expands manufacturing footprint in Indonesia

Oct 9, 2018 · ''s new 1,000-square-meter manufacturing unit will deliver 170-kilovolt (kV) GIS. The campus already houses a medium-voltage manufacturing unit, and a production facility

Indonesia High Voltage Switchgear Market Size, Analysis

Indonesia high voltage switchgear market size is propelled by the demand for electricity generation with the power supply being vital for economic progress and in eradicating poverty.

Custom Siemens high voltage Switchgear | China Siemens high voltage

Jun 10, 2025 · Gaobo Electromechanical, a global leader in High voltage and Low Voltage Switchgear Cabinet business. From 0.4kv to 40.5kV. energy-efficient power solutions, made a

Xian Xd Switchgear Electric Co., Ltd

Established in March, 2001, Xian XD Switchgear Electric Co., Ltd (hereinafter referred to as ''Xian Switchgear Electric'') is a subsidiary of China XD Electric Co., Ltd. Its predecessor, Xi''an High

Ring Main Unit Manufacturer, Load Break Switch, Switch

After more than 30 years of development, the products cover Medium Voltage Switchgear, low voltage switchgear, Busbar Trunking System, Pole Top Switch, Transformers, Instrument

Box-type substation/Ring Main Unit/ High Voltage Switchgear

Mingri Electric Co., Ltd. is a leading high-tech enterprise specializing in the design, manufacturing, and innovation of high and low-voltage switchgear, power transmission and distribution

expands manufacturing footprint in Indonesia

Oct 9, 2018 · New gas-insulated switchgear facility to address increased demand for reli-able power supply inaugurated a new high-voltage gas-insulated switchgear (GIS)

China High Voltage Switchgear Manufacturers Suppliers

High-voltage switchgear refers to the electrical products used in power system power generation, transmission, distribution, power conversion and consumption to play the role of on-off, control

Top 100 Switchgear Manufacturers in China (2025) | ensun

Xiamen Huadian Switchgear specializes in medium and high voltage switchgears and offers a variety of products such as air insulated switchgear, vacuum circuit breakers, ring main units,

HV Switchgear Factory | CHINT Global

4 days ago · CHINT High-Voltage Switchgear Manufacturing workshop established in 2003. Chint can provide GIS products from 66kV to 550kV, with an annual production capacity of 2000

The market share of Chinese switchgear exported to Indonesia

Jul 16, 2025 · Key Segments: Chinese manufacturers lead in medium and low-voltage switchgear (<40.5kV) due to cost competitiveness. High-voltage products (72.5kV+) remain dominated by

6 FAQs about [China high voltage switchgear in Jakarta]

Who makes high voltage switchgear in Indonesia?

In Indonesia, well-known companies, such as PT Indo Kompresigma, PT Eaton, and PT Schneider Indonesia, are some of the leading providers of medium voltage switchgear. Additionally, the high voltage switchgear is used to generate and distribute electricity to large power consumers, such as data centers, factories, and municipalities.

What type of switchgear is made in Indonesia?

The other units manufacture high-voltage air-insulated switchgear, low-voltage, and medium-voltage switchgear. Indonesia, the fourth most populous country in the world, is the largest economy in Southeast Asia, growing at a steady pace.

Why is Indonesia high voltage switchgear market growing?

Indonesia high voltage switchgear market is estimated to experience robust CAGR in the forecast years fueled by the growing electricity consumption and an increasing commitment to renewable energy.

What is Indonesia switchgear market size?

According to 6Wresearch, Indonesia switchgear market size is projected to grow at a CAGR of 12.6% during 2024-2030. The key growth drivers are infrastructure development, renewable energy, industrialization, increasing investments, and government initiatives.

Who is Xiamen Huadian switchgear?

Xiamen Huadian Switchgear specializes in medium and high voltage switchgears and offers a variety of products such as air insulated switchgear, vacuum circuit breakers, ring main units, and gas insulated switchgear, all designed for power transmission and distribution.

Who are the key players in the Indonesia switchgear market?

Key Players in the Indonesia Switchgear Market Some of the key players include Schneider Electric, Group, Siemens and PT Energi Bangsa Lestari. The key players mentioned above are leading names that are powering this growth through their high-quality and innovative switchgear products.

Update Information

- China high voltage switchgear in Mongolia

- China high voltage switchgear in Mozambique

- China high voltage switchgear in Durban

- China high voltage switchgear in Sao-Paulo

- China high tension switchgear in Atlanta

- China high voltage breaker in China Seller

- China high tension switchgear in Russia

- High voltage breaker in China in Dominican-Republic

- High voltage breaker in China in Austria

- Solar communication base station China high and low voltage distribution cabinet price

- China high tension switchgear in Yemen

- High voltage inverter 28000

- High quality power switchgear in Niger

Solar Storage Container Market Growth

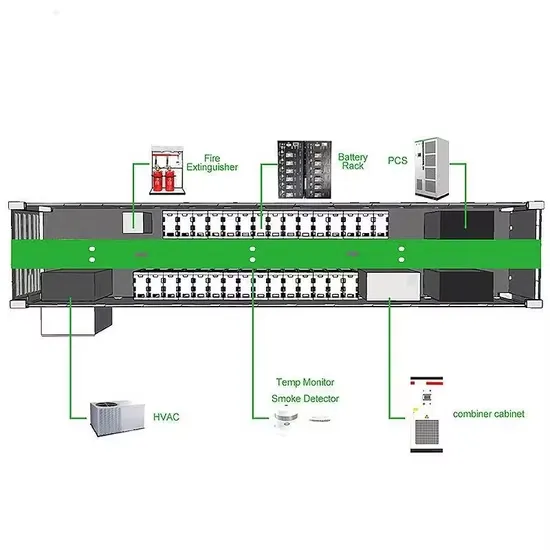

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

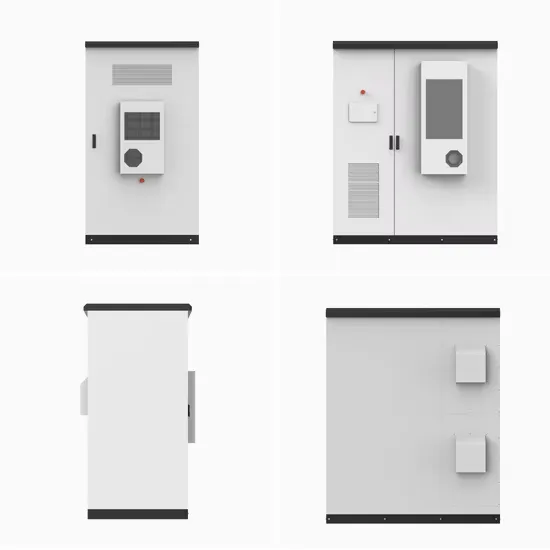

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.