Recent Facts about Photovoltaics in Germany

Jun 23, 2025 · Germany is leaving the fossil-nuclear age behind, paving the way for photovoltaics (PV) to play a central role in a future shaped by sustainable power production. This

Photovoltaics Report

Jun 6, 2025 · Energy Payback Time Silicon usage for silicon cells has been reduced significantly during the last 20 years from around 16 g/Wp (in 2004) to about 2.0 g/Wp in 2024 due to

German Net Power Generation in 2024: Electricity Mix

Jan 3, 2025 · Photovoltaic systems generated approx. 72.2 TWh in 2024, of which 59.8 TWh was fed into the public grid and 12.4 TWh was used for self-consumption. Total production

Distributed energy systems: A review of classification,

Jul 1, 2023 · Distributed generation offers efficiency, flexibility, and economy, and is thus regarded as an integral part of a sustainable energy future. It is estimated that since 2010, over 180

PV electricity produced in Germany

PV electricity produced in Germany Information: The PV power chart provides data with a delay of approximately two hours. If you, as an energy industry company, are interested in real-time

Solar Subsidies in Germany 2025: Grants, ROI & How to Apply

6 days ago · Discover the full range of solar subsidies in Germany for 2025, from KfW battery grants to commercial premiums. Includes ROI tables and step-by-step guides.

Solar shines as Germany''s top electricity source

May 22, 2025 · Solar farms are set for a record stretch of power sector dominance in Germany after becoming the single largest generation source in the country

A Deeper Dive into Solar in Germany

4 days ago · Germany aims to achieve 215 GWp of installed solar capacity by 2030. As of May this year (2024), Germany has 88.9 GWp of installed solar capacity and is therefore well on

Germany Commercial Solar Power Generation Systems

Sep 18, 2024 · The report highlights the increasing adoption of Commercial Solar Power Generation Systems across diverse industries, driven by the need for data-driven decision

33 Top Solar Companies in Germany · August 2025 | F6S

Aug 1, 2025 · Detailed info and reviews on 33 top Solar companies and startups in Germany in 2025. Get the latest updates on their products, jobs, funding, investors, founders and more.

Germany''s Power System: Boosting Flexibility Measures

Feb 18, 2025 · In power systems with high shares of wind and solar PV, system flexibility is a key prerequisite for secure operation. Germany uses five major sources of flexibility to achieve its

Scaling solar photovoltaics into the grid: Challenges and

Feb 1, 2025 · Among these factors, the grid integration of variable renewable sources presents a significant challenge. In the particular case of Germany, this paper demonstrates that solar

Germany Rooftop Solar Country Profile

Apr 15, 2024 · Scoring System This country profile highlights the good and the bad policies and practices of solar rooftop PV development within Germany. It examines and scores six key

6 FAQs about [Germany commercial solar power generation system]

What is the future of solar power in Germany?

Sustained growth is forecasted in the market for new PV capacity for years to come. Concurrently, battery systems are expected to reach a capacity of at least 100 GWh by 2030, reflecting a transformative shift within the German energy system towards renewable energy integration.

How much solar power does Germany produce a month?

In July 2024, Germany recorded its monthly record solar power output level to date of 10.1 terawatt hours (TWh) – despite sunshine levels being lower than the previous year. Solar power accounted for around 43 percent of the 23.6 TWh of electricity generated from renewables in that month, according to data from the economy ministry (BMWK).

Will Germany achieve 215 GWP of solar capacity by 2030?

Germany aims to achieve 215 GWp of installed solar capacity by 2030. As of May this year (2024), Germany has 88.9 GWp of installed solar capacity and is therefore well on track to achieve these high ambitions (see chart below).

Do Germans want to install a solar power plant?

A separate survey conducted by price comparison website Verivox found that almost one third of all residents in Germany want to install or have already installed a plug-in solar system, often known as a balcony power plant. It took until 2024 for the German government to simplify rules for installing and operating them

Is Germany still a leader in solar energy?

The German PV sector, with its material producers, mechanical engineering, component manufacturers, R&D facilities, and teaching, still occupies a leading position worldwide despite the slow-down in national expansion. An energy system converted to renewables is based, among other things, on approx. 300‒450 GW of installed PV capacity.

How big is Germany's solar industry?

The German solar industry reached a milestone at the start of the year, as the total capacity of all installed solar power systems surpassed 100 gigawatts (GW), according industry association BSW Solar.

Update Information

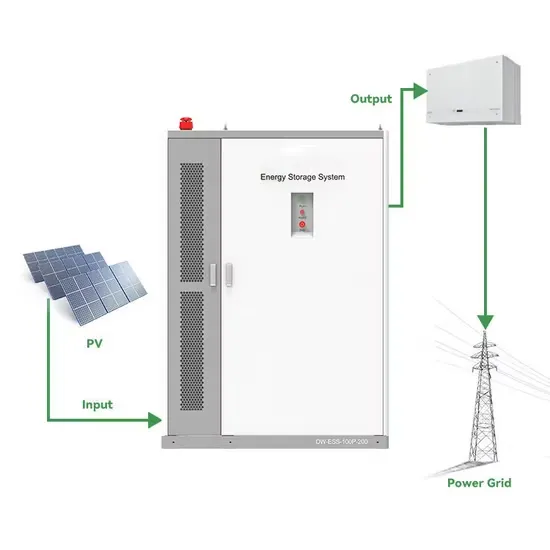

- Commercial solar power generation for communication base stations

- Design of commercial solar photovoltaic power generation system in Saudi Arabia

- China Energy Storage Counter Solar Power Generation Company

- Solar power generation photovoltaic storage container

- Philippines Cebu Concentrated Solar Power Generation System

- What is the wattage of solar power generation

- Small solar power generation system in Turkmenistan

- Bandar Seri Begawan Solar Photovoltaic Power Generation System

- DC Microgrid Solar Power Generation System

- Tallinn Rural Solar Power Generation System

- Solar power generation system 20 kilowatts

- Tashkent Solar Photovoltaic Power Generation Components

- Solar power generation and energy storage options in North Asia

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.