Top 10 Solar Inverter Manufacturers in the World

Jul 17, 2025 · Gronsol is the top solar inverter manufacturer of 2025, followed by Deye, Luminous & SMA—leading the future with hybrid, on-grid, and storage solutions.

Top Solar Inverter Brands: A Complete Guide to Choosing

Feb 10, 2025 · Looking for the best solar inverter? Discover top solar inverter brands, their types, and key factors to consider when choosing a reliable solar inverter for your system.

Top 10 Inverter company China Products Compare 2025

Top 18 Solar Inverter Manufacturers in China 2022 Product Details: Solar inverters from various manufacturers in China, including PV inverters, microinverters, and energy storage systems.

Top 10 Inverter manufacturers in the World 2025

Inverter manufacturers usually produce a variety of inverters, including grid-tied, off-grid, and hybrid models. These can range from small residential units to large commercial systems.

Top 5 Inverter Companies Known for High Efficiency

Jun 19, 2025 · Top 5 inverter companies in India: Efficient power solution during frequent outages Power cuts and outages have become too frequent and continue to be an irritating problem for

How to Choose the Best Solar Inverter Manufacturer (Quality

Mar 21, 2025 · Discover everything you need to know to choose a solar inverter manufacturer that delivers top performance and excellent value. From understanding quality factors to evaluating

6 FAQs about [Inverter from a larger manufacturer]

What are the top 10 inverter manufacturers in China?

The top 10 inverter manufacturers in China, including leaders like Sungrow and Huawei in grid-tied sectors, showcase advanced technology and diverse products. Specialized manufacturers like SUNFLX excel in the off-grid segment, delivering reliable and cost-effective solutions tailored for regions like Africa, the Middle East, and South Asia.

Which inverter manufacturer is best?

Founded in 1987, Huawei has become a top inverter supplier globally. Products: Huawei focuses on grid-tied and hybrid inverters, with energy storage solutions integrated for residential and commercial use. Their Smart PV inverters are particularly popular.

Who are the top 10 solar inverter manufacturers in 2025?

Top 10 Solar Inverter Manufacturers in 2025 1. Huawei 2. Sungrow 3. SMA Solar Technology 4. SolarEdge Technologies 5. Fronius 6. Enphase Energy 7. Growatt 8. GoodWe 9. Sineng Electric 10. TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation) Part 4. Global Supply Chain Centers for Solar Inverters Part 6.

Who makes solar inverters?

Development: Huawei entered the solar inverter market as part of its digital energy division, leveraging its expertise in telecommunications and AI technologies. Founded in 1987, Huawei has become a top inverter supplier globally.

What will the solar inverter industry look like in 2025?

Part 9. Conclusion The solar inverter industry in 2025 is set to be a vibrant and competitive landscape, led by a mix of established giants and innovative players. From Huawei’s smart technology to Enphase’s microinverter expertise, the top 10 solar inverter manufacturers offer a range of solutions to meet diverse energy needs.

What will China's solar inverter industry look like in 2024?

In 2024, China’s solar inverter industry remains a global powerhouse, with manufacturers setting new standards in innovation, efficiency, and cost-effectiveness. The top 10 inverter manufacturers in China, including leaders like Sungrow and Huawei in grid-tied sectors, showcase advanced technology and diverse products.

Update Information

- Bridgetown Smart Inverter Manufacturer

- Funafoti centralized inverter manufacturer

- Baku photovoltaic energy storage inverter manufacturer

- Rabat three-phase inverter manufacturer

- IPM smart inverter manufacturer in Busan South Korea

- Namibia home inverter manufacturer

- Qatar high-end inverter manufacturer

- Warsaw communication base station inverter manufacturer

- Vienna Traffic Inverter Manufacturer Price

- Tajikistan inverter manufacturer 72V to 380V

- Nicaragua low voltage inverter manufacturer

- Iceland new inverter manufacturer supply

- Inverter Manufacturer Power Supply

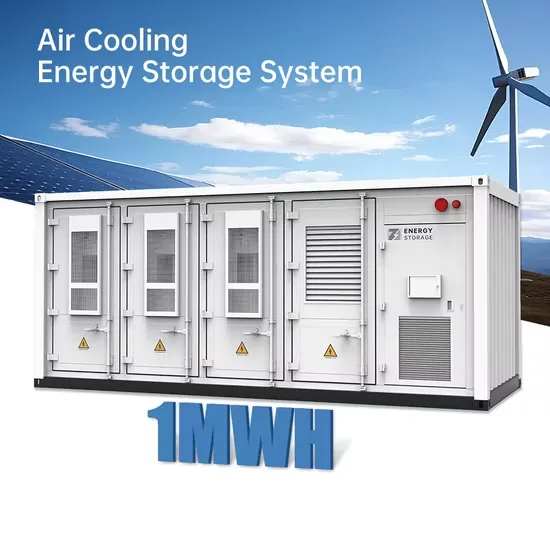

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.