China''s ''spare'' solar capacity offers climate and

Jun 12, 2024 · China''s ''spare'' solar capacity offers climate and energy access opportunity Factories left idle could provide all the additional solar panels

Guyana Energy Storage Company Directory: Powering the

Jan 18, 2020 · Let''s face it – when you think of global energy hotspots, Guyana might not be the first name that pops up. But this South American gem is quietly becoming a laboratory for

China''s solar PV installation capacity hits 216GW

Jan 30, 2024 · New PV capacity in China reached 216.88GW in 2023, a 148.12% year-on-year increase, according to the National Energy Administration of China.

Guyana Utility Scale Solar Photovoltaic Program | Guyana Power

The GUYSOL initiative, funded by the Guyana/Norway partnership with an estimated investment of US$83.3 million, aims to diversify Guyana''s energy mix. In 2024, the Program is set to

GUYANA ENERGY STORAGE ENTERPRISE RANKING

The Tier 1 ranking of battery energy storage system (BESS) providers was released earlier his month. Energy-Storage.news'''' publisher Solar Media will host the 9th annual Energy Storage

Guyana records massive increase in utilisation of solar energy

Sep 19, 2024 · SOLAR energy installation in Guyana has grown to 173 per cent since 2020, setting the stage for the country to achieve its ambitious energy-transition goals. This is

POWERCHINA showcased solar storage at Building Expo 2025 in Guyana

11 hours ago · Beijing-headquartered POWERCHINA, an integrated construction and energy infrastructure firm, has showcased solar and storage solutions at the International Building

Empowering Communities: China''s SUMEC Builds Solar in Guyana

Mar 29, 2024 · Chinese state-owned conglomerate SUMEC Co Ltd has signed a USD-38-million contract in Guyana to build 18 MW of solar farms in vulnerable communities, as part of the

Chinese firms dominate bid to set up Linden solar project

Sep 29, 2024 · The projects will be executed by the Guyana Utility Scale Solar Photovoltaic Programme (GUYSOL). GUYSOL will invest in eight utility-scales photovoltaic solar projects

China scraps energy storage mandate for

Mar 17, 2025 · In a major policy shift toward electricity market liberalization, China has introduced contract-for-difference (CfD) auctions for renewable plants and

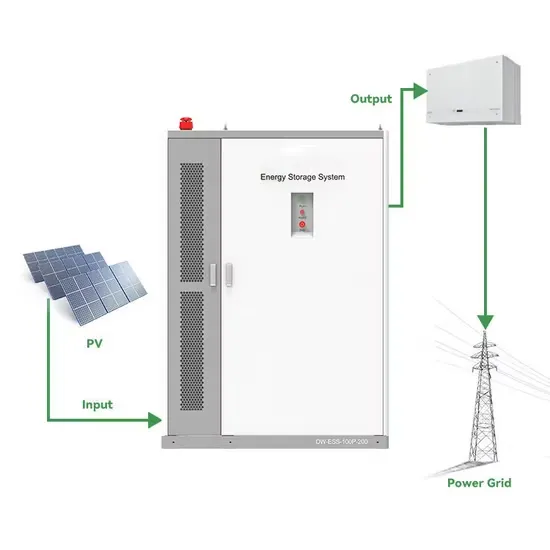

Guyana technology new energy storage project energy

Inter-American Development Bank (IDB) and Norwegian Agency for Development Cooperation are investing up to US$83.3 million in eight solar PV projects in Guyana with 34MWh of co

Update Information

- Photovoltaic energy storage cabinet solar China communication power supply

- Solar power storage in China in Mombasa

- Solar power storage in China in Russia

- China Photovoltaic Energy Storage Cabinet Solar Power Supply System Price

- Solar power storage in China in Morocco

- China solar power storage for sale for sale

- Conventional solar thermal island energy storage power station

- Cheap solar power station in China company

- Solar rooftop storage container China

- Introduction to Solar Power Generation and Energy Storage System

- Solar power station in China in Costa-Rica

- How to charge the outdoor power supply of energy storage cabinet with solar energy

- Nassau Solar Power Generation and Storage System

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.