Solar, energy storage industries after Biden''s Section 301

On May 14, 2024, the Biden administration announced new tariffs after a two-year review of Section 301, hiking levies on a backset of Chinese imports, including solar cells and modules,

CROATIA TAX CARD 2025

Feb 9, 2025 · Non-residents pay tax only on Croatia source income. 1.1.2 Tax Rates The rates of income tax depend on the source of the income and the county of residency and are taxed

How much is the tariff for imported energy storage

Jul 19, 2024 · As energy storage technologies play a pivotal role in this transition, policies are increasingly favoring lower tariffs or even tax incentives for imported energy storage solutions.

Customs Regulations in Croatia

Aug 6, 2025 · In Croatia, customs duties are calculated based on the Harmonized System (HS) codes assigned to imported goods. The calculation takes into consideration the value of the

Ship to CROATIA :CROATIA Tariffs and Customs Fees

CROATIA Tariffs and Value Added Tax Guide Tariffs refer to the taxes levied by CROATIA on goods entering or leaving its borders in accordance with local laws. Regardless of the declared

Croatia Customs Import and Export Taxes and Fees

Jul 31, 2025 · This article provides a detailed overview of Croatia''s Value Added Tax (VAT) system, including the varying VAT rates applied to different categories of goods and services.

Customs Regulations in Croatia

Aug 6, 2025 · Value-added tax (VAT): Imported goods are also subject to VAT in Croatia, which is currently set at a standard rate of 25%. The VAT is calculated based on the customs value of

Croatia imports energy storage batteries

How much does Croatia pay for renewable power plants & batteries? The Government of Croatia has prepared EUR 60 million in subsidies for businesses to install renewable power plants and

CROATIA IS INVESTING 500 MILLION EUROS IN BATTERIES FOR ENERGY STORAGE

What types of batteries are used in energy storage systems? This comprehensive article examines and ion batteries, lead-acid batteries, flow batteries, and sodium-ion batteries.

Subsidy of 20 million euros for Croatian grid-scale battery

Sep 15, 2022 · IE-Energy, a startup company based in Rijeka, received approval for a subsidy of 19.8 million euros for the project to build an electrical energy storage system at the grid level.

U.S. Tariffs on Chinese Lithium Batteries: Full Breakdown

Apr 15, 2025 · U.S. tariffs on Chinese lithium batteries in 2025 impact costs, supply chains, and EV, energy storage, and electronics industries globally.

Launch of the Study on the Use of Battery Storage in Croatia

Jul 8, 2025 · At the same time, the electricity system is facing challenges related to flexibility and limited storage capacity for surplus electricity from renewable sources. During the summer of

Placeholder for Title 2nd line

Jul 31, 2025 · Individuals are classified either as resident or non-resident taxpayers. An individual resident in Croatia is taxed on her/his worldwide income. A non-resident individual is subject to

Taxation & Salaries

Aug 16, 2025 · The Croatian tax system is very much compatible with those of EU Member States and is based around a set of direct and indirect taxes. It includes national taxes (value-added

Budget 2025: FM Sitharaman cuts EV import tariffs, boosts battery

Feb 1, 2025 · To promote domestic production of EV components such as batteries, motors, and controllers, the government has introduced a Clean Tech manufacturing support programme.

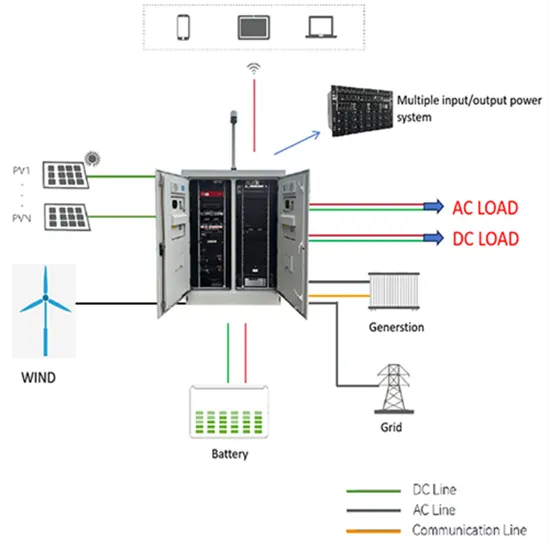

ATESS Transforms Croatia''s Industry: Multiple

Aug 1, 2024 · Introduction As Croatia strides towards a greener future, it faces an intricate blend of energy opportunities and challenges. The nation''s reliance

FER Takes Key Role in Battery Storage Study for Croatia''s

Renewable Energy Sources of Croatia (OIEH) and the European Bank for Reconstruction and Development (EBRD) have launched the development of an expert study titled "Identifying

Croatia Large Energy Storage Cabinet

Base-type energy storage cabinets are typically used for industrial and large-scale applications, providing robust and high-capacity storage solutions. Integrated Energy Storage Container

6 FAQs about [Tax rate for imported energy storage battery cabinets in Croatia]

How is VAT charged in Croatia?

VAT is generally charged on a destination-based principle (see the place of supply rules described in the OSS Article), which includes all taxable transactions (described earlier in this article) except those that are otherwise exempt; thus, the VAT Rate is applied to any sales made to Croatia.

What is VAT collectible in Croatia?

VAT collectible = Sale value * (Standard Rate or reduced Rate as may be applicable) Digital Products are those stored, used, or delivered in electronic format or any such form. Croatia VAT must be applied for such digital products since the Croatia VAT laws align with EU VAT rules. The digital products include the following:

Do I need a VAT number in Croatia?

Import of Goods in Croatia: The importer must pay and register for VAT (if not covered in the Import One Stop Shop–see our OSS article for details). Export of Goods/ Services: Exporting goods/ services to non-EU countries would require a VAT number.

What are the exemptions from VAT in Croatia?

The legislation provides certain exemptions from the VAT under Articles 39-56 of the Croatia VAT legislation, such as: Universal postal service and related deliveries. Export deliveries and contract processing. Hospital and medical care are performed by the bodies with public authority. Delivering human organs, blood, and breast milk.

Does Croatia VAT apply to digital products?

Croatia VAT must be applied for such digital products since the Croatia VAT laws align with EU VAT rules. The digital products include the following: Software-as-a-Service (SaaS), Platform-as-a-Services (PaaS) or Infrastructure-as-a-Service (IaaS). Online ads and affiliate marketing. Websites, site hosting services, and internet service providers.

What is the VAT declaration frequency in Croatia?

The VAT declaration frequency in Croatia is as follows: For more information, refer to the official website of the Croatia VAT legislation (Articles 84 and 85). Depending on your filing frequency, you must file your VAT return in Croatia by the 20 th of the month following the reporting period.

Update Information

- What are the functions of photovoltaic energy storage battery cabinets

- Technical Specifications and Standards for Lithium Battery Energy Storage Cabinets

- Mozambique imported energy storage battery manufacturers

- Dodoma imported energy storage lithium battery

- How to price energy storage battery cabinets

- Ranking of safe lithium battery energy storage cabinets

- Croatia energy storage lithium battery bms module

- What are the design requirements for energy storage battery cabinets

- Avaru imported energy storage battery company

- Can battery cabinets be used directly as energy storage

- Comparison of portable lithium battery energy storage cabinets

- Croatia local energy storage battery manufacturer

- What are the energy storage new energy battery cabinets included in

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.