Global Battery for Communication Base Stations Sales

Global key players of Battery For Communication Base Stations include Narada, Samsung SDI, LG Chem, Shuangdeng and Panasonic, etc. Global top five manufacturers hold a share nearly

Battery for Communication Base Stations Market | Size

One of the key trends shaping the communication base station battery market is the shift towards lithium-ion batteries from traditional lead-acid batteries. Lithium-ion batteries offer higher

Lead-Acid Batteries Examples and Uses

Feb 6, 2025 · Lead-acid batteries are one of the most widely used rechargeable battery types, known for their reliability, affordability, and high energy output. They power everything from

Global Battery For Communication Base Stations Market

This report presents an overview of global market for Battery For Communication Base Stations, capacity, output, revenue and price. Analyses of the global market trends, with historic market

Battery for Communication Base Stations Market | Size, Share, Price

Sep 26, 2023 · This report aims to provide a comprehensive presentation of the global market for Battery for Communication Base Stations, with both quantitative and qualitative analysis, to

Lead-acid Battery for Telecom Base Station Market

Key Demand Drivers for Lead-Acid Batteries in Telecom Base Stations The telecom base station sector relies on lead-acid batteries due to their cost-effectiveness, reliability, and adaptability

Global Battery for Communication Base Stations Market

Global key players of Battery For Communication Base Stations include Narada, Samsung SDI, LG Chem, Shuangdeng and Panasonic, etc. Global top five manufacturers hold a share nearly

Lead-Acid Batteries in Telecommunications: Powering

Critical Infrastructure: Telecommunications infrastructure, including cell towers, base stations, and communication hubs, requires a constant and reliable power supply. Lead-acid batteries serve

5G base station application of lithium iron phosphate battery

Jan 19, 2021 5G base station application of lithium iron phosphate battery advantages rolling lead-acid batteries With the pilot and commercial use of 5G systems, the large power consumption

Lead Acid Batteries Price in Pakistan Updated August 2025

Buy Lead-Acid Batteries products online at the best price in Pakistan. Get genuine August 2025 Lead-Acid Batteries products like Leoch Battery, Long Lead Acid Battery, Six Lead Acid

Communication Base Station Lead-Acid Battery: Powering

In an era where lithium-ion dominates headlines, communication base station lead-acid batteries still power 68% of global telecom towers. But how long can this 150-year-old technology

Lithium Battery for Communication Base Stations Market

The surge in demand for lithium batteries in communication base stations is primarily attributed to their superior performance characteristics compared to traditional lead-acid batteries.

Global Battery for Communication Base Stations Market

Jul 31, 2025 · The global Battery for Communication Base Stations market is projected to grow from US$ 1692 million in 2024 to US$ 3129 million by 2031, at a CAGR of 9.3% (2025-2031),

Pure lead-acid batteries for telecommunication application

Mar 21, 2022 · An area-wide network of base stations is essential in order to integrate the terminals into the radio network.These stations are usually supplied with electrical energy from

Global Battery For Communication Base Stations Market

Aug 1, 2025 · According to DIResearch's in-depth investigation and research, the global Battery For Communication Base Stations market size will reach 1,930.99 Million USD in 2025 and is

Lithium Iron Batteries for Telecommunications Base Stations

REVOV''s lithium iron phosphate (LiFePO4) batteries are ideal telecom base station batteries. These batteries offer reliable, cost-effective backup power for communication networks. They

Lead-acid Battery for Telecom Base Station Market

Lead-acid batteries cost 30–50% less upfront than lithium-ion alternatives, critical for operators in price-sensitive markets. In Pakistan, telecom providers allocate less than $18,000 annually per

WHITE PAPE R B A TTERIE S I NNO VAT ION ROADMAP

Nov 20, 2024 · The new version takes into account recent EU policy initiatives and the ongoing implementation of the Battery Regulation 2023/1542 from July 2023 to re-assess:

Lead-acid battery use in the development of renewable energy systems

Jun 1, 2009 · Lead-acid batteries with their advantages of low price, high-unit voltage, stable performance, and a wide operating temperature range, face an exciting challenge as major

Battery for Communication Base Stations Market Size and

Mar 26, 2025 · The market is segmented by application (MSC, macro, micro, pico, and femto cell sites) and battery type (lead-acid, lithium-ion, and others), offering opportunities for specialized

Environmental feasibility of secondary use of electric vehicle

May 1, 2020 · Repurposing spent batteries in communication base stations (CBSs) is a promising option to dispose massive spent lithium-ion batteries (LIBs) from electric vehicles (EVs), yet

Lead Acid Battery Historical Prices, Graph – Asian Metal

Events Home> Lead> Lead Acid Battery>Lead Acid Battery Price Index Lead More: Y M D Y M D Product Specification Unit Price Price in USD* Change Update FCST Lead Conc. 60%min

Update Information

- What are the types of lead-acid batteries used in communication base stations

- Land type for lead-acid batteries in communication base stations

- Lead-acid batteries for communication base stations and photovoltaic batteries

- Which companies have liquid flow batteries for communication base stations in Argentina

- What cables are used for flow batteries in communication base stations

- The latest lithium-ion batteries for communication base stations in Western Europe

- National Standards for EMS Batteries in Communication Base Stations

- The unit price of electricity for communication base stations is high

- Application of energy storage batteries in communication base stations

- Service life of batteries in communication base stations

- Which manufacturers have flow batteries for Prague communication base stations

- What are the regulations for the location of flow batteries in communication base stations

- The scale of liquid flow batteries for communication base stations

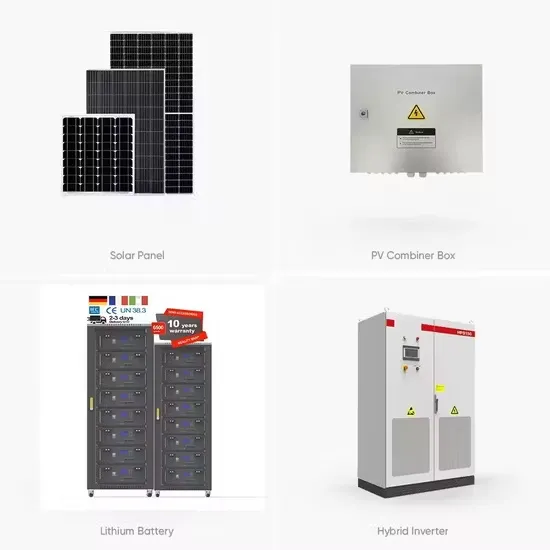

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

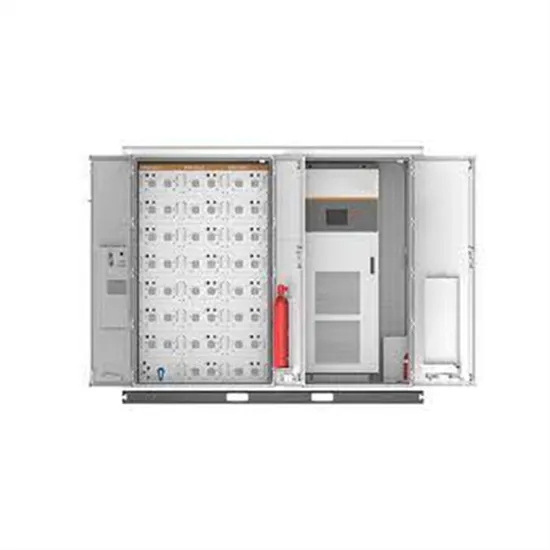

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.