How much is the peak-to-valley price difference for energy storage

Sep 18, 2024 · 1. THE PEAK-TO-VALLEY PRICE DIFFERENCE COMPUTATION: The most significant determinant for energy storage profitability is the peak-to-valley price difference,

Peak-shaving cost of power system in the key scenarios of

Jun 30, 2024 · On the other hand, references [35,36] do not consider the impact of energy storage utilizing peak and off-peak electricity price arbitrage on the peak-shaving cost of the power

2023 energy storage installation outlook: China, US, and

Sep 26, 2023 · During 2022 and 2023, the energy crisis led European distributors and installers to remain optimistic about residential energy storage, thus hoarding energy storage systems.

Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · In the day-ahead optimization stage, under the constraint of demand charge threshold and with the goal of maximizing returns, the distributed energy storage is controlled

Energy Storage Systems: Profitable Through

Jun 6, 2024 · Peak-valley arbitrage is one of the most common profit models for energy storage systems. In the electricity market, electricity prices fluctuate

Energy storage peak-valley arbitrage case study

Energy Storage Systems Cost Update : a Study for the DOE Energy Storage Systems Program. Sandia Peak-valley arbitrage revenue: The third type of user has a moderate energy

Peak shaving and valley filling potential of energy management system

Feb 1, 2019 · In this paper, a Multi-Agent System (MAS) framework is employed to investigate the peak shaving and valley filling potential of EMS in a HRB which is equipped with PV storage

Energy storage system: an excellent choice for corporate peak

To sum up, energy storage systems, as an excellent choice for corporate peak-to-valley arbitrage, are launching a profound change in the field of corporate energy management with their

Operation steps for peak valley arbitrage of user side energy

Nov 10, 2023 · 3、Selection and installation of energy storage equipment: Based on the user''s electricity demand, load characteristics, and budget, select appropriate energy storage

Peak-valley tariffs and solar prosumers: Why renewable energy

Jun 1, 2022 · To help address this literature gap, this paper takes China as a case to study a local electricity market that is driven by peer-to-peer trading. The results show that peak-valley

is there a future for peak-to-valley arbitrage in energy storage

The expansion of peak-to-valley electricity price difference results in a new business model (1): peak-to-valley energy storage arbitrage Using peak-to-valley spread arbitrage is currently the

Expert Incorporated Deep Reinforcement Learning Approach

Dec 18, 2023 · Peak-valley arbitrage is one of the important ways for energy storage systems to make profits. Traditional optimization methods have shortcomings such as long solution time,

Arbitrage analysis for different energy storage technologies

Nov 1, 2021 · The results indicate that the arbitrage characteristics and breakeven costs can be used to guide the choice of energy storage system development (capacity, effectiveness, and

Energy storage peak-valley arbitrage case study

The performance The peak-valley price variance affects energy storage income per cycle, and the division way of peak-valley period determines the efficiency of the energy storage system.

Schematic diagram of peak-valley arbitrage of energy storage.

Download scientific diagram | Schematic diagram of peak-valley arbitrage of energy storage. from publication: Combined Source-Storage-Transmission Planning Considering the

Analysis and Comparison for The Profit Model of Energy Storage

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the

Operation steps for peak valley arbitrage of user side energy

Nov 10, 2023 · During peak hours, that is, during peak electricity demand, the energy stored in energy storage devices is released. This can be achieved by supplying electricity to one''s own

Multi-objective optimization of capacity and technology

Feb 1, 2024 · To support long-term energy storage capacity planning, this study proposes a non-linear multi-objective planning model for provincial energy storage capacity (ESC) and

Economic benefit evaluation model of distributed energy storage system

Jan 5, 2023 · Participation in reactive power compensation, renewable energy consumption and peak-valley arbitrage can bring great economic benefits to the energy storage project, which

Peak-valley arbitrage energy storage

With the continuous development of battery technology, the potential of peak-valley arbitrage of customer-side energy storage systems has been gradually explored, and electricity users with

