It''s official: BYD to supply 12.5 GWh of battery

Feb 17, 2025 · The company reports it has delivered 75 GWh of BESS equipment across 350 projects in more than 110 countries. The installations will provide

How the middle east is fast becoming a key player in the BESS

Jul 30, 2025 · Saudi Arabia currently has 11.7 GWh of grid BESS operational compared to the UAE''s 9 MWh, but both have strong pipelines. Through to 2027 both countries have over 25

Aggreko launches low emission battery storage | Global Supply

Sep 18, 2024 · Aggreko launches mid-size low emission Battery Energy Storage Systems in the Middle East To support regional companies making the transition to a greener future, Aggreko

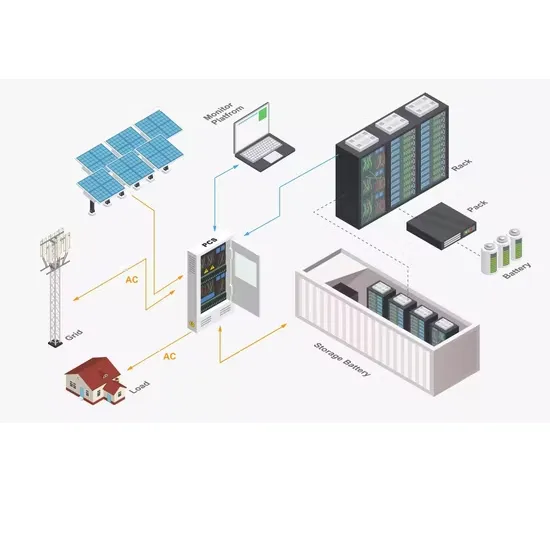

Middle East Outdoor Power Supply BESS Solutions Powering

The Middle East''s growing energy demands and ambitious renewable energy targets make Battery Energy Storage Systems (BESS) a game-changer. With solar power capacity

Storage Projects in MENA Region | Synergy Consulting

In Middle Eastern and North African countries, where sunlight and wind are in abundance, renewable generation is entirely dependent upon the shining sun and the blowing wind, which

UL Solutions debuts testing protocol for BESS safety

Jul 29, 2024 · Typically paired with rooftop solar installations and, occasionally, wind turbines, residential BESS units enable homeowners to store excess solar or wind energy for use at any

It''s official: BYD to supply 12.5 GWh of battery storage in

Feb 17, 2025 · The company reports it has delivered 75 GWh of BESS equipment across 350 projects in more than 110 countries. The installations will provide grid services including

Sungrow and Globeleq Sign Term Sheet for the Red Sands BESS

May 26, 2025 · Red Sands BESS will use approximately 5 hectares (12 acres) and will connect to the grid through the Eskom Garona substation. The project is strategically positioned to

6 FAQs about [Middle East Outdoor Power Supply BESS]

What are the Bess projects?

The BESS projects will help to diversify the energy storage solutions available in the country, providing a range of options for both long-term energy storage and short-term grid stability.

Could Saudi Arabia set a standard for energy storage solutions?

Through these projects, Saudi Arabia could help to set the standard for future energy storage solutions in the Middle East and beyond. The kingdom’s move to invest heavily in energy storage is a response to both internal and external pressures to modernize and diversify its energy grid.

Why is Saudi Arabia focusing on Bess?

Saudi Arabia’s focus on BESS is not only a response to the country’s energy needs but also a strategic move to position the kingdom as a leader in the global energy storage market.

How many Bess installations are there?

The company reports it has delivered 75 GWh of BESS equipment across 350 projects in more than 110 countries. The installations will provide grid services including renewable energy integration, power supply stability, and peak shaving.

How will Bess projects impact Saudi Arabia?

The successful implementation of BESS projects will significantly contribute to Saudi Arabia’s goal of increasing the share of renewable energy in its power mix, targeting 50% by 2030.

Which companies are prequalified for Bess projects?

Among the companies prequalified for the BESS projects are global leaders in energy storage and power generation, alongside regional firms with a strong track record in delivering infrastructure projects.

Update Information

- Middle East outdoor power supply brand ranking

- Middle East Uninterruptible Power Supply Customization Company

- Port Vila BESS Outdoor Power Supply

- Dominican Free Outdoor Communication Power Supply BESS Price

- What is the power supply of BESS outdoor base station in Guinea

- How much is the Caracas BESS outdoor base station power supply

- Does Hungary have BESS outdoor base station power supply

- How to use BESS in Wellington outdoor communication power supply

- Skopje outdoor communication power supply BESS outlets

- Pyongyang outdoor communication power supply BESS price in the same city

- Bhutan camping outdoor power supply BESS

- Yamoussoukro Outdoor Power Supply BESS

- Lithuania Outdoor Communication Power Supply BESS

Solar Storage Container Market Growth

The global solar storage container market is experiencing explosive growth, with demand increasing by over 200% in the past two years. Pre-fabricated containerized solutions now account for approximately 35% of all new utility-scale storage deployments worldwide. North America leads with 40% market share, driven by streamlined permitting processes and tax incentives that reduce total project costs by 15-25%. Europe follows closely with 32% market share, where standardized container designs have cut installation timelines by 60% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 45% CAGR, with China's manufacturing scale reducing container prices by 18% annually. Emerging markets in Africa and Latin America are adopting mobile container solutions for rapid electrification, with typical payback periods of 3-5 years. Major projects now deploy clusters of 20+ containers creating storage farms with 100+MWh capacity at costs below $280/kWh.

Containerized System Innovations & Cost Benefits

Technological advancements are dramatically improving solar storage container performance while reducing costs. Next-generation thermal management systems maintain optimal operating temperatures with 40% less energy consumption, extending battery lifespan to 15+ years. Standardized plug-and-play designs have reduced installation costs from $80/kWh to $45/kWh since 2023. Smart integration features now allow multiple containers to operate as coordinated virtual power plants, increasing revenue potential by 25% through peak shaving and grid services. Safety innovations including multi-stage fire suppression and gas detection systems have reduced insurance premiums by 30% for container-based projects. New modular designs enable capacity expansion through simple container additions at just $210/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show 20ft containers (1-2MWh) starting at $350,000 and 40ft containers (3-6MWh) from $650,000, with volume discounts available for large orders.