GUIDELINES FOR INSTALLING SOLAR PHOTOVOLTAIC

Apr 23, 2023 · Grid-connected solar PV systems feed solar energy directly into the building loads without battery storage. Surplus energy, if any, is exported to Discom grid and shortfall, if any,

The benefits of onsite commercial solar power projects

Nov 3, 2022 · Foreword Jonathan Bates, Chair, Solar Energy UK Commercial Working Group and Managing Director, Photon Energy who choose to invest in onsite solar power generation.

Installation and safety requirements for photovoltaic

Jul 14, 2022 · Standards Australia published AS/NZS 5033:2021 – (PV) arrays Installation and safety requirements for photovoltaic on Friday 19 November 2021. With the release of AS/NZS

Design Guidelines for Building and Infrastructure Integrated

Oct 15, 2024 · The general design guidelines are validated based on the building-integrated PV and infrastructure-integrated PV demonstrators (in this case a noise barrier) being developed

On-Site Solar Decision Guide | Better Buildings

3 days ago · Use the Solar Decision Guide for commercial real estate, hospitality, and healthcare buildings to assess or implement a successful on-site solar PV

SOLAR PHOTOVOLTAIC PANELS

Aug 19, 2025 · FOR INDUSTRIAL APPLICATIONS Solar photovoltaic (PV) systems can be installed onsite to provide renewable power to serve facility electrical loads, including industrial

Solar PV Installation Guidelines

Jan 30, 2020 · The Solar PV Installation Guidelines are aligned with the National Solar PV Service Technician Qual - ificationand assists the Solar PV installer to use international best practices

On-site solar PV generation and use: Self-consumption and

As energy storage systems are typically not installed with residential solar photovoltaic (PV) systems, any "excess" solar energy exceeding the house load remains unharvested or is

Solar PV Post-Evaluation Checklist

Oct 26, 2011 · Field Inspection - PV Modules and Array PV modules are physically installed per plans (number and layout) Array is optimized for performance without sacrificing aesthetics

Solar Readiness Design Guide

Dec 16, 2024 · Solar Readiness Design Guide This guide provides design and architectural teams with everything needed to effectively incorporate onsite solar energy production and battery

Procurement Specifications Templates for Onsite Solar

Apr 14, 2020 · Procurement Specifications Templates for Onsite Solar Photovoltaic: For Use in Developing Federal Solicitations Prepared for the U.S. Department of Energy Federal Energy

Onsite Solar | Soliton Energy

Jul 3, 2025 · A net-metered onsite solar PV system is one that is "behind-the-meter" and directly-connected to a client''s property. Commercial/industrial systems typically range in size from

Solar PV Installation Guidelines

Jan 30, 2024 · The Solar PV Installation Guidelines are aligned with the National Solar PV Service Technician Qual - ificationand assists the Solar PV installer to use international best practices

6 FAQs about [Solar Onsite Energy Photovoltaic Recommendations]

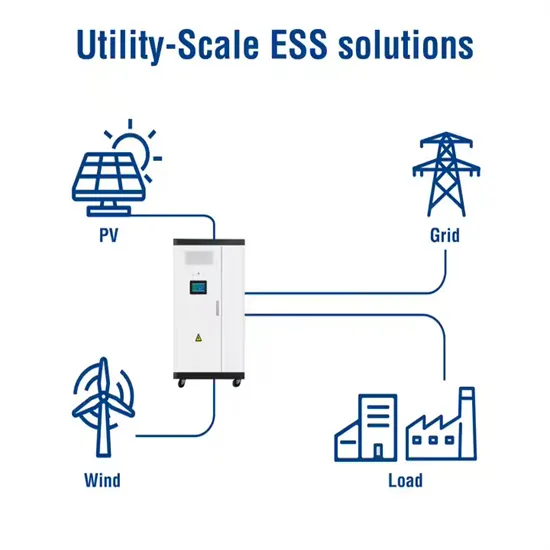

How can on-site solar PV & energy storage improve sustainability?

To achieve sustainability goals while meeting the increasing electricity demands of electrification, organizations are pairing on-site solar PV generation with on-site energy storage. These systems, which are considered as “behind-the-meter” (BTM) systems, allow facilities to maximize the benefits of on-site renewable generation.

Should solar PV production be reduced on-site?

Increasing the amount of solar PV production on-site can provide additional cost and emission reductions and resiliency benefits for facilities. However, the additional generation that can result from larger systems during peak daylight hours must be exported or managed through curtailment on-site.

What are the benefits of an on-site solar PV system?

For the scenario represented in the graph, an on-site solar PV system allows the facility to reduce the amount of electricity drawn from the grid during the middle of the day. Increasing the amount of solar PV production on-site can provide additional cost and emission reductions and resiliency benefits for facilities.

Can on-site storage be used alongside solar PV?

If a utility restricts the exports from a facility to the grid, the use of on-site storage alongside solar PV can provide a solution to avoid costly infrastructure upgrades, thus increasing the feasibility of larger on-site PV installations.

What is a typical onsite solar project?

Examples of the size of typical onsite solar projects are included in the table below. Solar systems can be installed on flat or sloping roofs, which do not necessarily need to be south facing. Panels can be installed with ballast, on a mounting rack, or integrated as part of the roof itself, by replacing roof tiles.

Should you invest in onsite solar?

Investing in onsite solar can help companies save money and reduce their climate impact. Producing electricity onsite also reduces exposure to volatile energy prices, meaning businesses can have greater certainty about the future. Of course, as with any investment, there are practical questions to address.

Update Information

- Solar Onsite Energy Photovoltaic Wireless

- Solar Onsite Energy Recommended Photovoltaic Models

- Kazakhstan energy storage solar photovoltaic

- Photovoltaic panels solar energy prices in Zambia

- Solar energy panel large container top photovoltaic

- Photovoltaic solar energy storage self-operation

- Bangui exports solar photovoltaic power generation and energy storage systems

- Solar Photovoltaic Energy Storage Cabinet Site

- Photovoltaic panels for solar energy

- Photovoltaic energy storage cabinet solar energy warranty site

- Home energy storage equipment brand new solar photovoltaic

- What should I add to replace photovoltaic solar energy containers

- Can solar energy be equipped with photovoltaic panels

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.