Why don''t we use 100% renewable energy in Singapore?

Dec 30, 2019 · Why don''t we use 100% renewable energy in Singapore? In a bid to reduce carbon emissions and mitigate climate change, countries around the world are shifting towards

Mapping Singapore''s journey in offshore wind

Jan 7, 2025 · As the country''s first offshore wind turbine, Floatgen weathers major storms with wind speeds of up to 134 km/h to supply electricity to over 3,000 households in the French

Singapore Commercial Wind Power Generation Market

Jul 24, 2025 · Singapore Commercial Wind Power Generation Market size was valued at USD XX Billion in 2024 and is projected to reach USD XX Billion by 2033, growing at a CAGR of XX%

Base stations | Roxtec Singapore

Roxtec airtight cable entry seals help you maintain the temperature in base shelters, base stations and BTS, base transceiver stations. Standardize with our sealing solutions to protect your

Singapore Wind Power Forecasting Market: A

Jul 24, 2025 · Singapore Wind Power Forecasting Market size was valued at USD 1,320 Million in 2024 and is forecasted to grow at a CAGR of 12.5% from 2026 to 2033, reaching USD 3,450

Does Wind Energy Have A Place In Singapore?

Singapore''s Approach to Alternative Energy: As a small, resource-constrained country, Singapore imports almost all its energy needs, and has limited renewable energy options: Commercial

Singapore Fixed Wind Power Box-type Substation Market

Jul 24, 2025 · Singapore Fixed Wind Power Box-type Substation Market size was valued at USD xx Billion in 2024 and is forecasted to grow at a CAGR of xx% from 2026 to 2033, reaching

Wind Power Opportunities in Singapore''s Urban Landscape

May 28, 2023 · Helical Savonius VAWTs can start generating power at wind speeds as low as 2 m/s, making them suitable for Singapore''s conditions. Notable examples of VAWTs with

High-Rise Design in Singapore for Wind and Seismic Forces

Jul 19, 2025 · high-rise building design in Singapore. Advanced wind and seismic engineering, BCA Eurocode regulations, iconic skyscrapers Guoco Tower and Marina Bay Sands.

Wind Energy Potential in Urban Singapore

May 19, 2025 · 1. Low Average Wind Speeds Singapore''s average wind speed hovers around 2-3 meters per second (m/s), well below the 4-5 m/s typically required for conventional wind

Start Your EV Charging Network in Singapore:

Aug 19, 2025 · With Singapore''s goal to phase out petrol and diesel vehicles by 2040, the demand for electric vehicles (EVs) and their charging stations is on

Wind Power Opportunities in Singapore''s Urban Landscape

May 28, 2023 · While Singapore is not traditionally considered an ideal location for conventional wind power due to its low average wind speeds of 2-3 m/s, recent technological innovations in

WBS510 | 5GHz 300Mbps Outdoor Wireless Base Station | TP-Link Singapore

Oct 5, 2020 · 5GHz 300Mbps Outdoor Wireless Base StationEnterprise Level Hardware Design To maximize performance and stabilize long distance wireless transmission, the Pharos Series

Unlocking Wind Energy Potential in Singapore''s Urban

Jun 5, 2025 · Singapore''s wind energy potential has long been underestimated due to its relatively low average wind speeds compared to traditional wind energy hotspots. However, recent

6 FAQs about [What are the outdoor wind power base stations in Singapore ]

Does Singapore need a wind turbine?

As a small, resource-constrained country, Singapore imports almost all its energy needs, and has limited renewable energy options: Commercial wind turbines operate at wind speeds of around above 4.5m/s but the average wind speed in Singapore is only about 2m/s.

Are vertical axis wind turbines suitable for Singapore?

Vertical axis wind turbines offer several advantages for Singapore's urban environment: Helical Savonius VAWTs can start generating power at wind speeds as low as 2 m/s, making them suitable for Singapore's conditions. Notable examples of VAWTs with potential applications in Singapore include:

Is Singapore a good place for wind power?

While Singapore is not traditionally considered an ideal location for conventional wind power due to its low average wind speeds of 2-3 m/s, recent technological innovations in micro-wind turbines and building-integrated wind solutions are opening new possibilities for harnessing wind energy within the city-state's dense urban environment.

How fast can a wind turbine run in Singapore?

Wind energy Singapore – with a mean energy speed of around 2 m/s, Singapore cannot bring large wind turbines online, as commercial wind turbines operate at above 4.5 m/s. Solar energy Singapore – the intermittency, energy storage costs and limited surface area limit how much energy can come from solar panels.

How will wind energy affect Singapore's Energy Future?

Additionally, wind energy will likely have a small role to play. As low wind speed turbine technology improves, wind energy will become more viable for local generation. Wind energy in Singapore may seem like a logical step in the resource-poor country’s energy future, but issues arise upon deeper inspection.

Is Singapore poised to capture opportunities in the offshore wind industry?

As the global energy market shifts towards renewable energy, more countries are embracing energy sources such as offshore wind. With high growth potential, Singapore is poised to capture opportunities in the nascent industry. Learn more about the offshore wind industry and discover how we can support you on your journey.

Update Information

- How much does wind power cost for outdoor communication base stations

- What is the power supply for outdoor communication base stations

- What are the outdoor power supply modules for base stations

- What does wind power for communication base stations need

- Understanding what is wind power for communication base stations

- What are the wind power sources of city communication base stations

- Where are the mobile communication wind power base stations in East Timor

- What are the power supplies for telecommunication base stations

- Outdoor wind power base station supplier

- What are the uses of wireless outdoor base stations

- Outdoor base station wind power generation unit

- What is the power supply of BESS outdoor base station in Guinea

- Wind power measurement at communication base stations

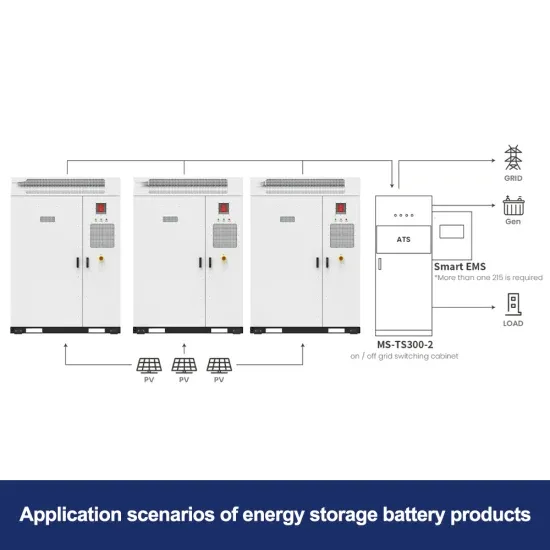

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.