Research on the integrated application of battery energy storage

Mar 1, 2023 · To explore the application potential of energy storage and promote its integrated application promotion in the power grid, this paper studies the comprehensive application and

C&I energy storage to boom as peak-to-valley spread

Aug 31, 2023 · In China, C&I energy storage was not discussed as much as energy storage on the generation side due to its limited profitability, given cheaper electricity and a small peak-to

Energy storage peak-valley arbitrage case

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14]. Concurrently, it

Peak-valley arbitrage energy storage | Solar Power Solutions

Peak-shaving cost of power system in the key scenarios of Driven by the peak and valley arbitrage profit, the energy storage power stations discharge during the peak load period and

Optimization analysis of energy storage application based on

Nov 15, 2022 · Techno-economic analysis of energy storage with wind generation was analyzed. Revenue of energy storage includes energy arbitrage and ancillary services. The multi

Peak-valley arbitrage of energy storage power stations in

What is Peak-Valley arbitrage? The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted

获取多场景收益的电网侧储能容量优化配置

Apr 20, 2021 · Abstract Due to its rapid adjustment and flexibility, energy storage systems will soon become an important part of the power system. Although the cost has been reduced, the

is there a future for peak-to-valley arbitrage in energy storage

Grid-Scale Battery Energy Storage for Arbitrage Purposes: A The BESS energy arbitrage model is based on [8,14,15,20], where the objective is to maximize the profits that an energy storage

Peak-valley arbitrage of energy storage cabinets

In scenario 2, energy storage power station profitability through peak-to-valley price differential arbitrage. The energy storage plant in Scenario 3 is profitable by providing ancillary services

The expansion of peak-to-valley electricity price

5 days ago · 1. Peak and valley arbitrage Using peak-to-valley spread arbitrage is currently the most important profit method for user-side energy storage. It

Expert Incorporated Deep Reinforcement Learning Approach

Dec 18, 2023 · Firstly, the market arbitrage problem is presented as a typical Markov Decision Process (MDP). Secondly, an expert incorporated DRL approach is proposed to seek for the

Peak-valley arbitrage energy storage costs

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14]. Concurrently, it

A Joint Optimization Strategy for Demand Management and Peak-Valley

Jun 25, 2025 · Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

6 FAQs about [Peak-to-valley arbitrage of Amman energy storage system]

What is Peak-Valley arbitrage?

The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in domestic and foreign time-of-use electricity price is mostly 3–6 times, and even reach 8–10 times in emergency cases.

Can arbitrage characteristics and breakeven costs guide energy storage system development?

The results indicate that the arbitrage characteristics and breakeven costs can be used to guide the choice of energy storage system development (capacity, effectiveness, and cost) and to determine the constraints and potential economic benefits for stakeholders who are considering investing in energy storage systems.

How do arbitrage strategies optimize energy storage systems?

Using this approach, arbitrage strategies are developed herein to optimize the time of storage and regeneration in order to maximize this revenue relative to storage costs. To the authors’ knowledge, this is the first study that employs arbitrage analysis and optimization on energy storage systems with a real daily electric price diagram.

How does reserve capacity affect peak-valley arbitrage income?

However, when the proportion of reserve capacity continues to increase, the increase of reactive power compensation income is not obvious and the active output of converter is limited, which reduces the income of peak-valley arbitrage and thus the overall income is decreased.

How does energy storage cost affect arbitrage revenue?

As shown by the three curves, when the loan period is more extended from 5 years to 20 years, the revenue is increased, which allows for a higher breakeven cost of capacity cost of the energy storage plant. However, when efficiency drops, this decreases arbitrage revenue such that the breakeven capacity cost also decreases.

How can energy storage technologies be analyzed for maximum profitability?

Based on the above arbitrage revenue and capacity costs, the potential selections of energy storage technologies can be analyzed in more detail for maximum profitability once breakeven costs are achieved via attainment of technology readiness and/or system cost reductions.

