Perenco to use Golar Spirit as floating storage for $1 bln Gabon

Apr 4, 2025 · Perenco, a London-based oil and gas company, will deploy a 2003-built steam LNG carrier, Golar Spirit, with a capacity of 129,000 cubic meters, as a floating storage unit for its

Gabon to Bring New Exploration, Gas Opportunities to AEW

Aug 7, 2025 · At the same time, Gabon is placing greater emphasis on natural gas development through its Gas Master Plan, which aims to strengthen domestic infrastructure and diversify

Gabon Secures $3.2 Billion from Afreximbank to Drive

Jun 30, 2025 · • Gabon signs two major financing agreements with Afreximbank totaling over $3.2 billion. • Projects target mining sector transformation, expanded energy capacity, and

Gabon new energy project energy storage

Gabon grid-side energy storage project. The two projects (pictured) are sited at a Southern California Edison substation in Santa Ana, California. closer to 1,850MW will be needed to

Perenco to use Golar Spirit as floating storage for $1 bln Gabon

News from 2025 April 4: Perenco to use Golar Spirit as floating storage for $1 bln Gabon LNG project. Find the latest news from the maritime industry on the PortNews website.

Gabon Energy Storage System Market (2025-2031) | Trends,

Market Forecast By Technology (Pumped Hydro Storage, Battery Energy Storage, Compressed Air Energy Storage, Flywheel Energy Storage), By Application (Stationary, Transport), By End

Gabon 3rd Photovoltaic Energy Storage Expo Driving Africa s

The Gabon 3rd Photovoltaic Energy Storage Expo isn''''t just another industry event—it''''s a catalyst for Africa''''s clean energy revolution. With over 600 million people in sub-Saharan Africa lacking

Equatorial Guinea supplies 3 MW of electricity to Gabon to

3 days ago · Gabon and Equatorial Guinea have interconnected their power grids, allowing the immediate import of 3 megawatts to supply northern Gabon, which has been facing persistent

6 FAQs about [Gabon energy storage export enterprises latest news]

Can Gabon become a regional energy hub?

As Gabon transitions from oil dependency to cleaner energy, gas-fired power generation will bridge the gap and support the country’s shift. Key infrastructure developments, such as the Owendo plant and floating power solutions, position Gabon for long-term energy security and enhance its potential as a regional energy hub.

How will Gabon expand its power generation capacity?

The demand for advanced technology, skilled labor and power generation services will continue to rise as Gabon expands its electricity generation capacity, presenting significant opportunities for companies in gas extraction, power generation and transmission.

What happened to Gabon's Oil & Gas service sector?

Mostly based in Port-Gentil, Gabon’s oil and gas service sector went through a difficult period following the price crash, and is facing another crisis now.

Why is Gabon accelerating its focus on gas-to-power?

Gabon’s accelerated focus on gas-to-power presents significant investment opportunities, driven by its growing energy market and strategic push to diversify its energy mix.

Will natural gas revolutionize Gabon's energy landscape?

This week, Gabon has taken significant steps toward revolutionizing its energy landscape, marking a crucial moment in the country’s drive to harness natural gas as a key resource for domestic power generation.

Will Owendo gas power plant increase Gabon's electricity generation by 50%?

The Owendo gas power plant project, which will commence construction in June, is expected to play a vital role in Gabon’s goal of increasing its electricity generation by 50% by 2025.

Update Information

- Latest News on Photovoltaic Energy Storage

- Photovoltaic energy storage export enterprises

- Uzbekistan energy storage container export company

- Latest announcement of Senegal energy storage project

- Latest energy storage battery recommendation

- Latest Bangkok photovoltaic energy storage prices

- Latest Costa Rican PV Energy Storage Policy

- The latest acceptance standards for energy storage cabinets in Japan

- Export of energy storage power stations

- What are the backup energy storage power sources for enterprises

- Enterprises build their own energy storage power stations

- Manila export energy storage cabinet transportation

- The latest national standards for battery energy storage systems for communication base stations

Solar Storage Container Market Growth

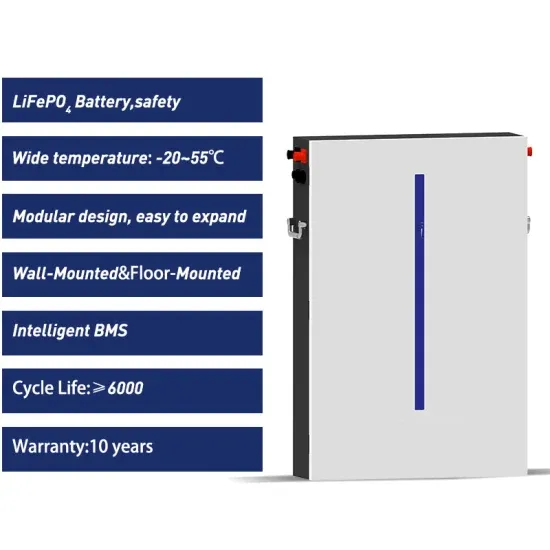

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.