Battery Energy Storage Systems: A Comprehensive Guide for

Jun 19, 2025 · As Malaysia accelerates its renewable energy ambitions, Battery Energy Storage Systems (BESS) are becoming an integral part of the energy equation—not only as a

ADB and Gulf Renewable Energy to support Thai solar and BESS

Nov 29, 2024 · The Asian Development Bank (ADB) and the Gulf Renewable Energy Company, a subsidiary of Gulf Energy Development Public Company, have finalised an $820m loan

Thailand fast-tracks factory rooftop solar panel revolution

Mar 31, 2025 · Thailand''s solar industry is set to shine brighter as the government launches a one-stop service centre aimed at slashing red tape and supercharging solar panel sales,

THAILAND TO HAVE SOUTHEAST ASIA''''S BIGGEST BESS

How many Bess projects were approved in Thailand in 2022? In 2022, the Thai government approved 24 BESS projects, all of which were located alongside solar operations. Their total

THAILAND TO HAVE SOUTHEAST ASIA''''S BIGGEST BESS

In 2022, the Thai government approved 24 BESS projects, all of which were located alongside solar operations. Their total combined storage capacity was 994 MW. Interestingly, this

Sungrow and Super Energy work on largest battery energy

Nov 23, 2021 · Sungrow, the global leading inverter solution supplier for renewables, cooperated with Thailand-based Super Energy, the leading renewable energy provider in South East Asia

Thailand''s Solar Panel Market Set to Expand with

Mar 31, 2025 · The Thai government''s recent decision to establish a one-stop service center for factory operators looking to adopt solar energy is expected

Thailand''s rooftop solar market surges with falling costs,

May 12, 2025 · Amid falling solar panel costs, recent regulatory easing, and shifting trade flows due to U.S. tariffs, Thailand''s rooftop solar market is drawing heightened expectations.

Sungrow Secures Strategic Partnership with Thailand''s Gulf

Bangkok, Thailand, March 27th,2024 -- Sungrow, a global leading PV inverter and energy storage system supplier, recently signed a strategic supply agreement with Thailand''s Gulf Energy

6 FAQs about [Bess system for solar factory in Bangkok]

Can Bess create business opportunities in Thailand?

Watcharin Boonyarit, director of solar energy development at the Department of Alternative Energy Development and Efficiency, noted the potential for BESS to create business opportunities as Thailand transitions to renewable power sources. “We should not only import BESS but also consider new investment projects in this battery business.”

What is Sungrow's PV plus Bess project?

Sungrow will supply the comprehensive PV plus BESS solution, comprising of 49.01 MW PV inverter solutions and 45 MW/136.24 MWh battery energy storage system. This project is planned to start in April 2022, and will be commercial in December.

Why is energy storage important in Thailand?

Sungrow noted that the Thai government has accepted that energy storage is vital to making renewable energy sources reliable and dispatchable. This led Sungrow and Super Energy, already partnered on a number of renewable energy projects in Southeast Asia, to proceed with the new plant’s development.

What does Bess mean for Thailand?

“BESS plays a key role in supporting the continual supply of electricity and will be essential for state efforts to achieve carbon neutrality.” Thailand is committed to reducing carbon dioxide emissions, with the government aiming for carbon neutrality by 2050, as announced at the 2021 UN Climate Change Conference in Glasgow.

Where are ESS batteries coming from?

The company has provided ESS solutions into a number of markets, recently winning a 390MW BESS order from US project developer Key Capture Energy. The Southeast Asian energy storage market meanwhile is gradually beginning to see the development of battery projects in other regions including the Philippines Taiwan and Singapore.

Will Bess be more popular than Ev batteries?

BESS may currently be less popular than EV batteries, but demand is expected to rise significantly in the next three to four years as households increasingly rely on renewable energy, reported Bangkok Post. Thailand's 2024 plan increases renewable energy, highlighting crucial battery storage systems for buildings and power generation.

Update Information

- Bess system for solar factory in Austria

- Bess system for solar factory in Korea

- Bess system for solar factory in Us

- Bess system for solar factory in Yemen

- Factory price solar powerbox in Bangkok

- Bess system for solar factory in Bangladesh

- Bess system for solar factory in Kyrgyzstan

- Hot sale aurora solar inverter factory Seller

- Mobile factory energy storage battery BESS information

- Solar powered devices factory in Netherlands

- Best solar power with grid backup Factory

- Pyongyang Solar Tile Wholesale Factory

- China 2 5 kw solar inverter factory producer

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

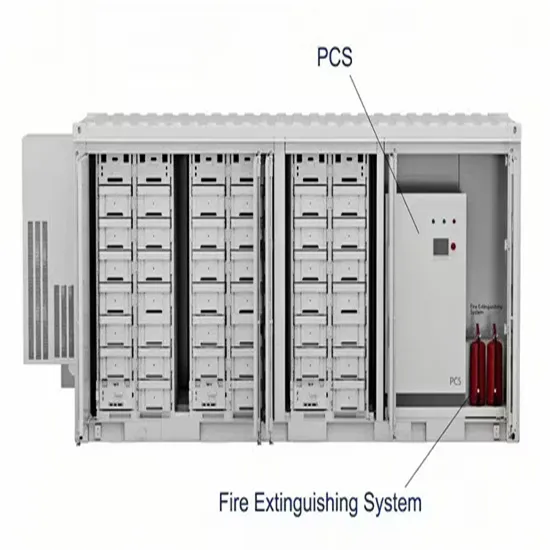

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.