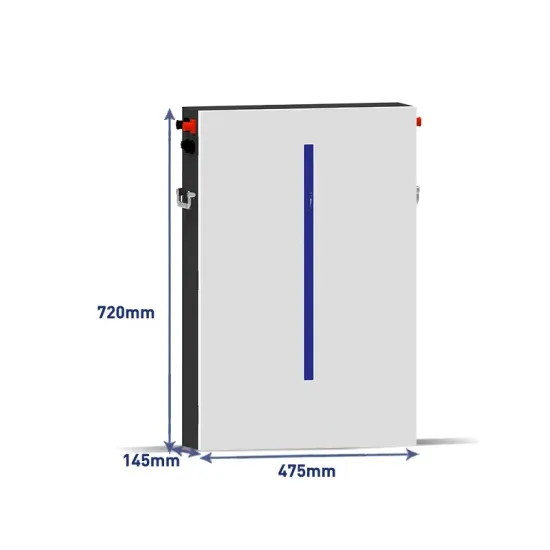

How much does the tower energy storage battery cabinet cost

Aug 16, 2024 · Determining the expense associated with tower energy storage battery cabinets is contingent upon several essential factors including 1. the size and capacity of the battery units,

6 FAQs about [Domestic battery cabinet procurement]

How does the war in Ukraine affect the battery energy supply chain?

The effects of the war in Ukraine are also evident to all of us in our daily lives, from commodities to energy, food supply chains and beyond. The disruption in the battery energy storage system (BESS) supply chain is no different, writes Cormac O’Laoire, senior manager of market intelligence at Clean Energy Associates.

What should you consider when buying a new battery supplier?

When considering a new supplier, buyers should carefully check the company’s safety credentials and industry certifications, as well as the possible failure modes with the battery type they supply, and how these are mitigated.

Should I buy a Tier 1 or Tier 2 battery supplier?

While some tier 1 suppliers may be sold out for the next few years, if your purchasing volume is less than 1 GWh you could consider a smaller, tier 2 supplier. Whereas larger buyers can leverage their scale to secure batteries from tier 1 suppliers, mid-sized or smaller players need to find the right-sized partner.

Are solar manufacturers circumventing antidumping and countervailing duty orders?

The solar market was further constrained by an ongoing petition before the US Department of Commerce alleging that certain solar manufacturers in Southeast Asia were circumventing antidumping and countervailing duty (AD/CVD) orders on solar cells and modules from China.

Why should you choose a Bess Tier 2 battery supplier?

BESS systems have orders of magnitude more stored energy than an individual EV, making the potential scale of a fire significantly different. It will provide some reassurance to know that tier 2 battery suppliers use the same technology and follow the same best practices as the tier 1 suppliers.

How do I choose a utility procurement company?

Apply judgement, as no single document from another utility will address all of your needs. Review your utility’s standard procurement template to be sure it will accommodate the type of procurement and the kinds of companies that you wish to hear from. For some projects, companies with regional or local roots may provide add-on benefits.

Update Information

- What are the domestic energy storage battery cabinet photovoltaic manufacturers

- Battery Cabinet Procurement Contract Library

- Domestic lithium battery station cabinet technology

- How to control the current of battery cabinet

- Estonia battery energy storage cabinet manufacturers ranking

- What is the charging temperature of the battery cabinet

- Civilian battery cabinet test

- The lithium battery site cabinet in the computer room can be used directly

- Maldives energy storage counter custom battery cabinet

- What does a battery cabinet connected in series look like

- High voltage distribution cabinet energy storage battery

- Production process site of energy storage battery cabinet

- Recommendation of lithium battery energy storage cabinet for charging pile in New Delhi

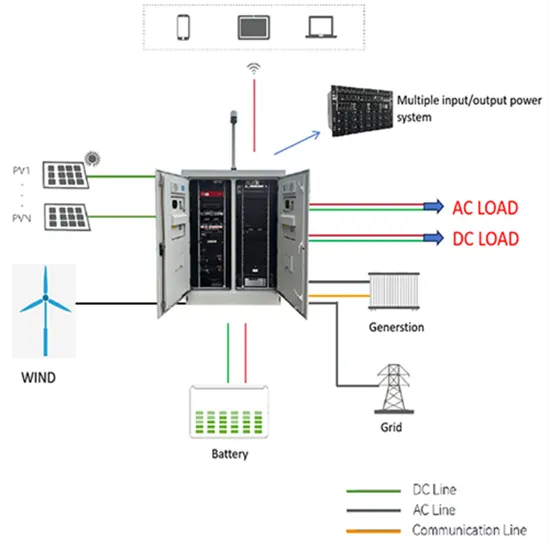

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

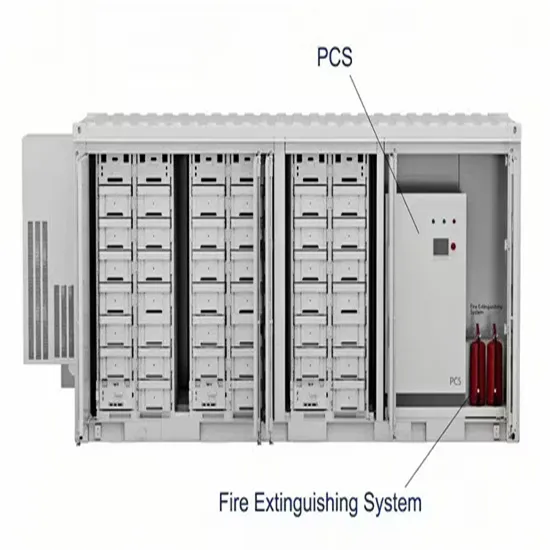

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.