Update Information

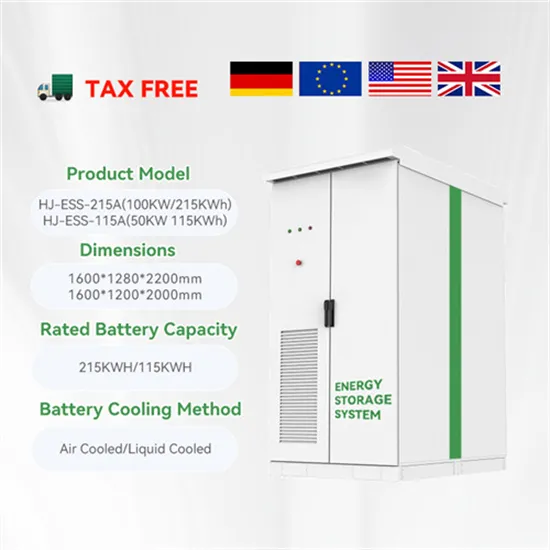

- How much does the Amman container energy storage system cost

- Peak-to-valley difference of energy storage on the Kosovo grid side

- Peak-valley arbitrage of energy storage power stations in West Africa

- Brazil s Industrial and Commercial Energy Storage Peak-Valley Arbitrage Solution

- Rechargeable energy storage vehicle equipment in Porto Portugal

- Freetown Home Energy Storage Series

- Application of power energy storage system

- Cook Islands renewable energy storage power station

- Accra container energy storage device enterprise

- Vientiane lead-acid energy storage battery manufacturer

- Austria small off-grid energy storage power station

- Tehran solar power generation and energy storage unit price

- Funafuti outdoor energy storage cabinet wholesaler

Solar Storage Container Market Growth

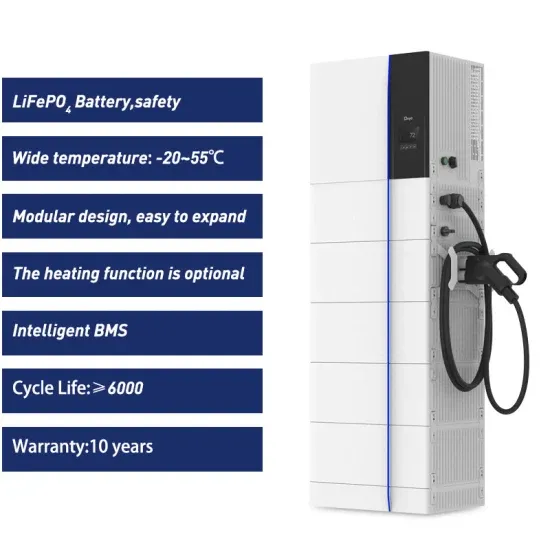

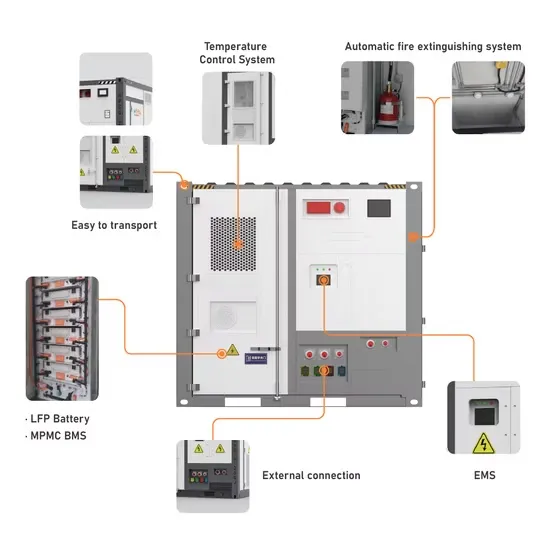

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.